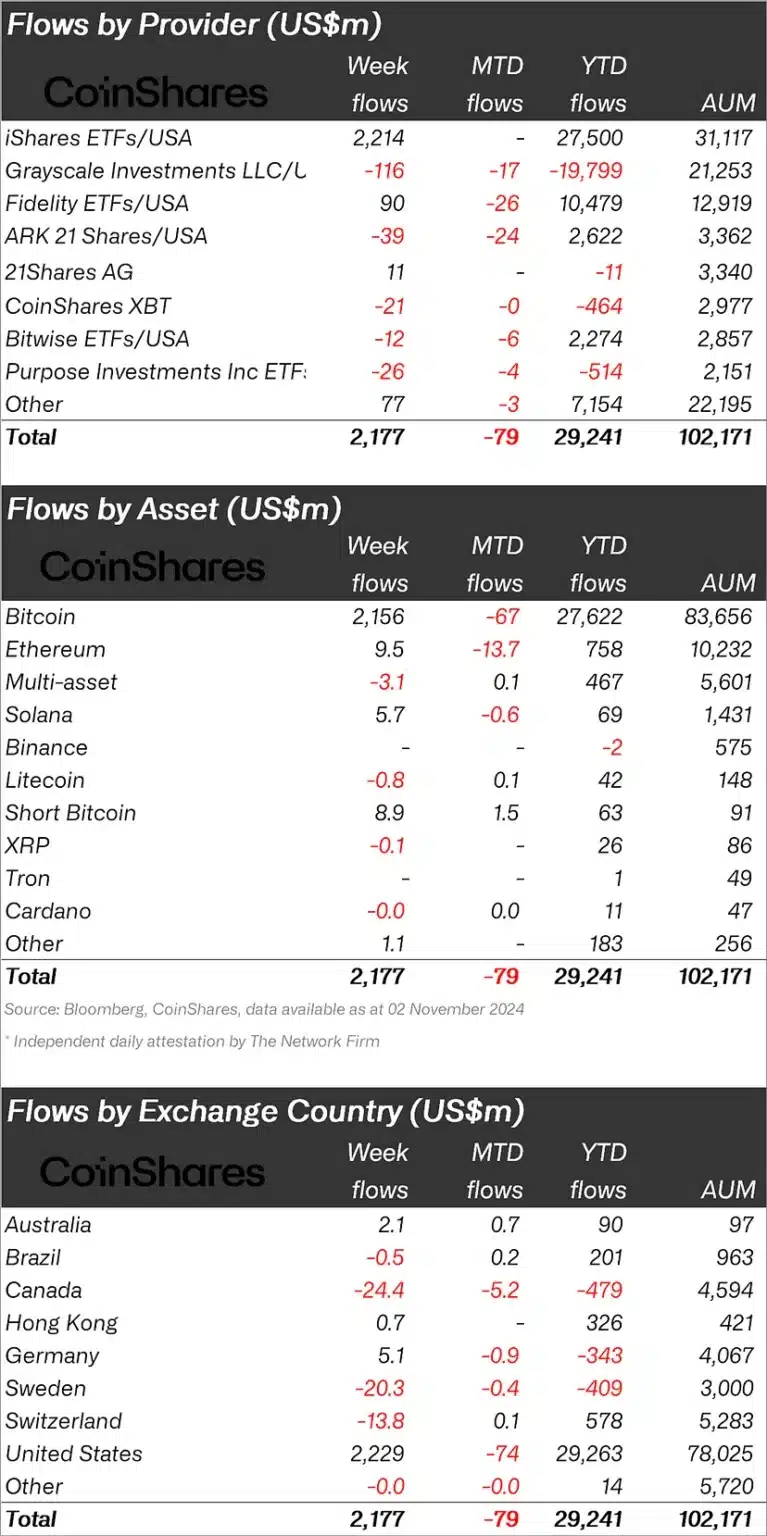

Investor interest in Bitcoin and select altcoins surged last week, with optimism surrounding the U.S. elections driving a massive $2.2 billion inflow into crypto asset investment products. According to a new report by CoinShares, this substantial inflow brought year-to-date total investments to a record-breaking $29.2 billion, fueled by expectations of a potential Republican victory. However, as polling results fluctuated toward the end of the week, some funds shifted to outflows, highlighting the crypto market’s sensitivity to U.S. political developments.

Strong Inflows for Bitcoin and Major Altcoins

The U.S. accounted for the largest share of crypto investment inflows, recording a remarkable $2.2 billion. This demand was predominantly concentrated in Bitcoin, while Germany followed with $5.1 million. CoinShares’ report noted that the current political uncertainties in the U.S. have likely intensified interest in crypto assets. Historically, U.S. elections have influenced crypto markets, and this year is proving to be no different.

Bitcoin led the market, attracting the full $2.2 billion inflow and even sparking activity in short Bitcoin products, which saw $8.9 million in investments. This strong demand not only reflects investor optimism for a market upswing but also appeals to short-term investors looking to capitalize on this sentiment. Ethereum also attracted attention, though to a lesser extent, with a moderate inflow of $9.5 million, suggesting a relatively stable interest compared to Bitcoin.

Altcoin Gains and Outflows in the Market

Beyond Bitcoin and Ethereum, other altcoins like Solana emerged as notable gainers, with Solana alone drawing $5.7 million in new investments. Solana’s recent technical advancements and user-friendly applications have bolstered investor confidence. Meanwhile, Polkadot and Arbitrum also experienced positive inflows, with Polkadot receiving $670,000 and Arbitrum $200,000, indicating a growing investor interest in innovative projects beyond mainstream cryptocurrencies.

In contrast, altcoins such as XRP, Litecoin (LTC), and Cardano (ADA) experienced outflows, reflecting a shift in investor focus toward Bitcoin and other high-demand assets.

Trading Volume Surge Highlights Market Activity

The past week also saw a substantial increase in trading volume, with a 67% rise pushing total weekly trading to $19.2 billion. This figure represents approximately 35% of Bitcoin’s total trading volume across trusted exchanges, underscoring a growing investor presence in the market as excitement over the U.S. elections builds.

As The Bit Journal continues to cover developments in the crypto space, the rising activity in the crypto market reflects increasing investor participation driven by election-related anticipation.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!