Bob Burnett, CEO of Barefoot Mining, envisions a future where Bitcoin blockspace becomes a highly contested resource, potentially leading to digital wars. Explore his predictions about the financialization of Bitcoin blockspace and its impact on the future of finance and digital transactions.

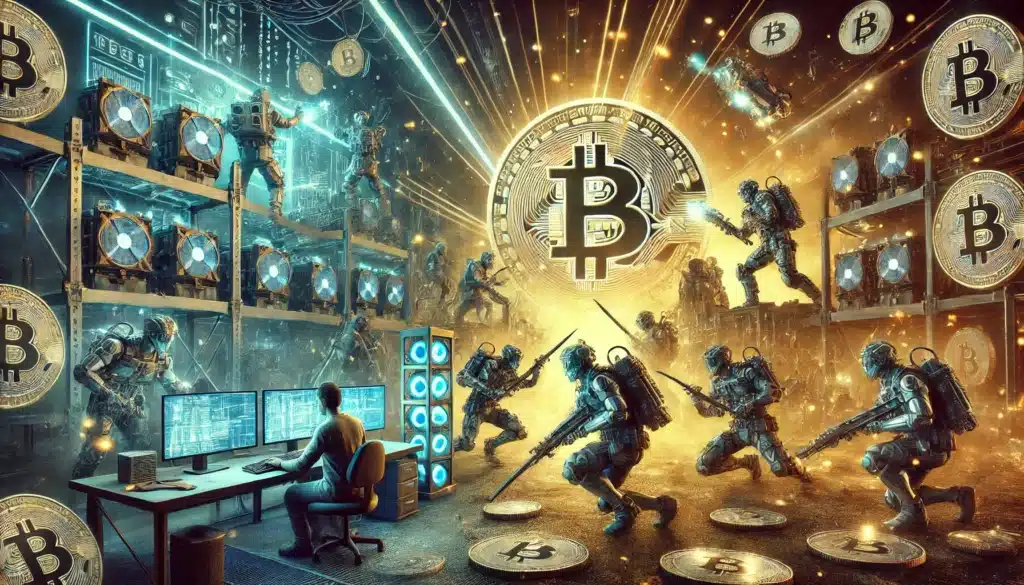

Picture a world where battles are fought over digital assets instead of land or oil. While it might sound like a scene from a sci-fi movie, Bob Burnett, CEO of Barefoot Mining, believes this could soon be a reality. In a recent interview on the Bitcoin Fundamentals podcast, Burnett shared his vision of the future, where Bitcoin blockspace becomes a scarce and highly coveted resource. His predictions have sparked significant debate among cryptocurrency enthusiasts.

Envisioning the Future

Bob Burnett, leading Barefoot Mining, a company renowned for its off-grid mining solutions, has sketched a captivating image of what lies ahead. He forecasts that as Bitcoin integrates more deeply into the global economy, its blockspace will transform into a hot commodity. Burnett argues that the “financialization” of Bitcoin blockspace is essential for solving the network’s long-term sustainability issues.

He anticipates a time when the demand for Bitcoin blockspace, especially at peak times, will create a market for blockspace futures. In this market, mining companies would auction off their blockspace to the highest bidders, who need to perform critical transactions on the Bitcoin network.

Shifting Perceptions of Value

This new way of thinking—viewing Bitcoin blockspace not merely for its immediate financial value but as a limited and precious resource—represents a significant shift. Burnett explains, “If we’re on a path to Bitcoin being the base layer of money, now Bitcoin is existential to all the financial services companies and government. We can probably debate the time frame, but we are on a path where wars will be fought over control of those 53,000 blocks.”

His statement underlines the tremendous value he believes Bitcoin blockspace will hold. As businesses and wealthy individuals increasingly rely on Bitcoin for their financial transactions, the competition for blockspace will escalate.

The Formation of Cartels

Burnett also predicts the emergence of alliances or cartels among companies to secure privileged access to Bitcoin blockspace. He believes mining organizations will band together to ensure that only their group’s transactions are processed. “These cartels will only process transactions from their inner circles, rejecting bids from other organizations,” he predicts.

This scenario suggests a future where the dynamics of Bitcoin mining and transaction processing could be drastically different. Controlling access to blockspace would give these cartels substantial influence over the Bitcoin network’s operation and performance.

Evolution of Revenue Streams

Looking forward, Burnett foresees a major shift in how Bitcoin mining companies will generate revenue. He predicts that within 15 years, transaction fees will surpass subsidies as the primary income source for miners. This change is crucial for the long-term sustainability of the Bitcoin network, which currently depends heavily on block subsidies that decrease over time.

“This situation will stabilize the income for bitcoin mining companies, which in 15 years will benefit more from transaction fees than from subsidies,” Burnett concludes. This transition is vital for the future of Bitcoin mining, ensuring that miners remain incentivized to maintain the network.

The Final Word

Burnett’s predictions provide a thought-provoking glimpse into the future of Bitcoin and its blockspace. While the idea of wars over digital assets might seem far-fetched, the underlying message is clear: as Bitcoin becomes more embedded in the global financial system, the control and value of its blockspace will become increasingly significant.

As our world becomes more digitally connected, the competition for resources extends beyond traditional commodities like oil or gold. According to Burnett, Bitcoin blockspace could become one of the most sought-after resources, shaping the future of finance and digital transactions. Whether his predictions come true or not, they offer an intriguing perspective on how the cryptocurrency landscape might evolve in response to these changes.

Reflecting on this potential future, it’s worth considering the implications of such a shift. Digital assets could become as valuable and contested as physical ones. Burnett’s vision opens up a new chapter in the conversation about Bitcoin and its role in our world, one that will surely be watched with great interest in the coming years. For more, stay tuned to The Bit Journal.