Illinois is poised to make history by officially incorporating Bitcoin into its fiscal reserves. State Representative John Cabello has put forth the Strategic Bitcoin Reserve proposal, which, if approved, would place Illinois at the forefront of emerging financial technology.

Illinois’ Bold Financial Move

On January 29th, 2025, the Bitcoin Strategic Bill was sent to the Rules Committee, marking a pivotal moment as it advances toward potential enactment. The proposed legislation empowers the Illinois State Treasurer to oversee a Bitcoin reserve fund, accepting gifts, grants, and donations of Bitcoin from constituents and governmental bodies. Notably, the bill mandates that any Bitcoin obtained be retained for no less than five years, ensuring a strategic long-term approach.

After this duration, the State Treasurer would have the authority to transfer, liquidate, or exchange the Bitcoin into other cryptocurrencies. The bill also allows for hiring staff to secure and manage the fund, requires regular reporting on its status, and permits Illinois residents to voluntarily contribute Bitcoin to the state’s reserve.

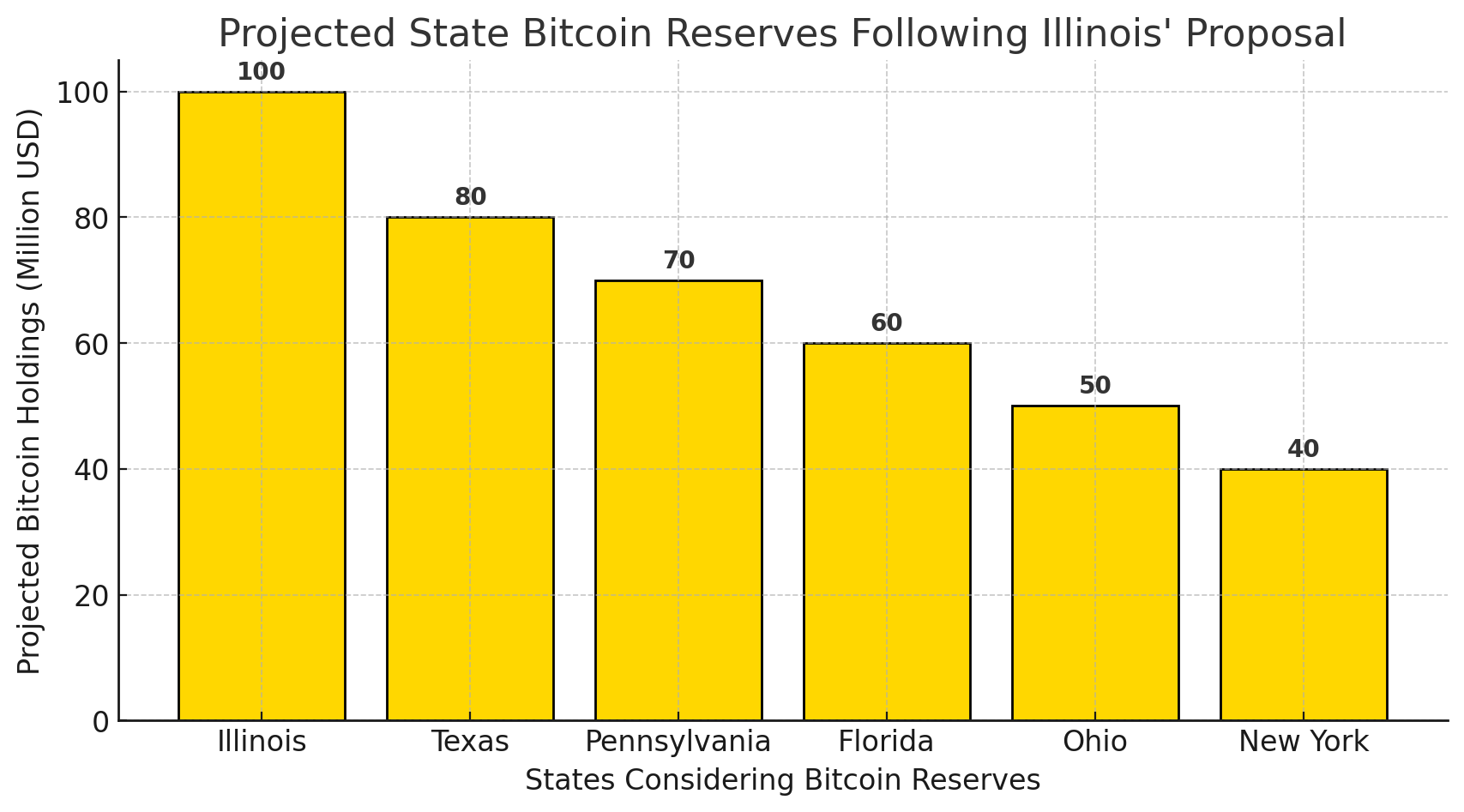

A Growing Trend Among States

Illinois has sparked discussion by exploring integrating Bitcoin into its coffers. States like Ohio, Texas, Florida, and Pennsylvania are weighing similar moves, underscoring swelling governmental fascination with cryptocurrency as a strategic store of value. Texas’ proposed Bitcoin Act, for instance, envisions allocating up to 10% of its nearly $8 billion treasury to the digital asset. These deliberations highlight a developing understanding of Bitcoin’s potential to diversify holdings and counter-economic unpredictability.

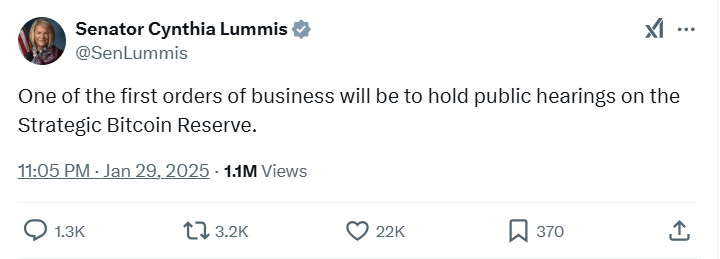

Federal Support and Advocacy

At the federal level, United States Senator Cynthia Lummis has vocally advocated for Bitcoin. In mid-2024, she introduced the Forward-looking Innovation to Strengthen Competitiveness through Technology Investment Nationwide (BITCOIN) Act, aiming to build a prudent Bitcoin stockpile to bolster the American dollar and reinforce America’s financial leadership globally.

“Establishing a wise Bitcoin reserve would firmly anchor the dollar’s place as the world’s reserve currency into the 21st century and confirm we remain the leader in pioneering monetary solutions,” Lummis stated.

Potential Benefits and Considerations

Proponents of the Strategic Bitcoin Reserve emphasize the cryptocurrency’s decentralized nature and scarce supply as an appealing means to counter inflationary pressures and economic unpredictability. By incorporating limited Bitcoin into state coffers, governments can diversify their holdings in ways that could fortify financial resilience during uncertain times.

However, the inherent instability of digital currencies must also be acknowledged. Critics assert that Bitcoin’s erratic price swings may present prospective dangers to state budgets. Thus, any move to embrace Bitcoin as a reserved resource demands accompanying risk management systems and thorough deliberation to shield finances from potential volatility.

Looking Forward

As Illinois inches nearer, to possibly establishing a Strategic Bitcoin Reserve, it sets a precedent that may sway other states and potentially even national policy. The convergence of provincial initiatives and federal advocacy indicates a significant evolution in how public entities perceive and leverage cryptocurrency.

In the coming months, lawmakers, financial experts, and the general public will engage in discussions determining the role of bitcoin in state and nationwide reserves. Illinois’ initiative could very well trigger a broader transformation in public finance, welcoming digital assets as core parts of governmental portfolios.

Conclusion

To conclude, Illinois’ proposed Strategic Bitcoin Reserve represents a bold and forward-looking approach to public finance. By embracing bitcoin, the state aims not only to bolster its financial standing but also to signal a willingness to lead in the evolving realm of digital assets. As this initiative unfolds, it will undoubtedly serve as a case study for other states and nations pondering comparable paths.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. Why is Illinois considering a Bitcoin reserve?

To hedge against inflation, diversify state assets, and embrace Bitcoin as a strategic financial reserve.

2. How will the Bitcoin reserve work?

The Illinois State Treasurer will manage BTC donations and holdings, keeping them for at least five years before any sale or conversion.

3. Could other states follow Illinois’ lead?

Yes, states like Texas, Pennsylvania, and Florida are exploring similar plans, and federal support for Bitcoin reserves is growing.