Bitcoin spot exchange-traded funds (ETFs) saw significant outflows on April 8, with a combined net loss of $326 million. This marks a four-day streak of redemptions, signaling a cooling of investor appetite. The outflows were largely driven by concerns over macroeconomic instability, including rising geopolitical tensions, particularly the ongoing US-China trade war.

The shift in investor sentiment sent shockwaves through the crypto market, leading to a decline in Bitcoin’s price and raising questions about the future trajectory of digital assets.

Key Developments in Bitcoin ETF Outflows

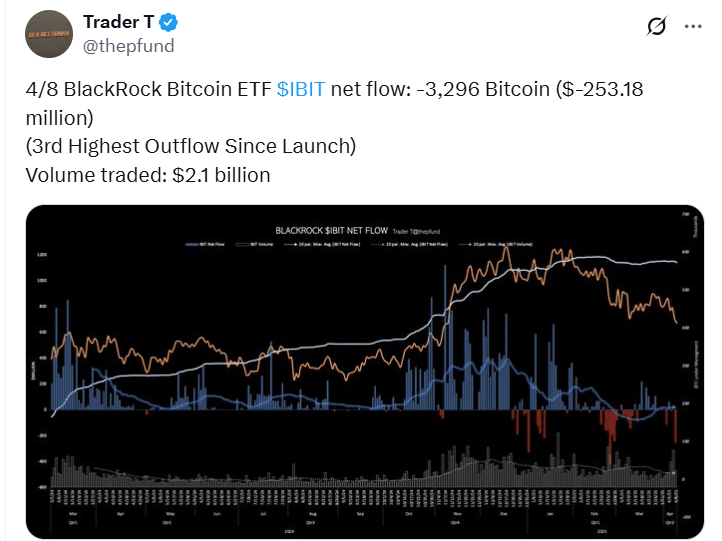

The largest portion of the outflows on April 8 came from BlackRock’s iShares Bitcoin Trust (IBIT), which saw a net withdrawal of approximately $252.9 million. Other Bitcoin spot ETFs also recorded losses, including Grayscale’s GBTC, which experienced an $8.5 million outflow; Ark’s ARKB, with $20 million withdrawn; and Bitwise’s BITB, which saw a $21.7 million exit. Ethereum spot ETFs did not fare much better, with all nine funds recording a total outflow of $3.29 million, signaling a general downturn in investor confidence across major digital assets.

None of the top 10 Bitcoin spot ETFs saw any net inflows on April 8, and funds such as Fidelity’s FBTC and VanEck’s HODL remained flat, indicating that investor sentiment was cautious at best. The outflows reflect broader risk aversion in both the crypto and traditional financial markets, driven by external factors such as economic uncertainty and geopolitical risk.

Investor Sentiment Shifts Amid Economic Concerns

Bitcoin and Ethereum faced sharp declines during early trading on April 8. Bitcoin dropped by 2.23%, falling to $77,182, while Ether slid 5.71% to $1,478. The sell-offs were triggered by mounting concerns over a prolonged US-China trade war, which saw the U.S. government implementing new tariffs. Investors are increasingly worried about the long-term economic implications of these trade disputes, which have already contributed to volatility in global markets.

Broader Crypto Market Decline

The broader cryptocurrency market mirrored the downturn in BTC and Ethereum, shedding about 7% of its total value in just 24 hours. As a result, the market capitalization of all cryptocurrencies dropped to $2.4 trillion. Other altcoins did not offer much relief, with only scattered gains seen across a few tokens. These small gains were not enough to offset the overall market decline, underscoring the broad risk-off sentiment that has permeated the crypto space.

ETF Data Reflects Broader Risk-Off Sentiment

The outflows from BTC and Ethereum ETFs are indicative of a wider risk-off attitude that has taken hold in both cryptocurrency and traditional finance. According to James Toledano, COO at Unity Wallet, the pullback in ETF flows signals that the crypto market is no longer isolated but increasingly tied to the broader financial system. “It breathes the same air as TradFi, especially when fear is this palpable,” Toledano explained, referring to the growing correlation between digital assets and traditional financial markets.

The surge in institutional interest in BTC that began in January following the approval of spot Bitcoin ETFs in the U.S. may now be tapering off. This cooling of institutional interest comes at a time when geopolitical and macroeconomic uncertainties are intensifying. The approval of spot Bitcoin ETFs has been hailed as a breakthrough for institutional adoption, but the recent outflows suggest that institutional investors are reassessing their positions in BTC and other digital assets amidst growing global risks.

Bitcoin’s Potential Role in Global Finance

Despite the short-term decline, some industry leaders believe that BTC may play a more significant role in global finance in the future. Jeff Parks, head of alpha strategies at Bitwise Invest, expressed the view that Bitcoin has a higher chance of surviving over the U.S. dollar, given the increasing distrust in fiat currencies. “For the first time, this thought doesn’t feel like theory, but an actual truth to grapple with,” said Parks.

Bitwise CEO Hunter Horsley echoed these sentiments, noting that with gold also showing drawbacks related to shipping and storage, Bitcoin could become the preferred safe haven asset during times of uncertainty. “You wind up buying Bitcoin,” Horsley said, suggesting that, amid geopolitical tensions and economic instability, BTC may be one of the few viable alternatives to traditional financial assets.

Geopolitical Tensions and Market Impact

The recent market decline is heavily influenced by geopolitical tensions, particularly those arising from the U.S.-China trade war. On April 5, President Trump signed an executive order imposing a 10% baseline tariff on imports from all countries. This move was followed by harsher tariffs on trading partners with whom the U.S. holds significant trade deficits. These tariffs are set to escalate on April 9, further fueling fears of a prolonged trade dispute and contributing to broader economic instability.

The uncertainty surrounding these trade policies and fears of a potential recession have triggered a wider market sell-off that has affected both traditional and crypto markets. This has left investors uncertain about where to place their capital, especially as global currencies and traditional assets appear increasingly volatile.

Conclusion

The outflows from Bitcoin ETFs underscore a broader shift in investor sentiment, as economic and geopolitical uncertainties weigh heavily on global markets. While the short-term outlook for BTC remains uncertain, some experts believe that cryptocurrency may emerge as a key player in global finance, especially as trust in fiat currencies like the U.S. dollar continues to erode.

Frequently Asked Questions (FAQ)

1. Why did Bitcoin ETFs see major outflows on April 8?

Macroeconomic concerns, geopolitical tensions, and fears of a prolonged U.S.-China trade war drove outflows.

2. What caused the broader cryptocurrency market decline?

A 7% decline in the overall market reflected broader economic uncertainties and fears of a recession.

3. Will Bitcoin survive over the U.S. dollar?

Some experts believe Bitcoin’s role in global finance may grow as trust in the U.S. dollar wanes.

4. How have President Trump’s tariffs impacted the market?

The new tariffs, particularly the 10% baseline, have contributed to a decline in global markets, including cryptocurrencies.

Appendix Glossary of Key Terms

Bitcoin ETF – A financial product that tracks Bitcoin’s price, allowing investors to trade Bitcoin without owning the asset directly.

Outflow – The withdrawal of funds from an investment vehicle, such as an ETF or mutual fund.

Geopolitical Tensions – Political and economic conflicts between nations that can impact global markets and investments.

Spot ETF – A type of ETF that directly tracks the price of an underlying asset, such as BTC, without derivatives.

Risk-Off Sentiment – A market condition where investors become more cautious and sell off riskier assets due to economic or geopolitical uncertainties.

Institutional Interest – Investment or involvement from large financial organizations, such as banks or hedge funds, in assets like BTC.

Trade War – A situation where countries impose tariffs or other trade barriers on each other in a bid to protect their own economies.

References

CryptoNews – cryptonews.com

Coin Telegraph – cointelegraph.com

CoinMarketCap – coinmarketcap.com

SoSo Value – sosovalue.com

The Wall Street Journal – wsj.com