Binance, the world’s largest crypto exchange, officially launched USD‑margined perpetual contracts for Aave (AAVE) and Uniswap (UNI) on June 16, igniting a sharp rebound in both tokens. With up to 75× leverage available, the AAVE and UNI contracts facilitate deeper liquidity and wider trading flexibility, responding to growing interest in DeFi tokens amid an uncertain macro backdrop.

In the 24 hours following the announcement, AAVE rose, reaching a weekly gain of 13%, while UNI climbed around 7%, extending a nearly 20% weekly rally.

Key Features: USDC Margin, Multi-Asset Support, Precise Tick Sizes

Binance confirmed the AAVEUSDC perpetual contract opens at 08:30 UTC with a tick size of 0.01, followed by UNIUSDC at 08:45 UTC with a 0.001 tick size. These contracts are settled in USDC and support multi-asset margin, enabling positions with BTC or other assets, subject to risk-based haircuts.

Binance capped funding rates at ±0.75% for AAVEUSDC and ±0.45% for UNIUSDC, settled every eight hours, aiming to balance trader demand and reduce excessive speculation.

AAVE Prices Hold Strong; UNI Rockets Higher

Following the launch, AAVE traded near $286, up from a low of $266.79 and high of $291.30, and saw 13% weekly gains. The twenty-four-hour trading volume increased about 29%, a sign of renewed trader interest.

Analyst Livercoin noted:

“AAVE showed strength and pullback when other altcoins were plummeting during the recent market crash.”

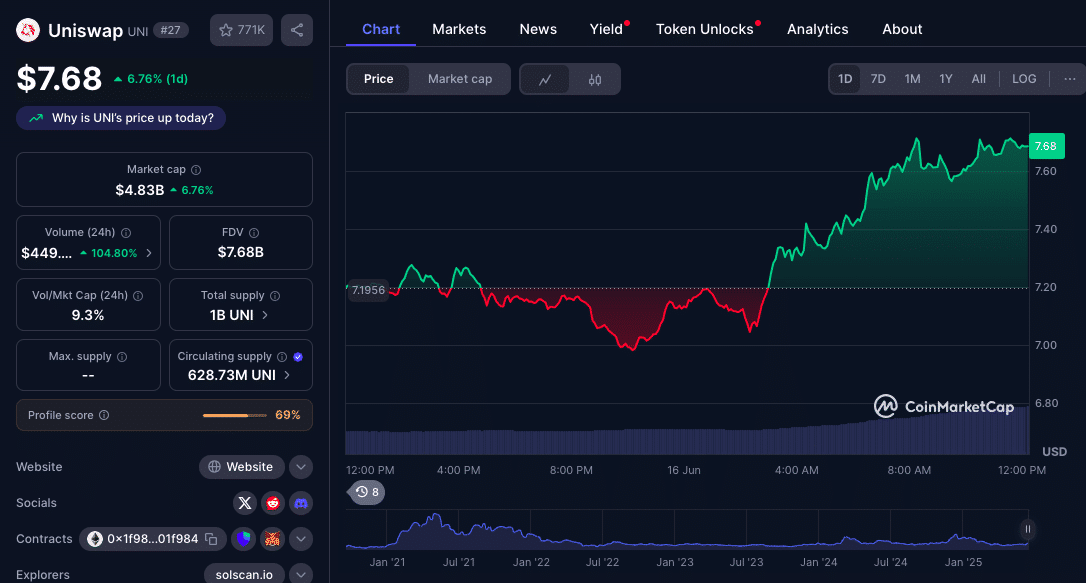

UNI followed suit, jumping approximately 7% in 24 hours to $7.68, with a weekly gain exceeding 20%, and volume spiking by roughly 90% . On-chain data shows UNI’s daily trading highs at $7.72, lows at $6.98, signaling robust activity .

Why This Matters: Leveraged DeFi Access and Liquidity Boost

This is not just a product launch; it’s a strategic move to deepen DeFi liquidity. USDC-margined perpetuals allow cross-asset margining, reducing users’ entry barriers and improving capital efficiency. By enabling BTC-collateralized positions, Binance is effectively bundling DeFi exposure into diverse portfolios, an increasingly critical play as the crypto market decouples from traditional fiat volatility.

Historically, the launch of high-leverage derivatives on major platforms correlates with heightened speculative activity, increased open interest, and more dynamic price discovery, factors reinforcing DeFi token momentum.

Powered by aggressive leverage, these new contracts come with inherent risks. Funding rates at ±0.75% for AAVEUSDC and ±0.45% for UNIUSDC create steep carry costs during strong directional moves. Traders unfamiliar with margin dynamics may face rapid liquidations, especially during volatile swings.

Smarter investors, however, may use these tools to hedge exposure or gain targeted DeFi feel, allowing more strategic management of price risks in volatile environments.

Broader Impact on DeFi: Catalyzing Ecosystem Growth

Enhanced liquidity, leverage, and cross-collateral features can spill over into DeFi ecosystems. DeFi tokens like BAL, AAVE and UNI serve as governance markers and bridges into active yield strategies. Enhanced derivative infrastructure can support more resilient DeFi treasuries, better hedging mechanisms, and deeper capital flow.

By expanding into USDC-settled perpetuals, Binance is setting a standard that may pressure other exchanges to introduce similar products, building interoperability and financial sophistication across platforms.

Conclusion: Binance AAVE Perpetual Spurs Tier-One DeFi Revival

Binance’s launch of USDC-margined perpetuals for AAVE and UNI with tick precision, multi-asset margin, and capped funding rates is delivering immediate impact.

As AAVE trades near $286 and UNI surges to roughly $7.70, the move reinforces Binance’s strategy to deepen DeFi involvement and empower traders with better tools. However, with 75× leverage comes significant risk, requiring users to balance conviction with prudent risk management.

Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQ

What are AAVEUSDC and UNIUSDC perpetuals?

They are USDC-margined perpetual futures contracts on Binance for AAVE and UNI, offering up to 75× leverage.

How does the multi-asset mode work?

Traders can use assets like BTC as collateral, subject to risk-based haircuts, allowing more flexible margining structures.

What are the funding rates?

±0.75% for AAVEUSDC and ±0.45% for UNIUSDC, settled every 8 hours, to balance demand between long and short positions.

What triggered price jumps in both tokens?

The contract launches led to immediate inflows: AAVE surged ~6% and UNI ~7% within 24 hours as trading volume rose sharply.

Are there risks?

High leverage can amplify losses; funding costs and liquidation risks mean traders must manage positions carefully.

Glossary

Perpetual Contract – A derivative resembling futures without expiry dates, offering leverage and continuous trading.

USDC-Margined – Trades settled in the stablecoin USDC, offering stable collateral and reduced fiat exposure.

Tick Size – The minimum price movement unit, set at 0.01 for AAVE and 0.001 for UNI.

Funding Rate – A periodic fee paid between long and short positions to stabilize perpetual contract pricing.

Multi-Asset Margin – Allows using different assets (e.g., BTC) as collateral, increasing capital flexibility.

Leverage – Borrowed exposure to increase potential returns—and potential losses—beyond initial capital.