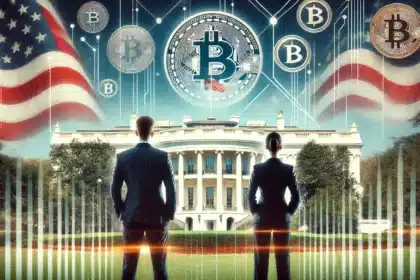

Binance.US is gearing up for an extended legal battle with the SEC, emphasizing its commitment to compliance and sharply criticizing the agency’s enforcement tactics. This unfolding drama is poised to capture significant attention in cryptocurrency, with potential implications for the broader market, including major players like Bitcoin and Ethereum. The conflict highlights the ongoing tension between regulatory bodies and cryptocurrency exchanges, as both sides prepare for what could be a protracted and high-stakes legal confrontation.

In a recent statement on its official X platform, Binance.US declared its readiness to confront the SEC in court, signalling its intention to vigorously defend its practices. The exchange, a major player in the US cryptocurrency market, accused the SEC of adopting overly aggressive enforcement tactics that do not foster a conducive environment for innovation and growth within the industry.

“On Friday, the Court decided that the SEC’s case against Binance.US will continue. We were prepared for this and look forward to having this case move forward in the judicial process.”

The SEC’s allegation against Binance.US borders on securities law offences, unregistered investment products, and anti-fraud crimes.

The Binance.Us team reiterated that it focused on serving US customers while adhering to US rules and regulations.

“Binance.US was established with the express purpose of serving United States customers in accordance with U.S. rules and regulations” the statement read. “We maintain 1:1 reserves for all customer assets and have robust compliance and risk programs which ensure our platform’s safety, security, and integrity.”

The SEC’s handling of cryptocurrency regulation has been a point of contention, with many industry leaders believing that it is excessively punishing instead of instructive. Binance.US shared the same view concerning the SEC’s inconsistency and use of forceful means to get things done. This exchange’s decision to sue the SEC is a milestone in the ongoing debate on regulatory models that best suit digital assets.

The legal conflict between Binance.US and the SEC will have widespread consequences on the cryptocurrency market. Binance.US, one of the largest U.S. exchanges, plays an essential role in trading major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). The outcome of this lawsuit may determine how these digital assets will be regulated and traded afterwards.

According to news sources, this case can possibly generate a precedent regarding how regulators interact with crypto exchanges going forward. This might inspire other exchanges to be more aggressive when they are faced with regulations they find oppressive or unfair. On the other hand, if the SEC wins, it could then move forward with stronger enforcement measures throughout this sector.

Both Binance.US and the SEC are playing high-stakes games as market stability and investor confidence hang in balance. For traders in Bitcoin and Ethereum, resolving this issue can affect volumes traded as well as market dynamics, especially if new regulations are introduced. Investors who want their holdings unaffected by changes in regulation await some clarity from this situation.

Binance.US and SEC: Future Outlook

The future of US cryptocurrency regulation hangs in the balance as Binance.US and the SEC prepare for their major legal battle. Both sides expect a protracted, contentious war with far-reaching consequences for the industry. The battle will determine the direction of rules to govern operations in exchange markets and digital trading platforms over the next few years.

It is important for investors and market participants to be aware of regulatory developments. The changing legal landscape will directly affect market dynamics, influencing investment decisions and trading strategies. To navigate these times, it is crucial to get updated by reliable news sources like The BIT Journal.

In conclusion, the impending legal clash between Binance.US and the SEC represents a critical juncture for the cryptocurrency industry. As both sides prepare for what promises to be an epic battle, the stakes could not be higher. The outcome will not only determine the future of Binance.US but also set the tone for how digital assets are regulated and traded in the United States and potentially around the world.