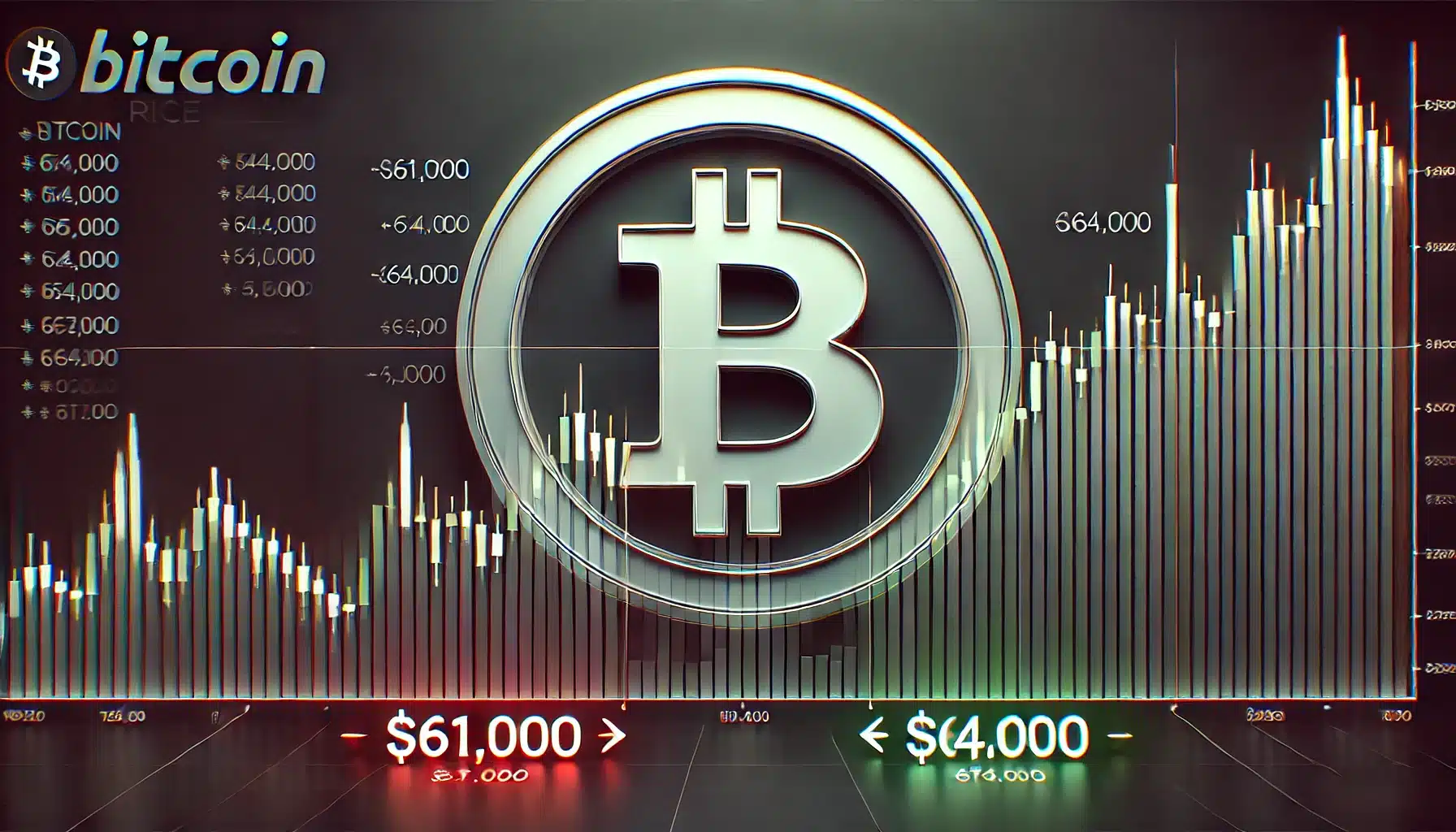

Bitcoin (BTC) has been catching the attention of investors with its recent price movements. Data from Coinglass indicates that significant liquidations are on the horizon as the price approaches certain key levels. Both long and short positions could be affected, leading to substantial market volatility. Here’s what you need to know…

$61,000 Support Breakdown Could Trigger $653 Million in Liquidations

According to Coinglass, if Bitcoin’s price drops below $61,000, the market could see a major wave of liquidations. Long positions face the most significant threat, with a potential liquidation total of $653 million. This could lead to a sharp drop in Bitcoin’s price, accompanied by a severe loss of liquidity.

If this critical level is breached, panic selling could increase, accelerating Bitcoin’s decline. Investors are closely watching this key support level, which is likely to play a pivotal role in determining the market’s next move.

$64,000 Resistance Could Spark $848 Million in Short Liquidations

On the other hand, if Bitcoin rises above $64,000, short positions will be at significant risk. Reaching this level could result in a massive $848 million worth of short liquidations. This would trigger a rally, as short positions are forced to close, further driving up the price and deepening liquidity issues.

A break above this resistance could lead to a bullish surge, but it also poses a considerable risk for those betting on short-term declines. Investors need to keep a close eye on this level and adjust their strategies accordingly.

The Impact of Liquidation Clusters on Bitcoin’s Market

Coinglass’ liquidation data highlights the importance of liquidation clusters in Bitcoin’s market. Each cluster reflects the potential magnitude and impact of price movements at certain levels. The height of these liquidation bars signals the strength of upcoming market action as Bitcoin approaches these critical levels.

Investors can use this data to better position themselves in the market and reduce potential risks, especially as the market becomes increasingly volatile.

Expert Shares Bold Bitcoin Prediction

As The Bit Journal reports, liquidation waves can have significant consequences, especially for investors holding large positions. Monitoring the market’s liquidity levels and key price points is crucial. Coinglass’ data clearly outlines the risks at these critical thresholds. The volatile nature of the crypto market presents both opportunities and risks, making it essential for investors to remain vigilant.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!