Binance exchange has rolled out two new features designed to help users make better-informed trading decisions. These tools, Token Lock-up Addresses and Holding Concentration Indicators, offer crucial insights into token supply and ownership distribution. The updates aim to improve transparency, especially in volatile market conditions.

Binance Exchange New Features for Smarter Trading

Binance exchange’s new tools aim to help traders understand token dynamics more clearly. The Token Lock-up Addresses feature allows users to see if part of a project’s tokens is locked and unavailable for trading. The Holding Concentration Indicator, on the other hand, reveals how widely distributed a token’s ownership is. Both features are essential in understanding token volatility and supply dynamics.

Token Lock-up Addresses: Locked Token Supply

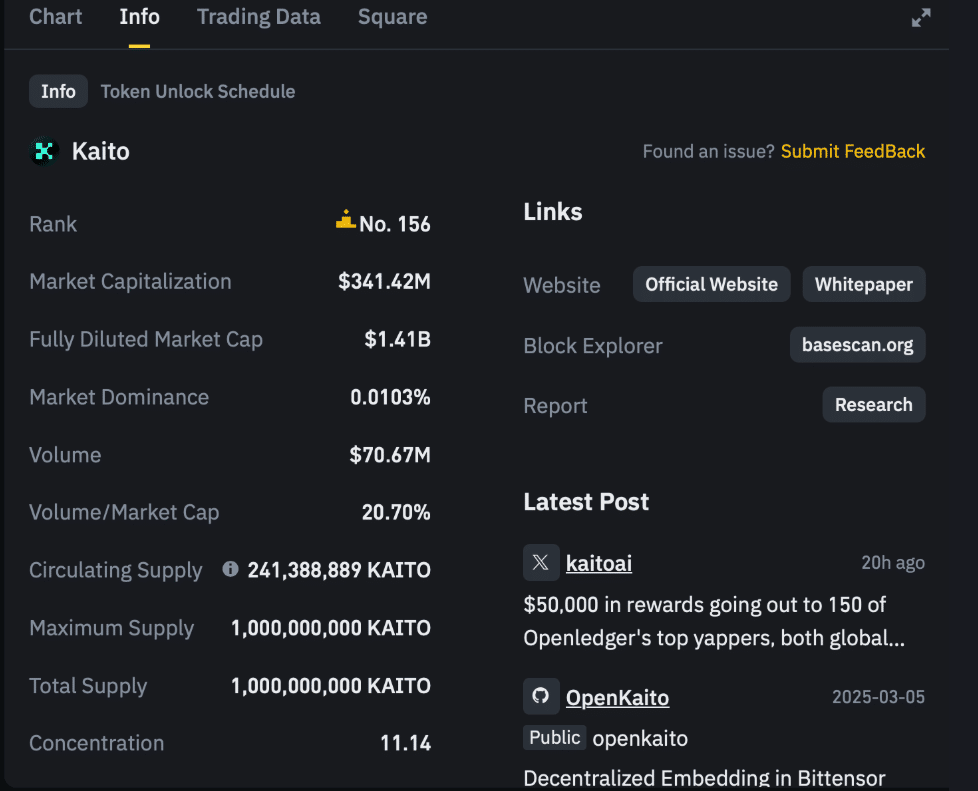

Many cryptocurrency projects lock a portion of their tokens for strategic purposes. These tokens are inaccessible until a certain vesting period ends. Binance’s new feature makes it easy for users to track locked tokens. By showing how much of a token’s supply is locked, this feature helps users avoid misinterpreting circulating supply and market cap.

This tool is important because a project’s circulating supply directly impacts its market cap and liquidity. The visibility of locked tokens ensures more accurate data, helping traders make informed decisions. Users can find this information under the token’s Info tab on the Binance exchange.

Holding Concentration Indicator: Assessing Token Ownership

The Holding Concentration Indicator helps users understand token ownership distribution. A small number of holders controlling a large portion of a token’s supply can increase volatility. With this tool, Binance exchange users can see if token ownership is concentrated in the hands of a few or widely distributed among many holders.

The feature calculates ownership concentration both within and outside Binance exchange. It uses a weighted formula to generate a score from 0 to 100. A higher score indicates higher concentration, meaning fewer holders control most of the supply. A lower score suggests a more even distribution, with potentially less volatility risk.

A Step Toward Greater Transparency in Crypto Markets

These new tools are part of Binance’s larger goal of enhancing transparency in the crypto market. The exchange has been adding features to provide users with more data to inform their trading decisions. Binance rolled out the Token Unlock and Vesting Schedules feature in September 2024. It also revamped its token methodology in February 2025 to improve market cap and circulating supply calculations.

In April 2025, Binance began linking to project financial reports on token information pages. These efforts show Binance exchange’s commitment to providing users with the tools they need to navigate the crypto market effectively.

Yi He: Leading the Charge for Transparency

Yi He, Binance’s co-founder, spoke about the importance of transparency. He stated, “We’ve heard clearly from the community that users want more transparency and tools to better understand the tokens they are trading… Binance exchange is not just making more token information available; we are setting new standards in increasing market transparency.”

Binance’s goal is to educate users and help them make better trading decisions. By offering clear information about token supply and ownership, Binance exchange ensures users have the knowledge to navigate the market.

Conclusion

The Token Lock-up Addresses and Holding Concentration Indicators are key steps in Binance’s mission to increase transparency and provide better tools for its users. These features, along with the platform’s previous updates, offer users more visibility into token dynamics, helping them make informed trading decisions.

Binance continues to lead the way in enhancing transparency in the crypto industry. By prioritizing user education and providing powerful tools for analysis, Binance exchange is setting a new standard for what a cryptocurrency exchange should offer. As the market evolves, Binance exchange commitment to transparency will play a crucial role in shaping the future of crypto trading.

Frequently Asked Questions (FAQ)

1: What is the purpose of Binance’s new Token Lock-up Addresses feature?

The feature allows users to view whether a portion of a token’s supply is locked, helping them better understand circulating supply and market liquidity.

2: How does the Holding Concentration Indicator work?

The Concentration Indicator shows how widely distributed token ownership is, helping traders assess the risk of price volatility based on ownership concentration.

3: Can I access these features directly on Binance exchange?

Yes, both the Token Lock-up Addresses and the Holding Concentration Indicator are available within the Binance platform, easily accessible from the token’s Info tab.

4: How does Binance plan to improve token transparency further?

Binance continues to introduce new tools and features aimed at providing more comprehensive token information, including upcoming token unlocks and financial reports.

Appendix: Glossary of Key Terms

Token Lock-up Addresses: A tool showing if a token’s supply is locked and unavailable for trading, offering clarity on circulating supply.

Holding Concentration Indicator: This feature reveals the distribution of token ownership to assess volatility risks based on holder concentration.

Circulating Supply: The amount of a cryptocurrency that is currently available for market trading, excluding locked tokens.

Market Cap: The total value of a cryptocurrency, calculated by multiplying its circulating supply by the current market price.

Vesting Period: A set timeframe during which certain tokens are locked, preventing them from being traded.

Transparency in Crypto Markets: The practice of providing clear, accessible data to help traders make well-informed decisions.

Weighted Formula: A calculation method used to assess token ownership distribution, impacting volatility and market stability.

Reference

Coinomedia – coinomedia.com