As Bitcoin’s dominance takes a notable dip, analysts are pointing to a potential altcoin rally this December, with smaller cryptocurrencies poised to capture investor interest before January 20. Let’s dive into what this could mean for the market and which coins to watch closely.

Bitcoin Dominance Hits a Critical Threshold

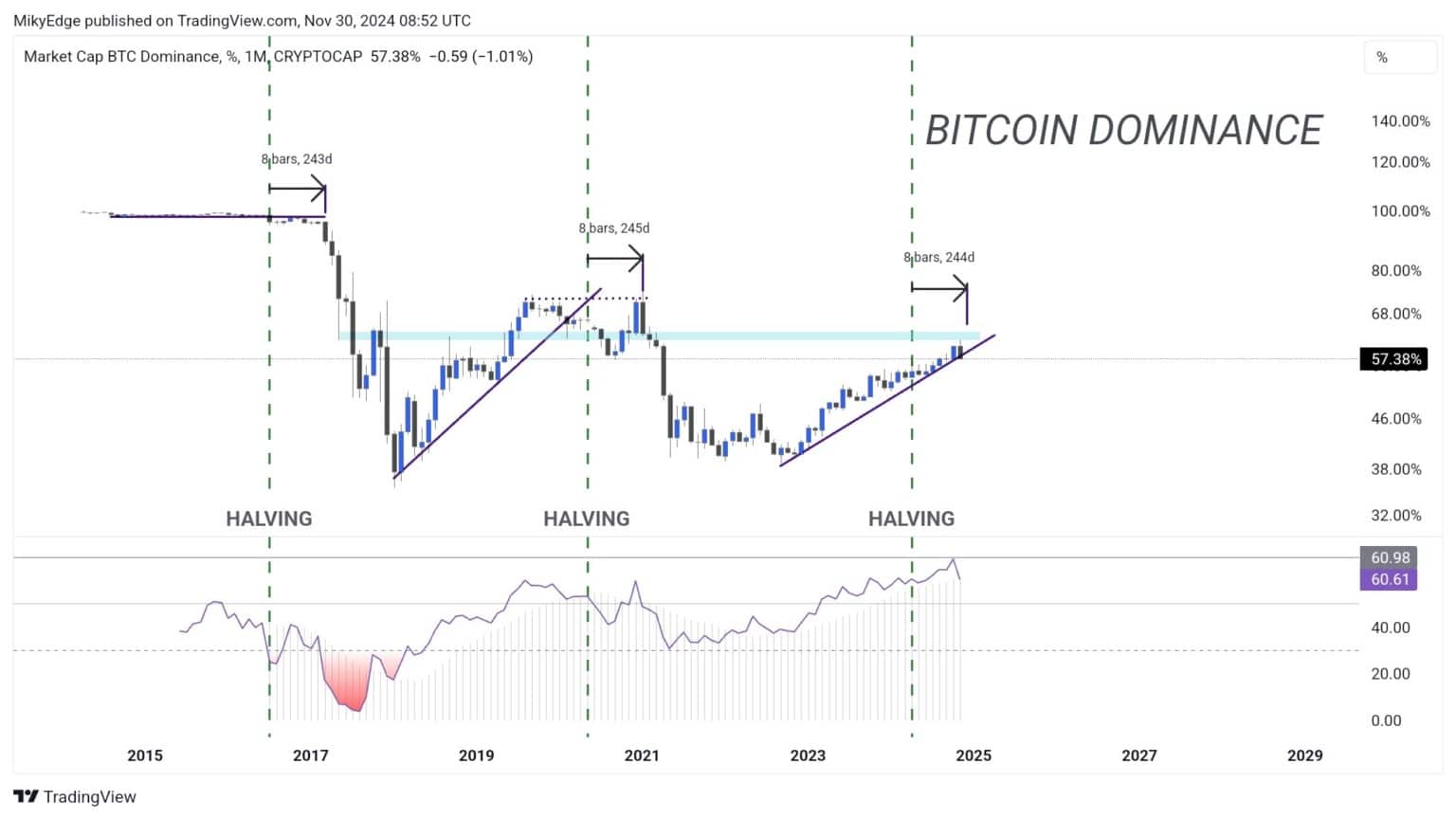

Renowned analyst Mikybull Crypto recently highlighted a pivotal shift in Bitcoin’s dominance, which measures BTC’s share in the total crypto market capitalization. On November 30, the metric fell below a two-year support line, reaching 56.1%. According to Mikybull, this officially marks the beginning of altseason, a period characterized by strong rallies in altcoins as investors shift profits from BTC to smaller-cap cryptocurrencies.

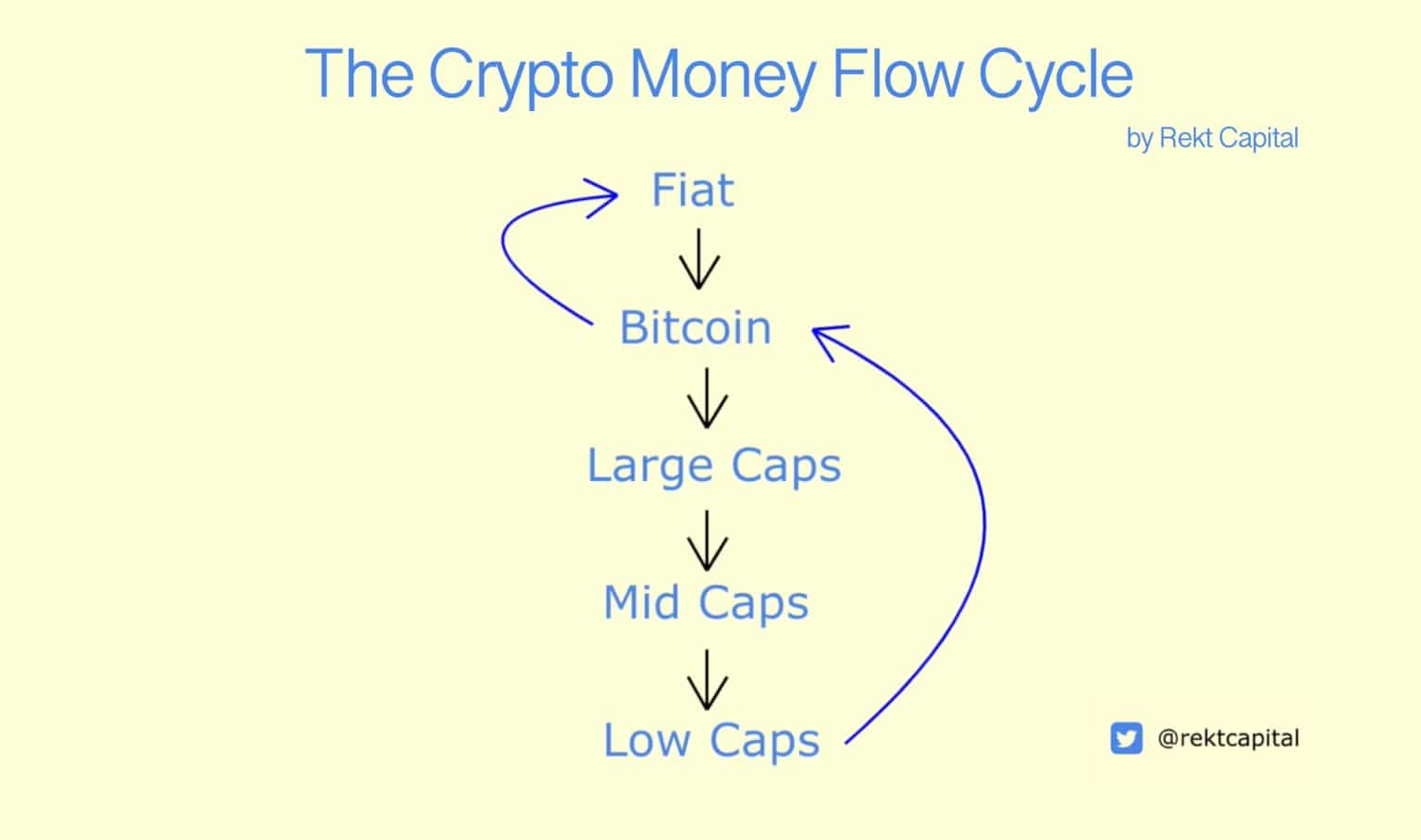

Historical patterns suggest that declining BTC dominance reflects a redistribution of capital, where funds flow into altcoins like Ether (ETH) and XRP. This could create lucrative opportunities for altcoin enthusiasts during the year’s final month.

Ether and XRP at the Forefront

Market data indicates rising interest in Ether as demand for leveraged ETH exchange-traded funds (ETFs) surged over 160% since Donald Trump’s presidential win on November 5. Analysts predict a potential rally pushing Ether beyond $4,000, fueled by growing market optimism.

Meanwhile, XRP is also under the spotlight. According to Ryan Lee, the lead analyst at Bitget Research, XRP could see its price climb to $2.57 before the year’s end. Lee emphasized the historical impact of Bitcoin halving events on XRP, which tends to rally approximately 228 days after these halvings.

Key Catalysts Driving XRP’s Growth

The potential launch of an XRP ETF could be a significant catalyst for its price. On November 1, 21Shares became the latest entity to file an XRP ETF application with the U.S. Securities and Exchange Commission (SEC), joining other prominent players in the race. Additionally, rumors surrounding SEC Chair Gary Gensler’s resignation, expected on January 20, could pave the way for clearer regulatory frameworks and a surge in crypto-backed ETFs.

As President Trump’s inauguration approaches, investor sentiment is likely to remain bullish, particularly for assets like Ether and XRP, which are positioned to benefit from these shifting market dynamics.

What to Watch Next

The crypto market’s December performance could set the stage for early 2025. With Bitcoin dominance weakening, savvy investors may find opportunities in altcoins, especially those with strong catalysts like XRP and Ether.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Folgen Sie uns auf Twitter und LinkedIn und treten Sie unserem Telegram-Kanal bei, um sofort über aktuelle Nachrichten informiert zu werden!