Bitcoin had a turbulent week; it started strong, above $62K, but quickly dropped to $60.5K, driven by intense sell pressure. The market saw $169.45M in liquidations, with long positions spiking 500%, despite brief recoveries, tightening liquidity added to the volatility and downside risks.

Bitcoin Drops to $60.5K as Market Faces Sell Pressure

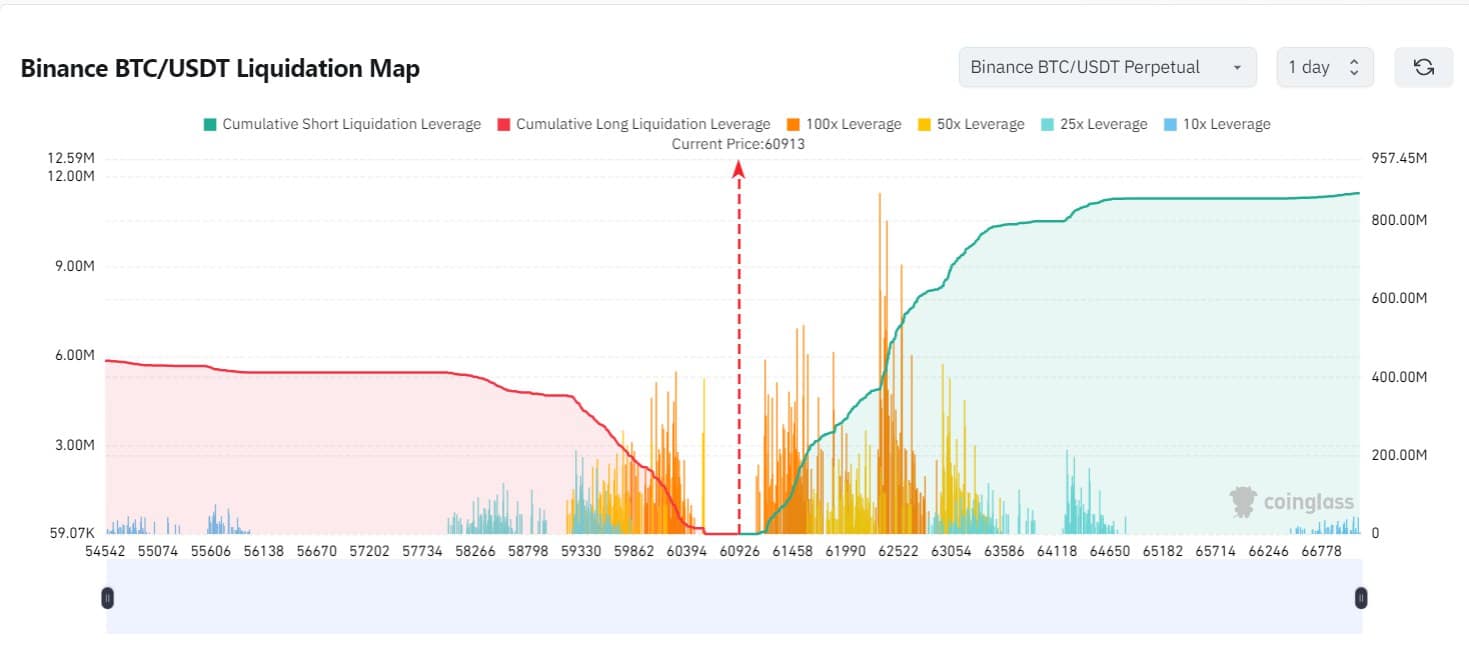

Bitcoin traded at around $62,000 when it opened on Wednesday, but it fell to a daily low of $60,540. This has resulted in big bar-long liquidation, as depicted in the red area of the map, around $60,000/$59,500. $40 million in long positions were liquidated as the price dropped, while the broader market saw $169.45 million in liquidations across long and short positions. This liquidation map supports the notion of sell pressure and volatility, with short and long liquidations occurring around critical price levels.

Source: Coinglass

The market’s Wednesday performance shows that Bitcoin continues to experience difficulties retaining the price figures above key psychological and technical markers. Some of these are caused by institutional investors, whose participation has been a strong catalyst in determining the price of Bitcoin over the last several months.

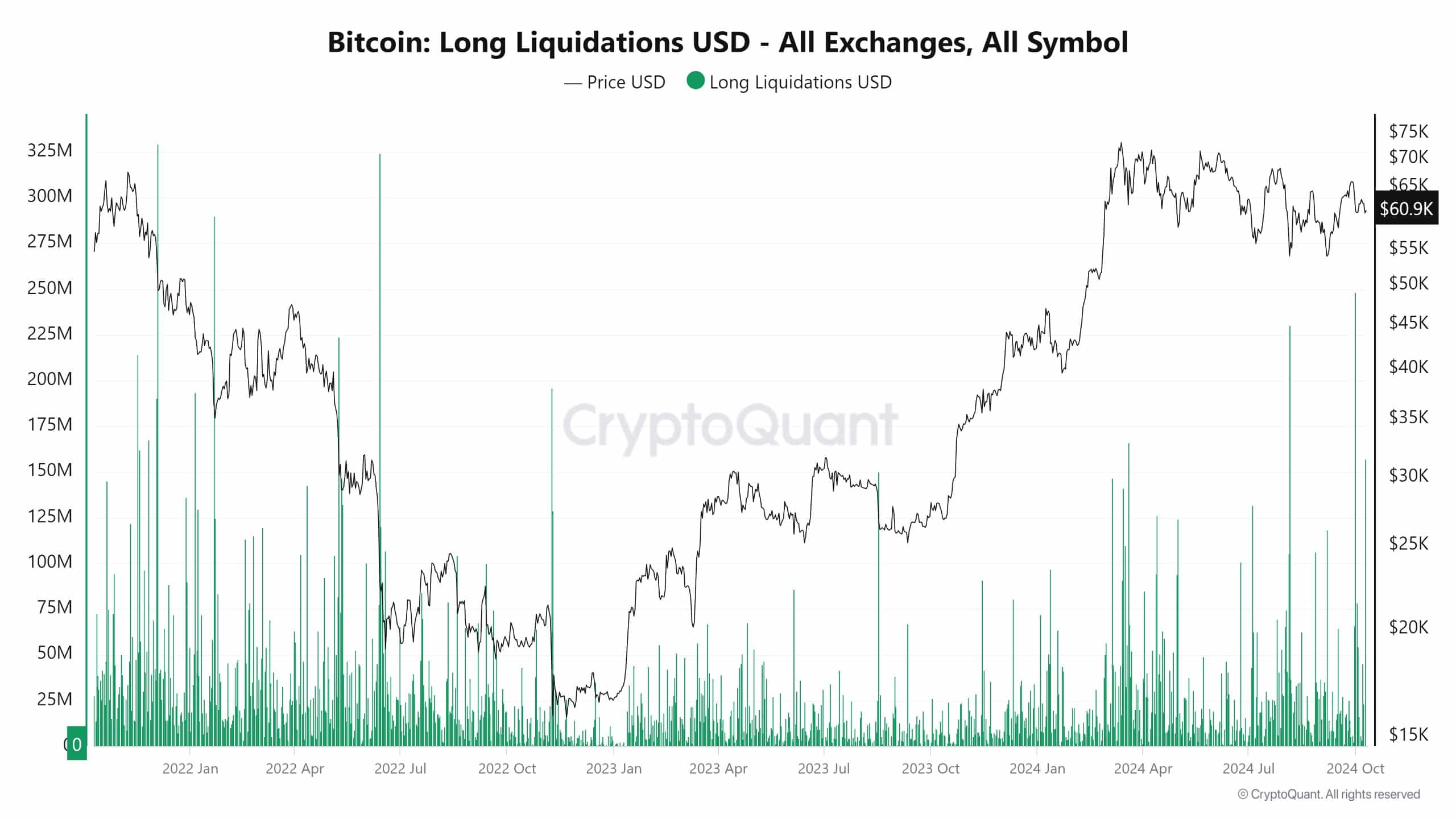

Bitcoin Long Liquidations Surge 500% from $25M to $150M in Early October

The chart shows a substantial rise in long liquidations in the recent two weeks. Long liquidations were relatively low on the last week of September, hovering around $25 million. By October 10th, liquidations spiked dramatically, reaching peaks exceeding $150 million. This represents an increase of 500% in liquidations over this time frame.

In percentage terms, the value of liquidations escalated from $25 million at the end of September to over $150 million by October 10th. This sharp rise signals a combination of over-leveraged positions and rapid price corrections during that period, leading to liquidations at a scale unseen in the previous weeks. These liquidations contributed to downward price pressure, causing increased volatility as traders were forced to close their positions.

Outlook for Bitcoin: Long-Term Optimism Amid Short-Term Challenges

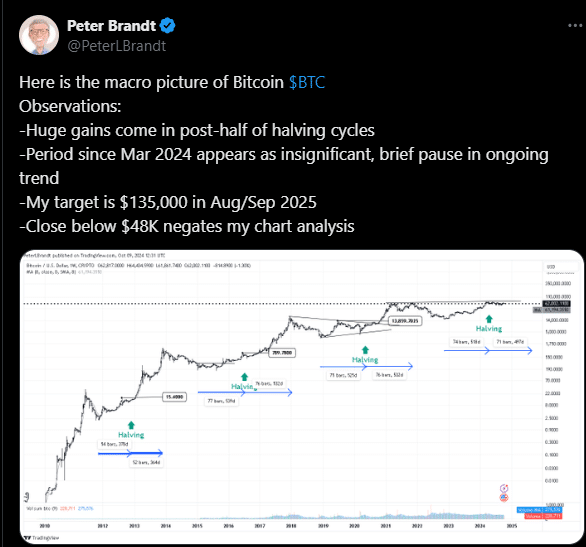

As shown in this Twitting post, Peter Brandt, an experienced trader, shares how he interprets the long-term Bitcoin charts based on halving. He underlines that most price increases occur at the end of the halving cycles, which means that the most important price fluctuations have yet to be observed.

Source : X

Thus, according to Brandt’s analysis, he comes up with a price target of $135,000 by August/September 2025 by extrapolating based on the time period since the last halving events. In particular, he sees these fluctuations as tests of his bullish sentiment, supported by historical data. The cyclical patterns in Bitcoin’s halving cycles provide the foundation for his prediction of substantial future gains.

However, Brandt also issues a warning, if Bitcoin closes below $48,000, it would invalidate his bullish chart analysis. This price point acts as a critical support level in his view, and a dip below it could signal a breakdown in the ongoing trend. Therefore, while Brandt remains optimistic, he acknowledges the risks tied to significant support levels that could impact his forecast.

Technical Analysis

For now, Bitcoin remains vulnerable to further declines. If the price breaks below key support levels, such as the 50 & 100 -day Exponential Moving Average (EMA) at $60,000, a more significant correction could follow to $54,000 Double Bottoms level.

On the other hand, a recovery above $63,000 could signal renewed strength and the potential for Bitcoin to resume its upward trajectory and gain 33% to find the next resistance at $80,000 psychological level. As the market navigates these short-term fluctuations, both retail and institutional investors will be closely watching for signs of stability or further downside risk.

The recent volatility of Bitcoin is a reminder of how tenuous the market can be against selling and liquidity constraints. On the other hand, despite $60.5K becoming a wealth transfer zone and causing enormous liquidations just below that level, Bitcoin showed signs of bullishness over the long-term perspective. Traders should be strictly cautioned as more sell-offs and continued tightening liquidity can create further downside risk in the short term. For longer-term traders, though— those mainly interested in what the more distant future holds — there is some optimism based on historical data, especially with Bitcoin halving cycles.

What’s Next for the Traders

Near-term traders should watch for crucial support being tested at $60K or even $48K, as a breach of that could indicate more problems to come. Conversely, a bounce back through $63K may bring the bulls back to life. Traders also have to make sure they manage their leverage intelligently as liquidations continue to gain traction, and trading conditions remain choppy, with volatility ahead but also potential opportunities once the market finds some form of stability.

Stay updated with TheBit Journal by following us on Twitter and LinkedIn and joining our Telegram channel.