The crypto market, along with Bitcoin’s price, is focused on the upcoming FOMC meeting and Fed Chair Jerome Powell’s speech. With optimism high following Donald Trump’s presidential win, investors are positioning themselves in anticipation of a potential 25 basis-point rate cut today. Although this could potentially drive Bitcoin’s price towards the $100,000 mark, some experts caution about potential volatility.

FOMC Expectations for Bitcoin’s Price

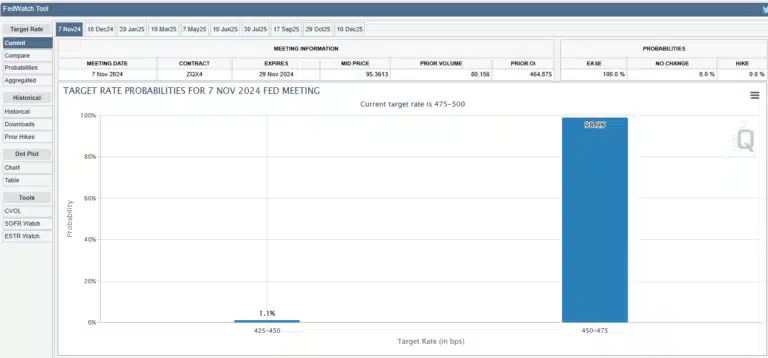

As the FOMC meeting approaches, market participants are eagerly awaiting clarity on the economic outlook. A 0.25% rate cut by the Federal Reserve is anticipated, with the CME FedWatch Tool indicating a 99% probability for this decision, and a similar cut expected in December. Despite the positive expectations, some investors remain cautious, seeking greater certainty in market trends. Experts suggest that Jerome Powell’s speech could bring volatility, as his tone will shape market sentiment.

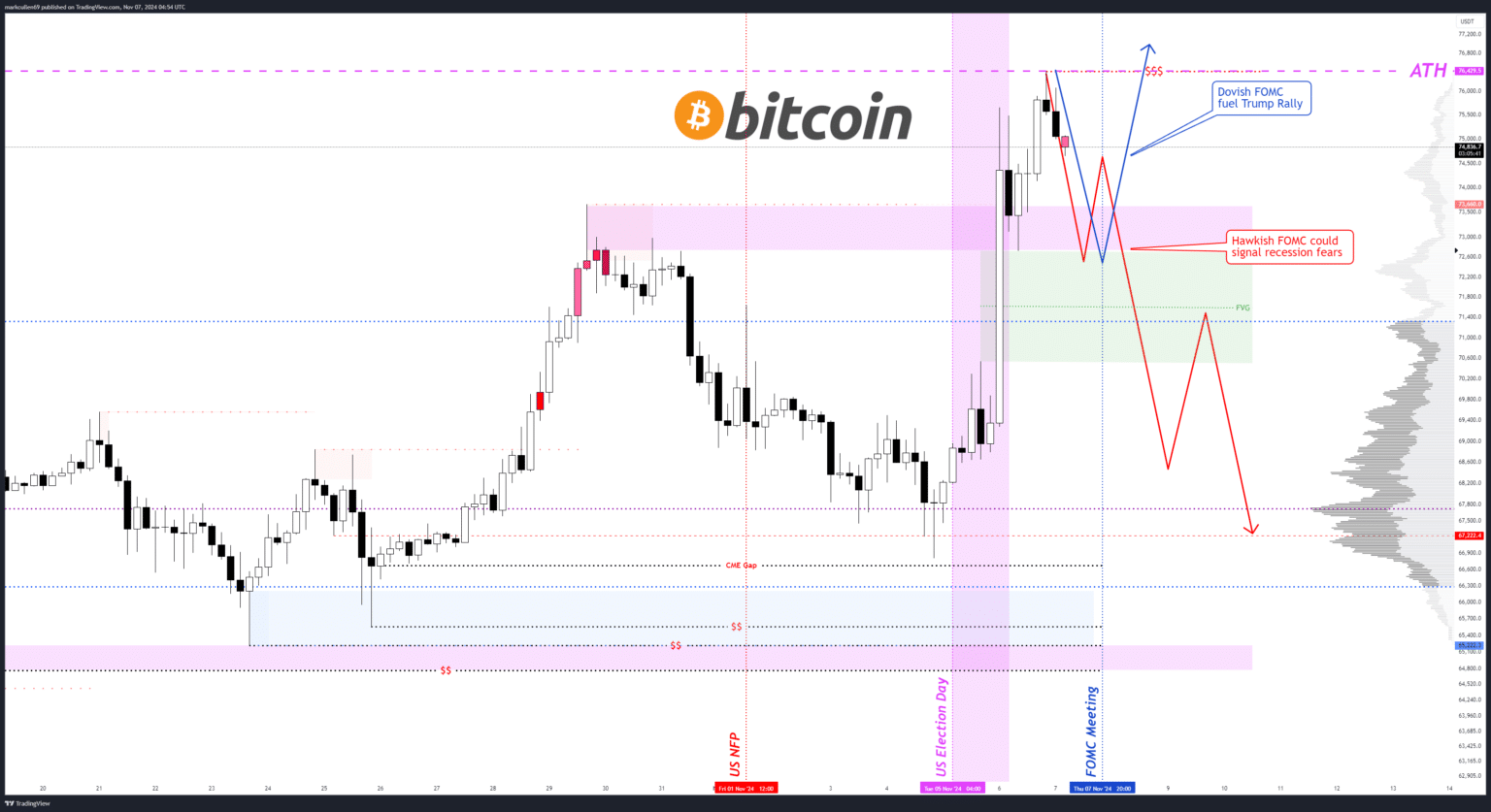

Crypto advocate AlphaBTC expressed cautious optimism, expecting a quarter-point rate cut. According to AlphaBTC, Powell’s stance could influence the “Trump Rally.” A hawkish tone could fuel recession fears, while a dovish stance may drive markets further. Powell’s views on Trump, who has previously criticized the central bank, will also be closely watched. Meanwhile, Elon Musk’s D.O.G.E. initiative is generating enthusiasm, with speculation that Dogecoin could experience a strong rally.

Will BTC Hit $100,000?

While short-term volatility is expected following the FOMC meeting and Powell’s remarks, several crypto experts remain bullish on BTC’s price. Many analysts foresee an upward trend for BTC under Trump’s presidency, anticipating clear crypto regulations. At the time of writing, Bitcoin traded at $74,828, up 1.5% after hitting an all-time high of $76,460. BTC futures open interest has also increased by around 4% since yesterday, reflecting market optimism.

The notion of Bitcoin as a strategic reserve asset in the U.S. is gaining traction. Wyoming Senator Cynthia Lummis reiterated her support for this approach, and Trump’s campaign echoed similar promises. Additionally, a report from Matrixport suggests Bitcoin is on track for a rally to $100,000, citing SEC Chair Gary Gensler’s potential departure and the strategic reserve prospect as positive catalysts.

While the FOMC meeting may introduce volatility and temper a Bitcoin rally, recent developments have some investors shifting attention to altcoins like Ethereum. This shift raises concerns for some traders, as increasing interest in altcoins could affect market sentiment.

Bitcoin Sell-Off Expected?

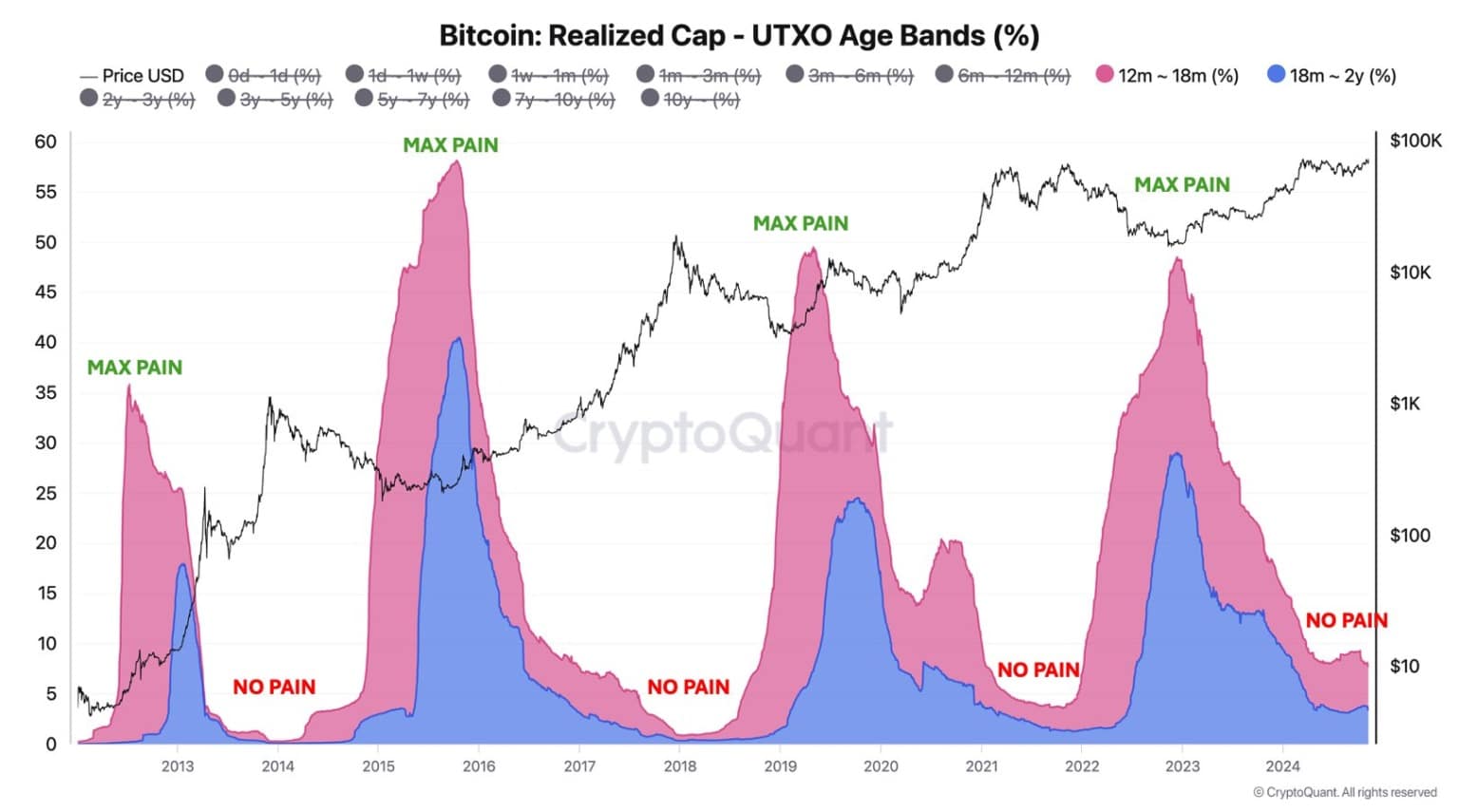

CryptoQuant CEO Ki Young Ju recently predicted on X that a BTC sell-off might be imminent. Ju speculates that new investors might see this rally as an opportunity for profit-taking, which could hinder a strong Bitcoin rally. “New investors often hold BTC through bear markets and sell as the pain eases. I believe now is the time for gradual selling,” Ju stated.

As developments unfold, investors in The Bit Journal’s community and beyond are advised to stay vigilant, as market conditions remain dynamic.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!