A major step forward toward cryptocurrency adoption comes in the form of the Minnesota Bitcoin Act (SF2661) introduced by Minnesota State Senator Jeremy Miller. The legislation also has a prominent backer in the person of Miller, who was previously known as one of Bitcoin’s biggest skeptics and is now promoting the idea of using Bitcoin and other cryptocurrencies as a part of the state’s financial structure.

Senator Miller’s Transformation: From Skeptic to Advocate

Senator Miller’s metamorphosis into a crypto convert has been illuminating. He continued,

“As I do more research on cryptocurrency and hear from more and more constituents, I’ve gone from being highly skeptical to learning more about it, to believing in Bitcoin and other cryptocurrencies.”

This development illustrates the increasing acceptance and comprehension of digital assets by policymakers.

Key Provisions of the Minnesota Bitcoin Act

The Minnesota Bitcoin Act introduces a number of first-of-its-kind reforms:

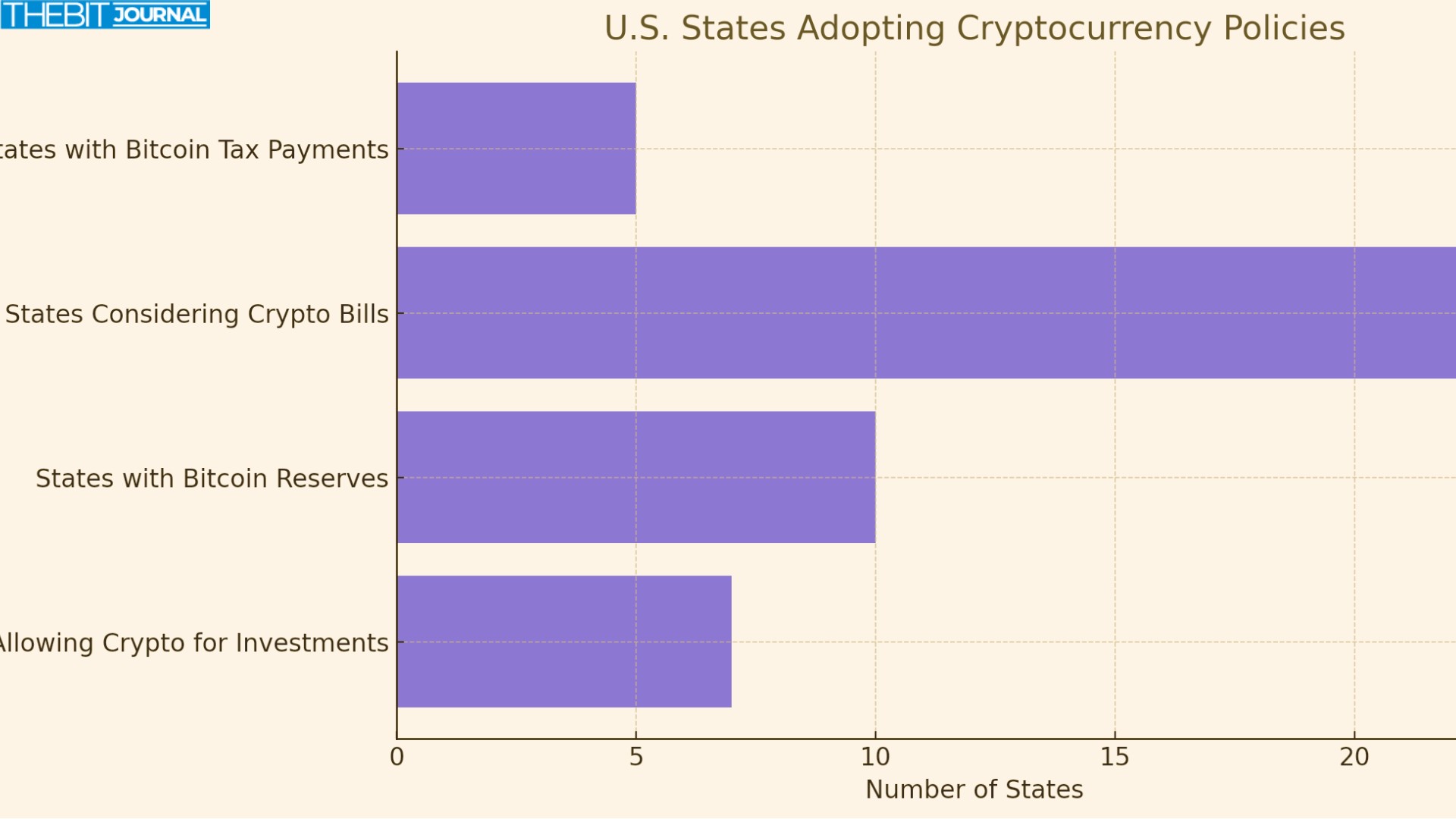

Investing State Assets in Crypto: It allows the Minnesota State Board of Investment to invest state assets into Bitcoin and other Cryptocurrencies instead of only traditional investments, such as stocks and bonds.

Allowing Cryptos for Retirement Plans: State employees could include Bitcoin and other cryptocurrencies in their retirement accounts, creating an alternative method of wealth generation.

Tax Payments with Cryptocurrency: Residents could use Bitcoin to pay their state taxes and fees, offering more convenience and flexibility. Colorado and Utah have already implemented similar measures for tax payments, and Louisiana accepts crypto for state services.

Exemption of State Income Tax on Bitcoin and Other Cryptocurrency Gains: Residents and businesses investing in Bitcoin or other cryptocurrencies would not be required to pay state income taxes on their investment gains.

Minnesota’s Position in the National Cryptocurrency Landscape

Minnesota is the latest U.S. state to consider adopting cryptocurrency. Currently, 23 states are proposing legislation to determine Bitcoin reserves and take the path of a new financial system. The move puts Minnesota in the ranks of potential candidates to lead the cryptocurrency space alongside states like Texas and New Hampshire, which are exploring such initiatives.

Implications for Financial Innovation and Economic Growth

The Minnesota Bitcoin Act could have far-reaching implications:

Economic Diversification: By embracing cryptocurrencies, Minnesota could attract blockchain and fintech companies, fostering economic growth and job creation.

Financial Inclusion: Allowing cryptocurrencies for tax payments and retirement plans could enhance financial inclusion, providing more options for residents to manage their finances.

Innovation Encouragement: Tax exemptions on cryptocurrency gains could spur innovation and investment in the digital asset space within the state.

Conclusion

This is especially true since Senator Jeremy Miller recently introduced the Minnesota Bitcoin Act. Minnesota — by suggesting the inclusion of cryptocurrencies in state investments, retirement plans, and tax payments — is staking its claim as a leader in the future of finance. The two-fold effect of this legislative initiative signals a shift in attitude towards digital assets as a legitimate component of the financial landscape, highlighting the state’s focus on leveraging emerging technologies to drive economic growth and diversification.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What Is the Minnesota Bitcoin Act?

On Tuesday, the Minnesota Bitcoin Act (SF2661) introduced a bill to allow Bitcoin and other cryptocurrencies to be included in state investments, employee retirement plans, and tax payment options.

How will this act impact state investments?

According to the act, the Minnesota State Board of Investment is authorized to invest state assets within Bitcoin and other cryptocurrencies, doing so diversifies the state’s investments beyond typical stocks and bonds.

It’s October 2023. Can state employees have cryptocurrencies as part of their retirement?

Well, to the extent state workers can hold Bitcoin and other ‘crypto’ in their retirement accounts, the proposed legislation opens up new wealth accumulation options.

Are residents going to pay taxes using Bitcoin?

If the act were ever implemented, the common Minnesota resident would be able to pay state taxes and fees using Bitcoin, offering more convenience and flexibility.

Are there tax breaks for crypto investments?

Under the bill, investment income from Bitcoin and other cryptocurrencies will also be exempted from state income taxes, encouraging residents and businesses to explore this emerging financial space.

Glossary

Bitcoin: A decentralized digital currency that operates without a central authority, using peer-to-peer technology to facilitate instant payments.

Cryptocurrency: A digital or virtual form of currency that uses cryptography for security and operates independently of a central authority.

Blockchain: A distributed ledger technology that records transactions across many computers in such a way that the registered transactions cannot be altered retroactively.

State Board of Investment (SBI): A state agency responsible for managing and investing state funds, including retirement funds and other state assets.

Tax Incentives: Financial benefits provided to encourage certain activities or investments, often in the form of tax exemptions or reductions.