Bitcoin’s seemingly unstoppable rally could be approaching a critical juncture. According to a recent CryptoQuant report, demand for Bitcoin is drying up at levels not seen in years, setting off alarm bells across the market.

The analysis, flagged by Coinpedia, points to a “historic low” in BTC demand momentum, particularly among ETF inflows and retail investors. Institutional appetite, once the driving force behind BTC’s surge past $100K earlier this year, is now fading. Since April, spot Bitcoin ETF inflows have plunged by over 60%, signaling a massive shift in market sentiment.

But is this truly the start of a crash, just a temporary cooldown before the next leg up?

Whale Accumulation Tells a Contradictory Story

Despite a broad drop in demand, large-scale Bitcoin holders are quietly accumulating. CryptoQuant’s data reveals that wallets holding more than 10 BTC have risen by 231 addresses in the last 10 days, while smaller wallets (holding between 0.001 and 10 BTC) have dropped by more than 37,000.

This divergence between retail and institutional behavior offers a deeper insight. While casual investors are exiting, major players appear to be buying the dip, often a strong bullish signal.

Glassnode reinforces this narrative, framing it as a sign of maturing market behavior. “It’s not panic. It’s positioning,” one analyst noted, arguing that capital is flowing from weaker hands into long-term, well-capitalized wallets.

Technical Breakdown Looms if Key Support Levels Fail

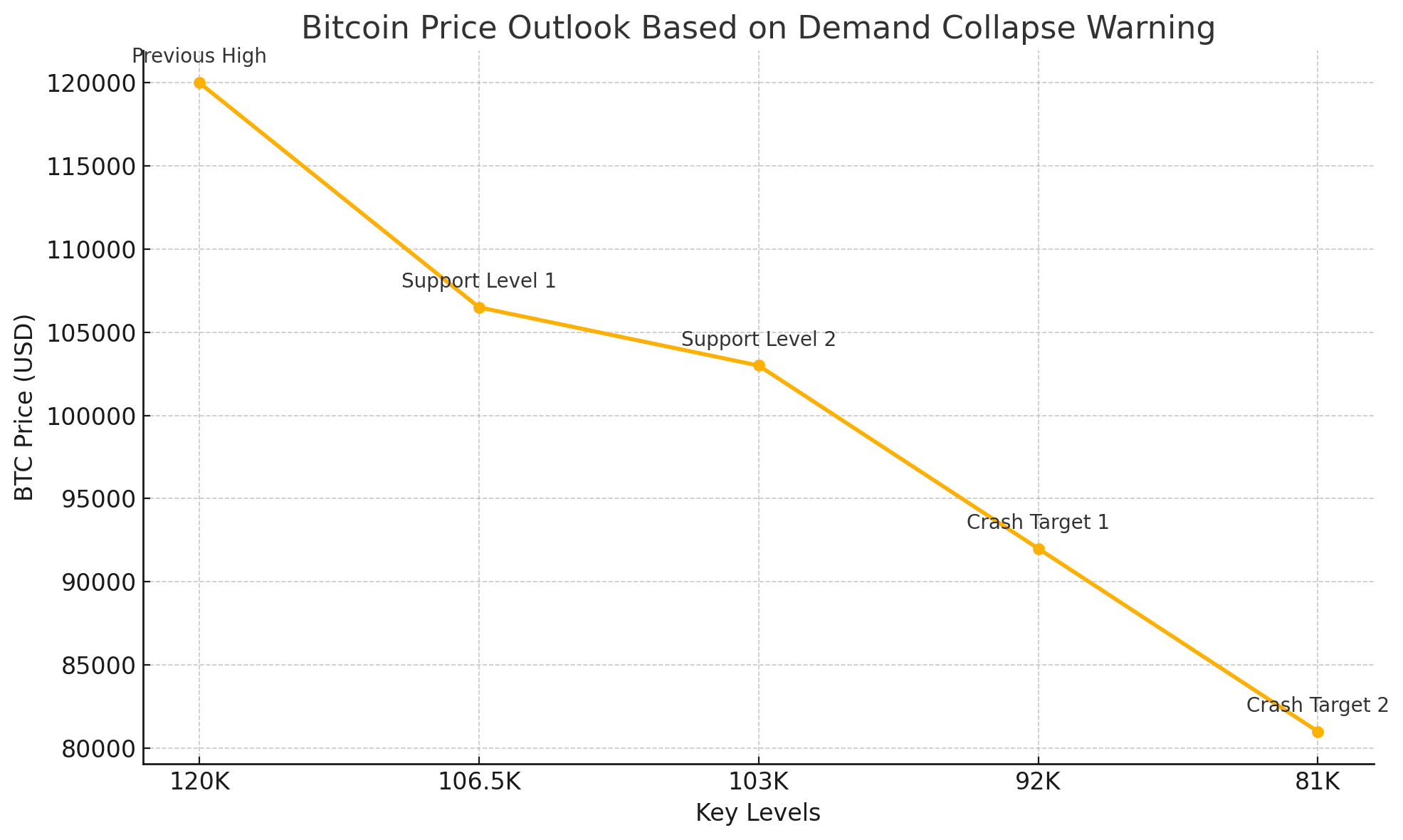

Bitcoin is now hovering around sensitive technical zones. Analysts from FingerLakes1 note that support levels at $106.5K and $103K are crucial to watch. If these break, BTC could slide to $92K, and some models even suggest a dip toward $81K.

Cointelegraph adds that BTC’s latest correction, triggered partly by geopolitical unrest in the Middle East, follows a familiar historic pattern. In prior instances, such pullbacks resulted in average gains of over 64% within 50 days after the crash. This suggests the potential for a V-shaped recovery if long-term confidence holds.

Miners and Metrics Point to a Buying Zone

One overlooked angle in the bearish vs. bullish debate is Bitcoin’s Puell Multiple, a metric that compares miner revenue to historical norms. When this multiple drops low, it historically marks accumulation phases.

Currently, the Puell Multiple is approaching territory associated with undervaluation, strengthening the case for strategic buying, even if short-term volatility persists.

At the same time, miner activity remains strong, with no mass sell-offs, which historically precedes sharp downward pressure.

Bitcoin Support and Risk Levels

| Indicator | Level/Status | Implication |

|---|---|---|

| ETF Inflows | –60% since April | Weakening institutional demand |

| Whale Accumulation | +231 wallets (10+ BTC) | Smart money buying |

| Retail Wallets | –37K wallets (0.001–10 BTC) | Fear-driven exit |

| Support Levels | $106.5K, $103K | Breakdown if breached |

| Target Lows | $92K, $81K | Bearish if demand stays weak |

Middle East Tensions Add Fuel to the Volatility

Geopolitical tension remains an undercurrent driving recent Bitcoin price swings. The sharp drop to around $102.6K came amid heightened fears around Iran–Israel developments. Though some expected BTC to act as a hedge, it instead moved in lockstep with risk assets, reaffirming its “digital tech stock” behavior during global crises.

A viral YouTube analysis even predicted that escalating tension could trigger a “massive crash followed by a violent rebound”, a pattern that fits BTC’s historically volatile DNA.

Conclusion: Crash Incoming or Smart Money Setup?

The Bitcoin market is sending mixed signals. Retail demand is shrinking, ETF inflows are tapering, and geopolitical risk is rising. Yet whales are accumulating, technical support still holds (for now), and miner-related metrics suggest BTC is near a buy zone, not a blowout.

If BTC breaks below $103K, the road to $92K or even $81K opens fast. But if institutional accumulation continues and global tensions ease, a sharp rebound could follow just as quickly.

Investors should stay vigilant. This is not the time to trade on emotion; data and discipline matter most now.

FAQs

What triggered the recent BTC demand collapse?

According to CryptoQuant, it’s a mix of reduced ETF inflows, retail sell-off, and uncertain macroeconomic conditions.

Are whales still buying BTC?

Yes. On-chain data shows large holders are accumulating, signaling long-term confidence.

Could Bitcoin crash to $81K?

If BTC breaks critical support at $103K and $92K, some models indicate a potential dip to $81K.

Glossary of Key Terms

ETF Inflows: Capital entering exchange-traded funds holding BTC, often seen as a proxy for institutional demand.

Puell Multiple: A metric comparing daily miner revenue to long-term averages, used to gauge market undervaluation.

Whale Wallets: Addresses holding large amounts of Bitcoin (typically 10 BTC or more), often used to track big investors.

Support Levels: Price zones where historical buying demand has previously halted or reversed downtrends.

Accumulation Phase: A market period where smart money quietly builds positions ahead of a potential price surge.