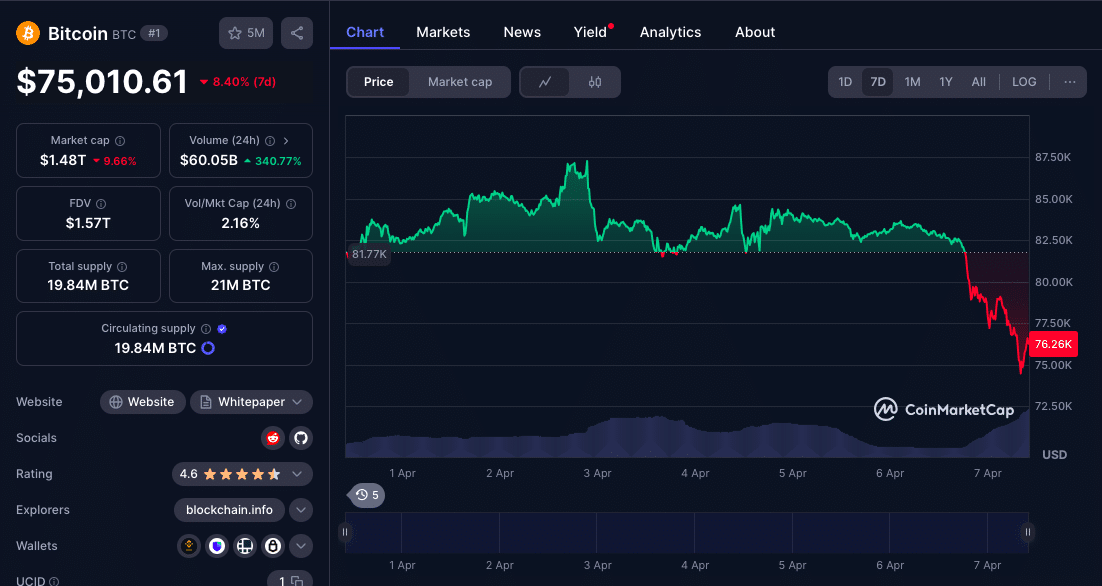

Bitcoin took a nosedive over the weekend, plummeting to $75,000, an 8% drop which sent ripples through digital asset markets, lighting up recession fears. According to reports, the U.S.-China trade standoff reignited by Donald Trump’s sweeping tariff announcement also had a lot to do with it. In just 24 hours, nearly $1 billion in crypto positions were liquidated, a whooping $842.2 million in long bets gone. Coinglass data shows just how quickly bullish sentiment unraveled.

The slump came after one of the most volatile trading weeks on Wall Street since 2020. As global equities took a hit, Bitcoin’s correlation with tech stocks which was once debated became pretty undeniable.

Staggering Liquidation Numbers

Bitcoin had held steady above $80,000 throughout the first quarter of this year. Then it broke below that critical support to currently trade around $75,000. The sell-off triggered rapid liquidations across exchanges. Coinglass says over 318,000 traders were affected globally.

Of the $976 million wiped out in the derivatives market, 86% came from long positions. That suggests traders were caught off guard by just how bad the drop was. Ethereum wasn’t spared either, falling 13% to $1,568. Other major tokens like XRP and Solana tumbled over 12%, reflecting just how broad-based the market stress was.

Markus Thielen, head of research at 10x Research, notes that,

“this level of liquidation is typically associated with extreme panic or macro-driven catalysts.”

Trump’s Tariff Policy at the Heart of the Turmoil

Trump signed an executive order imposing a 10% blanket tariff on all imported goods and reciprocal levies against countries with “unfair” trade practices on April 2. Beijing retaliated with new tariffs on American exports by the end of the week.

Hong Kong’s Hang Seng Index took a 10% hit in ‘Monday morning trade, the largest single-day fall since the 2008 financial crisis. Chinese equities continued their slide as investors braced for further economic fallout.

In the U.S., major stock indices posted their worst week’ in over four years. Analysts from Goldman Sachs have raised the probability of a U.S. recession to 45%, up from 30% a month ago. Citi and JPMorgan have issued similar warnings in recent client notes.

Victoria Greene, Chief Investment Strategist at G Squared Private Wealth, says, “Trump’s tariffs have introduced a massive layer of uncertainty.”

Bitcoin’s Correlation with Tech Stocks Is Getting Stronger

Bitcoin’s trajectory in 2025 has mirrored that of high-growth technology stocks more and more. Analysts at Bernstein noted a correlation coefficient of 0.88 between Bitcoin and the Nasdaq Composite in March. That near-lockstep movement continued through last week’s sell-off.

With spot Bitcoin ETFs now in US markets, big funds are treating Bitcoin as a risk-on asset and exposing it to the same macro pressures that affect equities.

“Bitcoin is now behaving like a tech stock on steroids,” said Lyn Alden, founder of Lyn Alden Investment Strategy. “It’s not surprising it’s falling when risk-off sentiment dominates the market.”

Some Crypto Experts Urge Calm, See Long-Term Strength

Despite the carnage, seasoned investors are urging calm. Gadi Chait, investment manager at Xapo Bank, downplayed the short-term volatility.

“These price swings may spook the speculators but ultimately this is just noise,” Chait said. “Bitcoin’s strength lies in its monetary independence, decentralisation and finite nature—not in how it responds to political theatrics.”

Bitcoin has been up over 60% this year, even after the pullback. Traditionally, similar corrections have happened on the way to higher highs, especially during times of high geopolitical and monetary stress.

Technical Levels to Watch

Traders are now looking at $76,600 as the short-term support. A break below that could trigger more selling and bring Bitcoin back to $70,000, a level last seen in late February.

Technical analysts at QCP Capital flagged $82,500 as the immediate resistance level bulls need to reclaim to shift momentum. Meanwhile, the broader market is digesting macro risks with caution.

Conclusion: Bitcoin is a Proxy for Global Risk Appetite

The current pullback is showing us Bitcoin could be becoming a global macro asset. No longer insulated from external shocks, it’s now moving with the financial markets and central bank decisions. With US-China tensions at an all time high and central banks not cutting rates in the face of sticky inflation, the next few weeks will be important.

If Bitcoin can hold its range while the macro storm rages, it may further solidify its position not just as a speculative asset, but as a strategic one.

FAQs

Why did Bitcoin drop to $75K?

The drop was triggered by global market turmoil after Donald Trump imposed new tariffs and investors started to offload risk assets.

How much crypto was liquidated during the crash?

Coinglass reports $976 million in crypto positions liquidated in 24 hours, most of them long.

Is this the start of a bigger Bitcoin decline?

The short term looks bearish, but many think this is a short-term correction in a longer-term bull run.

How are traditional markets affecting Bitcoin?

Bitcoin is being correlated with tech stocks and US equities and it seems broader financial events like trade wars might be affecting crypto markets more directly.

What are the levels to watch for Bitcoin?

Support at $76,600, resistance at $82,500. A break from either could be the next move.

Glossary

Liquidation: when a position is forced to close due to margin calls in leveraged trading.

Correlation Coefficient: This measures just how closely two assets move in relation to each other.

Spot ETFs: track the real-time price of an asset like Bitcoin. They give you a direct view of what’s happening in the market.

Tariffs: are taxes on imported goods. Governments impose them to protect domestic industries or retaliate against foreign trade policies.

The Relative Strength Index (RSI): shows you when a market is overbought or oversold. It’s a key indicator of momentum.

References