Bitcoin (BTC) fell to $82k yesterday, but a buyer rush brought back prices to $86,298 but remains down by 2.45% in the last 24 hours. The price decline was preceded by a low value of Fear and Greed Index that reached 10 and defined the market as extremely fearful.

However, there are those who are positive thinkers, and among them include Robert Kiyosaki who is the author of Rich Dad Poor Dad. Kiyosaki also views the downturn as an opportunity for strengthening his opinion in buying Bitcoin, being a shield against economic turmoil.

Bitcoin Market Overview

The Bitcoin market’s price fell to a low of $82,000 before rising slightly to the present value of $86,298. This is a more than 2.45% a drop in the price within a space of 24 hours. The decrease of value is a result of a period of high volatility and increased sales from institutions and investors who are afraid of the future of the market.

The market trend indicator such as the Fear and Greed Index has recently dropped to level ten, which indicates that investors are worried. Some industry participants believe that the decline implies the best buying opportunity as the long run exponential increase in Bitcoin fundamentals remains valid despite short-term volatility.

Bitcoin’s Fear and Greed Index:

This index is an important measure of the market sentiment in the Bitcoin market. The recent drop to 10 signals widespread fear. This suggests that a lot of people are skeptical or bearish on Bitcoin for the short forecast. A lower score in the index has usually signified heightened SELL activity within the market, and generally, it has done well as a market sentiment barometer.

Robert Kiyosaki’s Positive Outlook

Despite the current setback, Robert Kiyosaki has not lost faith in Bitcoin and the market. He consider the recent downward slide as a chance he should exploit to acquire more of the shares. Kiyosaki states that physical money and other commodities would not be able to effectively cope with the global economic uncertainty that is currently facing the world. To him, it is a vehicle of ‘’Money with integrity”, an asset to run to when things go wrong.

Liquidations Hit $769 Million

The drastic drop in Bitcoin prices meant that over $769 million was liquidated in the past 24 hours. Of this, $606.44 million stem from long positions. Out of the total amount, $164,548,744, $163.19 million was generated from short positions. The liquidations included more than 185,000 traders, which can be regarded as the significant cause of increased volatility in the markets.

Technical Indicators Show Bearish Trend:

Several technical aspects of the price charts point to some weakness prevalent in the Bitcoin market. Currently the price line of Bitcoin is below the middle Bollinger Band signaling that selling pressures are intensifying. It is also noteworthy to observe that the cryptocurrency is in the process of testing the lower Bollinger Band. If true, a bearish reversal is possible, however, the current movement of price remains bearish.

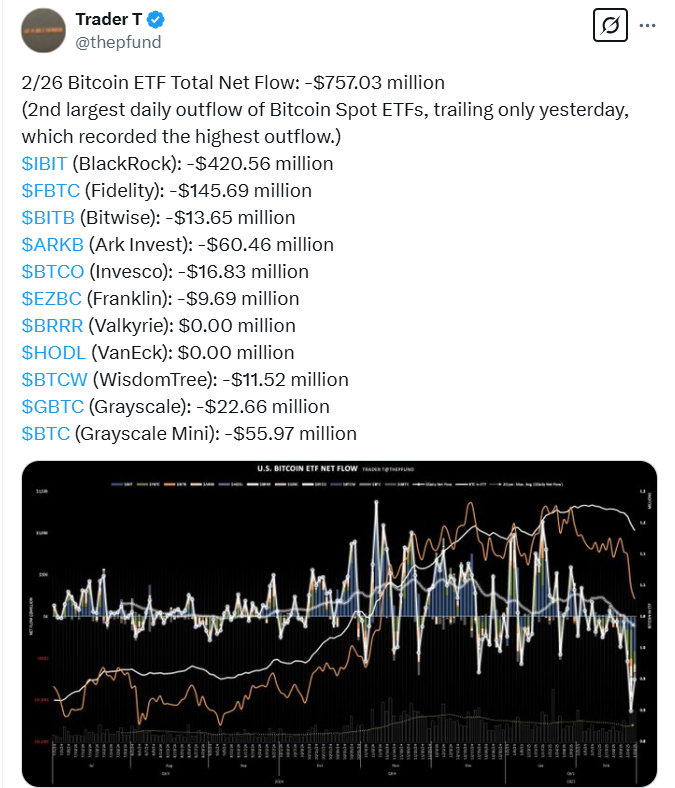

Institutional Sell-Offs Amplify Downturn

One of the factors that have been attributed to the downturn are institutional sell offs. A number of digital asset based ETFs in the United States were trading in the red with record outflows of more than $1b earlier this week. A record outflow of 5,000 BTC was witnessed in BlackRock’s spot Bitcoin ETF on February 26th. These large withdrawals have put more pressure on what has been already a delicate market.

Market Sentiment Shifts Amid Economic Concerns

Macroeconomic data are leading indicators that the industry of the market is feeble. Early on in the new administration of the United States of America some positive remarks on legislative shifts that would be beneficial for Bitcoin was made. On the other hand, a volatile and decreasing figure means that there are no very strong sentiments among speculators. The recent global economic downturn has forced a number of players in the investment industry to tone down their expectations.

Conclusion

This week has seen Bitcoin go down again proving the high volatility in financial market cryptocurrencies. Nevertheless, despite short-term volatility remains unknown, certain people, including Robert Kiyosaki, believe in the long-term bullish scenario. Fear is surely gripping the market, yet for many this is perceived not as an adversative circumstance but a chance. The market is volatile and investors must assess the various risks in the market and prepare for worse expecting the best results.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQ)

Why did Bitcoin drop to $82,000?

Bitcoin suffered these price drops mainly through market volatility combined with institutional sell-offs and movement in the Fear and Greed Index.

How did Robert Kiyosaki react to Bitcoin’s price drop?

The market drop enables Robert Kiyosaki to view Bitcoin as a strong defense against economic instability. He recommends this fall as an excellent investment chance.

What does the Fear and Greed Index say about the market?

The Fear and Greed Index is now at 10 marking an “extreme fear” indicating that investors are skeptical and prices face a selling pressure.

How did liquidations impact the market?

More than $769 million in long and short liquidations escalated instability and deepened price declines.

Appendix: Glossary of Key Terms

Bollinger Bands: An indicator of Bitcoin price fluctuation, which allows the trader to identify whether the given market is oversold or overbought.

Fear and Greed Index: A measure of market emotions that reflect the ratio of greed and fear of investors that influence the activities on the market..

Liquidation: When positions are automatically closed due to price movements, which tend to magnify the market fluctuations.

MACD: One of the trends used in trading signal, it is based on the relationship of two variables-shorting and long-term moving average..

Spot Bitcoin ETF: It is a mechanism through which an investor gets an exposure to Bitcoin by investing on it, but without physically owning it.

References

CryptoNews – cryptonews.com

CoinMarketCap – coinmarketcap.com

Alternative – alternative.me

TradingView – tradingview.com

CoinGlass – coinglass.com