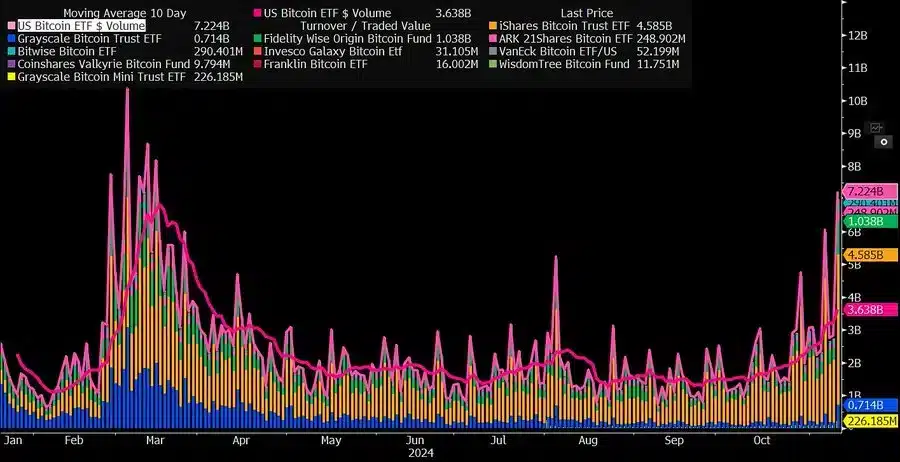

BlackRock’s Bitcoin ETF made up half of today’s trading volume, with around $4.6 billion worth of shares exchanged. FBTC Bitcoin ETF came in next, topping $1 billion. This jump comes on the heels of IBIT’s previous record last Thursday when it saw over $4 billion in shares traded—its highest daily volume since launch.

That day, however, IBIT Bitcoin ETF had $69 million in net outflows, followed by a massive turnaround the next day with over $1 billion in net inflows, marking its biggest one-day capital injection to date.

Bitcoin ETF analyst Eric Balchunas pointed out that high trading volumes don’t always mean buying alone; they can reflect both buying and selling. It might take a few days for market watchers to see if this spike in activity leads to consistent net inflows.

How Trump’s Victory is Pumping Bitcoin ETF Trading Volumes

Bitcoin ETF trading volumes are on the rise, fueled by the recent Bitcoin rally following the election. With Donald Trump back in office, there’s a growing sense that his policies could be a win for crypto, sparking optimism across the market. This upbeat outlook is likely behind the recent boost in Bitcoin prices and the increase in ETF activity.

On Monday, it was reported that Bitcoin has now overtaken silver in market capitalization, reaching an impressive $1.736 trillion and making it the world’s eighth-largest asset. This milestone came as Bitcoin’s price surged past $88,000, marking a 10% jump in just one day, while silver dropped 2%. Bitcoin now stands among giants like gold, Nvidia, Apple, Microsoft, Google, Amazon, and Saudi Aramco.

Crypto Market Cap Hits $3.1T High

As per reports, the crypto sector has now crossed a new milestone, with market capitalization hitting an incredible $3.12 trillion, leaving it slightly off from France’s economy. Moreover, on November 11, the total crypto market cap increased by 7% in just 24 hours, thanks to a rise in the price of Bitcoin which pushed it to $89,500. In case the crypto sector was a nation, it would be the 8th largest worldwide, following the United States, China, Germany, Japan, India, the United Kingdom, and France.

The value of Bitcoin continues to rise and now sits at a staggering $1.77 trillion, which is higher than the entire GDP of Spain, as per the IMF. In fact, the last time that the total market capitalization was in the $3 trillion range was on November 15, 2021 when Bitcoin touched its all-time high of around $69,000. This information is by CoinGecko and it currently traces data from 15129 coins on 1149 exchanges.

It is true that the current value of Bitcoin has exceeded that of Microsoft and is quickly approaching Nvidia and Apple, which are Google Finance’s two most valuable companies. The price recovery in Bitcoin in the latest weeks also saw its market cap going beyond silver’s market cap once more on November 11.

US Senator Mentions Bitcoin as a National Reserve Asset

Amidst the heated presidential campaigns, many American politicians posed questions and suggested policies regarding the use of digital currencies in America’s economy. Cynthia Lummis, a member of the USA Senate from Wyoming, proposed the idea of a ‘Bitcoin Reserve’ for the country to match its level of debt.

Predictably, her plan is very unpopular with the government. However, as luck would have it, it gained substantial support when Donald Trump secured the position of President. This is because Lummis previously felt that the US economy has a ‘strong case’ for establishing a Bitcoin standard, which did not sit well with former President Joe Biden of the Democrats.

To wrap up, Bitcoin’s recent rally has sparked a big increase in Bitcoin ETF trading volumes, signalling a fresh wave of market optimism since Donald Trump’s election. The crypto market has now surged to an all-time high of $3.12 trillion, with Bitcoin’s price reaching $89,500, pushing the total market cap up by 7% in a single day.

Stay tuned to TheBITJournal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!