Bitcoin (BTC) continues to maintain a dominant position in the cryptocurrency market, despite growing attention to altcoin exchange-traded funds (ETFs). While various altcoins, including Ethereum (ETH), are likely to see the launch of several ETFs in 2025, experts predict that these altcoin ETFs will have a minimal impact on Bitcoin’s market share.

According to Bloomberg analyst Eric Balchunas, Bitcoin ETFs control a staggering 90% of global crypto fund assets, and it is expected that BTC will retain 80-85% of the market share in the long run, despite the rise of altcoin ETFs.

Bitcoin ETFs Maintain Massive Market Share

Bitcoin ETFs have reached $110 billion in assets under management (AUM). In comparison, Ethereum ETFs control a mere $7 billion, which amounts to only 5% of the market share. Over the past year, Ethereum’s market dominance has decreased significantly, from a peak of 19% in 2024 to 7%.

On the other hand, Bitcoin’s dominance has surged, with its market share reaching 64.5%, up from 50% when considering the stablecoin market capitalization. This dramatic increase in Bitcoin’s dominance reflects its continued strength and appeal to institutional investors.

Altcoins Will Make a Minor Impact

Despite the predicted surge in altcoin ETFs in the coming year, these funds are unlikely to significantly dent BTC’s dominance. Balchunas notes that although numerous altcoin and meme coin ETFs are expected to launch, they will only make a “minor dent” in the overall market. Bitcoin’s established presence and its primary role in the cryptocurrency market remain the key driving forces behind its long-term dominance.

Additionally, analyst Benjamin Cowen supports Balchunas’ view, stating that BTC is likely to continue outperforming altcoins. Cowen further projects that BTC dominance could reach 66%, driven by the ongoing decline in altcoin/BTC pairs. He attributes this shift to macroeconomic factors, such as the Federal Reserve’s move to slow Quantitative Tightening (QT), which has historically benefited the BTC market.

U.S. Spot Bitcoin ETFs Face Sell-Offs

While BTC continues to dominate, the U.S. spot Bitcoin ETFs experienced a period of sustained sell-offs in early 2025. Between February and April, over $4 billion was withdrawn from these products due to tariff uncertainties and market fluctuations.

However, on April 21, Bitcoin ETFs saw a major recovery, logging $381 million in daily inflows—the highest amount since February. This surge in investment was likely driven by a U.S. dollar sell-off and growing interest in BTC and gold as safe-haven assets amid global financial uncertainty.

BTC ’s Price and Future Prospects

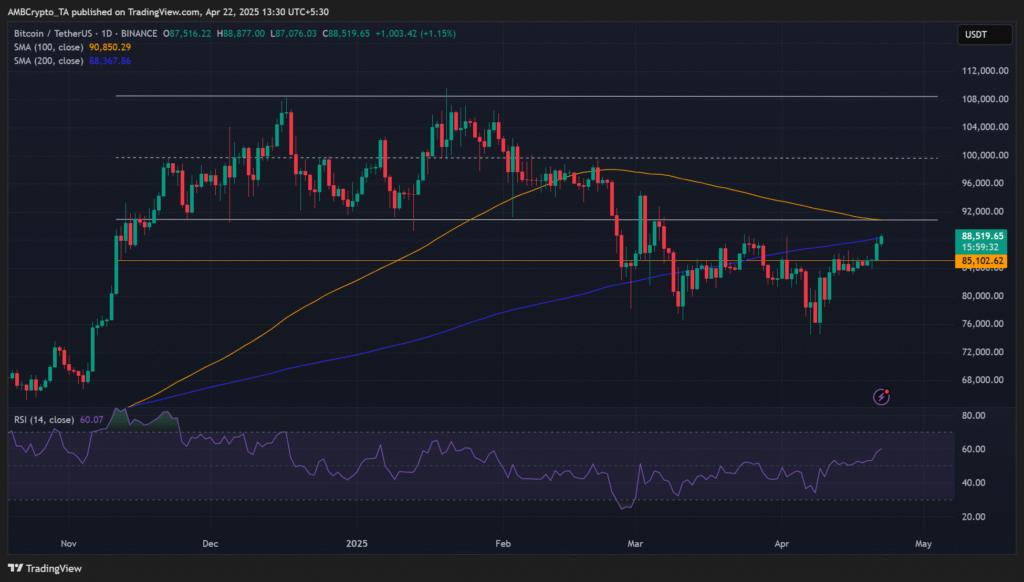

As of press time, Bitcoin’s price is trading at $88,500. The cryptocurrency is now less than 2% away from its next key resistance level of $90,000. A modest 5% gain could push BTC to test its resistance at $92,540, a high last reached on February 25. BTC price movements are supported by two critical technical indicators: the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD).

The RSI is currently trending upwards at a reading of 59, indicating that the cryptocurrency remains in bullish territory. Similarly, the MACD has displayed green histogram bars above the neutral line, suggesting sustained upward momentum.

Overcoming Key Resistance Levels

The path to further growth for Bitcoin depends on overcoming two crucial resistance levels. The first hurdle is the 200-day Moving Average (MA), which sits at $88,300. BTC needs to surpass this point to maintain its recovery trajectory. Following that, the next resistance level is the previous range-low of $92,000, which would open the door to higher price levels. Should BTC continue its upward movement and clear these obstacles, it could see further bullish action.

Bitcoin’s Dominance in the Long Run

Despite the growing interest in altcoin ETFs, BTC remains the dominant force in the cryptocurrency market. The significant capital inflows into Bitcoin ETFs, along with its increasing dominance in the market, indicate that institutional investors continue to view BTC as the leading digital asset. While altcoins may have their place, Bitcoin’s position as a store of value and a safe haven asset is unlikely to be easily challenged.

Conclusion

Bitcoin’s continued dominance in the cryptocurrency space, coupled with its ability to maintain a significant share of ETF assets, highlights its long-term strength. Despite the increasing launch of altcoin ETFs, Bitcoin remains the primary asset of choice for institutional investors and traders alike. With growing market share, increasing inflows, and bullish technical indicators, BTC is well-positioned to continue leading the crypto market well into the future.

Frequently Asked Questions (FAQ)

1- What percentage of crypto ETF assets does Bitcoin control?

BTC controls 90% of global crypto ETF assets, maintaining its dominance in the market.

2- How has Ethereum’s market share changed in 2025?

Ethereum’s market share has dropped to 7% in 2025, down from a 19% peak in 2024.

3- What is Bitcoin’s current market dominance?

Bitcoin’s market dominance has surged to 64.5%, including the stablecoin market cap.

4- What are the key indicators supporting Bitcoin’s price growth?

Bitcoin’s bullish momentum is supported by the RSI and MACD, signaling continued upward movement.

Appendix: Glossary of Key Terms

Bitcoin (BTC): A decentralized digital currency and the first cryptocurrency, created by an anonymous person or group of people using the pseudonym Satoshi Nakamoto in 2009.

Altcoins: Cryptocurrencies other than Bitcoin, including Ethereum, Solana, and various other tokens and coins.

Exchange-Traded Fund (ETF): A type of investment fund that is traded on stock exchanges, much like stocks. It holds assets such as stocks, commodities, or cryptocurrencies.

Assets Under Management (AUM): The total market value of the assets that an investment firm or fund manages on behalf of clients.

Relative Strength Index (RSI): A momentum oscillator used in technical analysis to measure the speed and change of price movements, typically to identify overbought or oversold conditions.

Moving Average Convergence Divergence (MACD): A trend-following momentum indicator used to determine the strength of a cryptocurrency’s price movement and potential shifts in trends.

Market Dominance: A measure of the total market capitalization of a cryptocurrency relative to the entire cryptocurrency market, indicating its share of the market.

Sources

AMB Crypto – ambcrypto.com

FX Street – fxstreet.com