The cryptocurrency market has taken a bearish turn this week, and Binance‘s announcement to delist three altcoins from its futures trading has only added to the downward pressure. Following the news, the prices of the affected tokens—MAVIA, OMG, and BOND—experienced sharp declines.

Binance Announces Delisting of MAVIA, OMG, and BOND Futures

In a recent update, Binance confirmed it will remove MAVIAUSDT, OMGUSDT, and BONDUSDT perpetual contracts from its USDⓈ-M Futures platform. According to the announcement, all positions will be automatically settled, and the contracts will be delisted at 12:00 PM UTC on December 16, 2024.

Binance advised users to close their open positions before the deadline to avoid automatic settlement. Starting at 11:30 AM UTC on December 16, 2024, users will no longer be able to open new positions in these contracts.

Altcoin Prices React to Delisting Announcement

The delisting news triggered immediate price drops for the affected tokens:

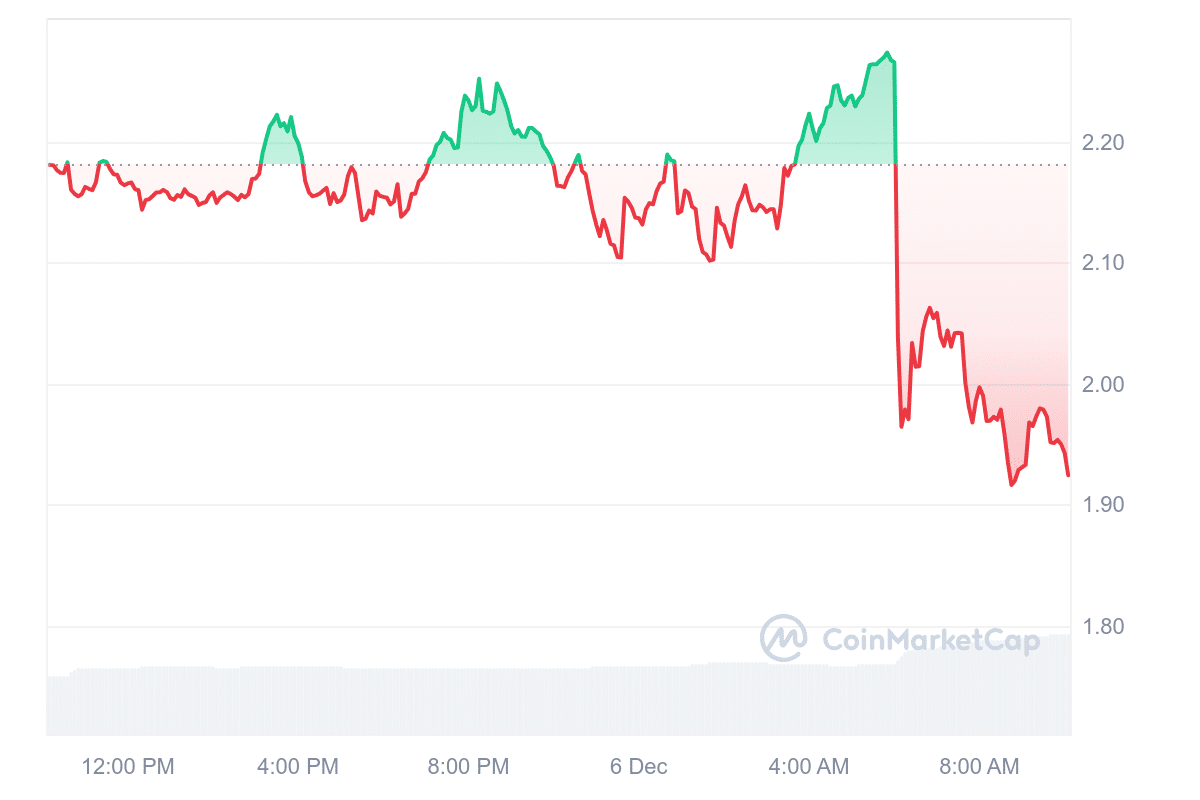

- MAVIA: The token fell from $2.26 to $1.92, marking a daily loss of over 10%. MAVIA was trading at $1.94 at the time of writing, with trading volume surging by approximately 70%, reflecting a rush among traders to offload the token.

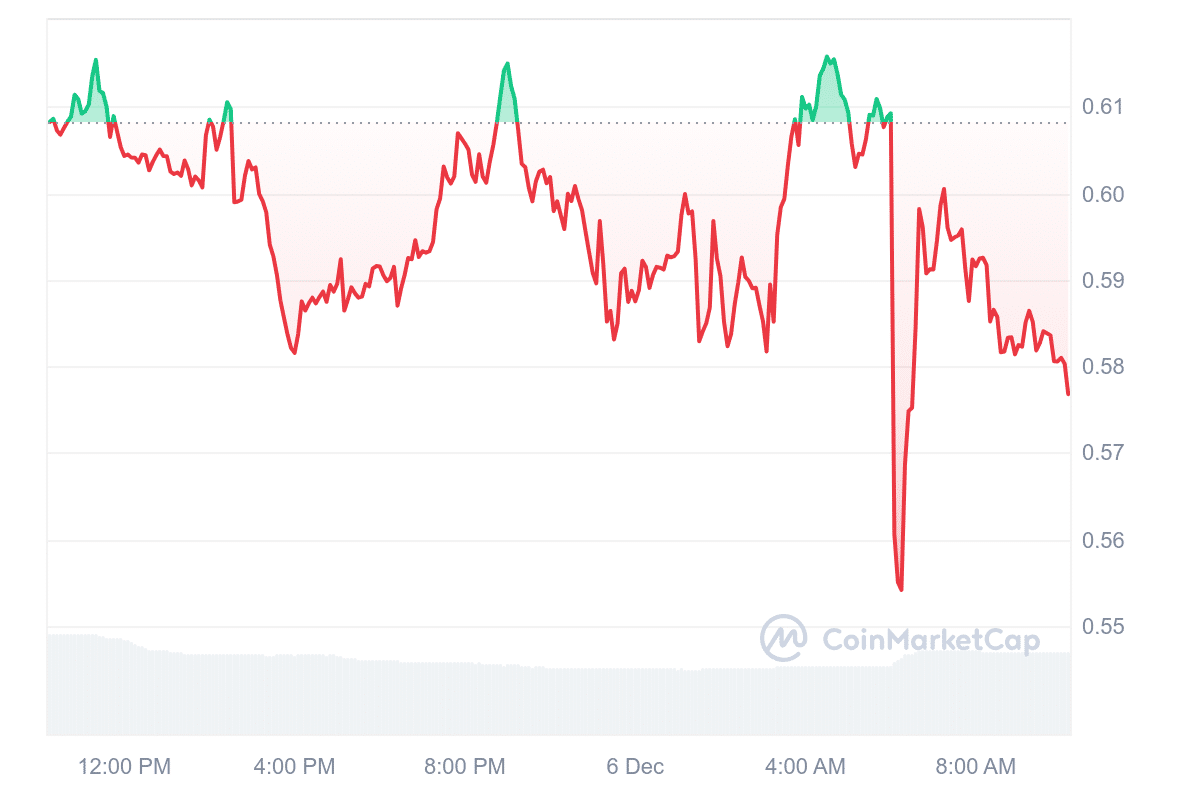

- OMG: OMG saw a decline from $0.61 to $0.5541 before recovering slightly. It was trading at $0.578, down 4.6% for the day. The token’s trading volume rose by 17%, indicating waning investor confidence.

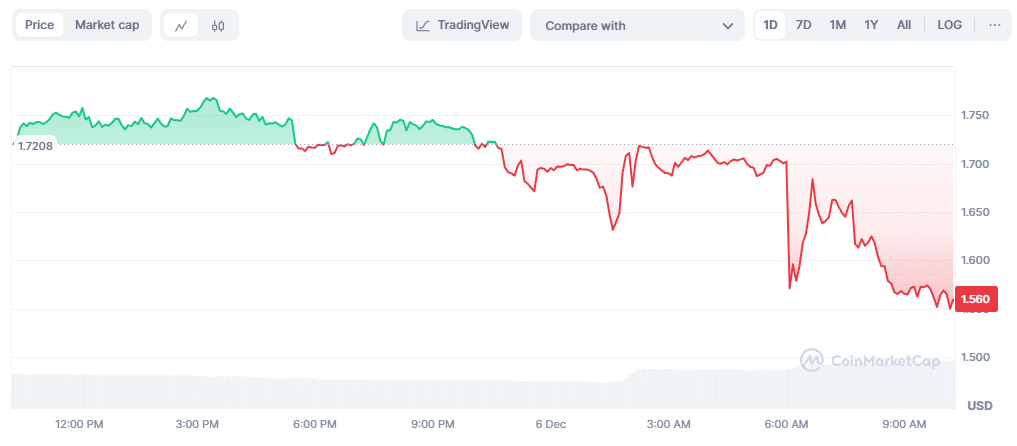

- BOND: Similarly, BOND dropped from $1.75 to $1.56, posting a daily loss of around 9%. Its trading volume increased by approximately 37%, further signaling traders’ efforts to liquidate their holdings.

What This Means for the Market

The delisting decision has contributed to a broader sentiment of caution in the cryptocurrency market. As The Bit Journal highlights, the move underscores Binance’s commitment to periodically review and update its offerings, even if it means short-term volatility for certain tokens.

Investors and traders should stay vigilant, as the removal of these altcoins from Binance Futures could signal shifting priorities within the market. The Bit Journal will continue to provide updates on this developing story.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!