On July 28, investor interest in crypto exchange-traded funds picked up, with both Bitcoin and Ethereum funds recording robust inflows. Spot Bitcoin ETFs recorded $157 million in net inflows, while Ethereum ETFs extended their streak to 17 consecutive days.

Trading volumes were high, and a sustained level of institutional interest demonstrated support despite a wider fall in the market.

Bitcoin ETFs Lead with Steady Gains

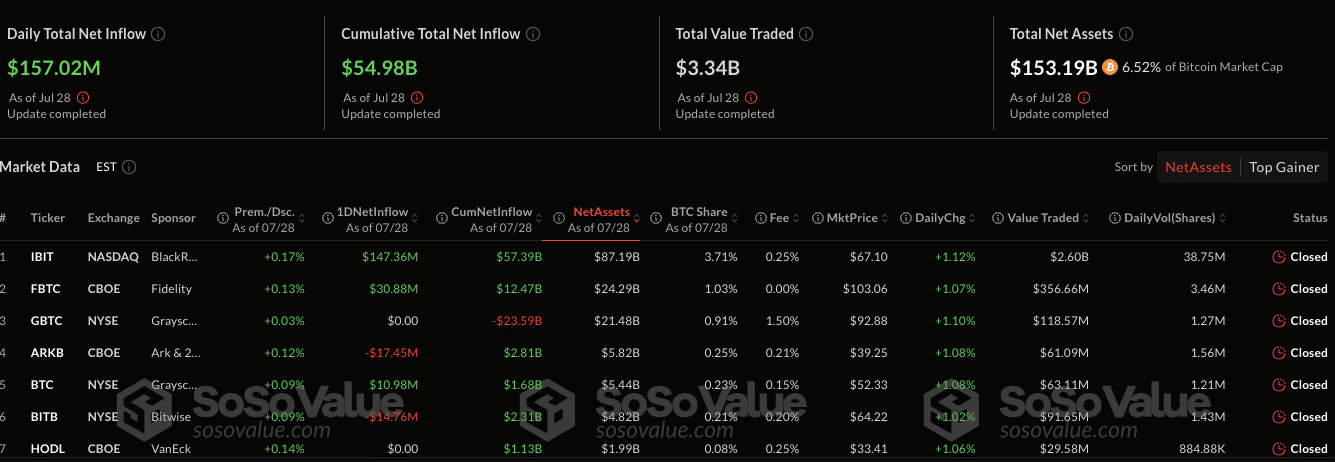

Bitcoin ETF inflows continued for the third straight session, reinforcing investor confidence despite crypto market volatility. BlackRock IBIT is the leader with the $147.36 million net inflows, and it is much better than the other rivals in the segment. Total U.S. spot Bitcoin ETF inflows have now reached $54.98 billion, showing a steady growth trend.

Cumulative assets under management (AUM) for Bitcoin ETFs climbed to $153.19 billion, supported by a $3.34 billion trading volume on July 28. These numbers indicate the high rates of institutional involvement, despite an overall 5 percent drop in the capitalization of the cryptocurrency marketplace. Investors continued favoring Bitcoin ETFs, with Fidelity’s FBTC adding $30.8 million and Ark Invest’s ARKB seeing outflows of $17.45 million.

It now has IBIT, which manages $87.19 billion, or 3.71 percent of Bitcoin’s full menace. These consistent inflows suggest strong demand for spot Bitcoin ETFs even as prices consolidate. Bitcoin’s strength, which reached over 119,000 dollars, provided more technical optimism.

Ethereum ETF Inflows Accelerate Amid Structural Demand Shift

Ethereum ETF inflows accelerated, bringing in $65.14 million on July 28 and marking a 17-day consecutive streak. BlackRock’s ETHA led the segment with a daily inflow of $131.95 million, boosting its AUM to $11.22 billion. This continued accumulation reflects a significant rise in institutional confidence.

Ethereum ETFs now manage $21.5 billion in total, accounting for 4.7% of Ethereum’s market capitalization. Trading volume across Ethereum ETFs reached $1.91 billion on the day, signaling active investor participation. Additional inflows came from Grayscale’s ETHE and VanEck’s EFUT, reinforcing broad-based demand.

Jeffrey Hu of HashKey Capital noted that “a growing corporate shift toward Ethereum reflects a strategic pivot in institutional portfolios.” Corporate buyers like SharpLink Gaming have surpassed the Ethereum Foundation in holdings, acquiring over 280,000 ETH. Hu also cited over $1.6 billion in ETH acquisitions by treasuries within the past month.

Momentum Tilts Toward Ethereum as Market Dynamics Shift

The ETH/BTC ratio has risen above its 200-day average for the first time in a year, forming a golden cross. Jamie Elkaleh of Bitget Wallet said Ethereum’s recent 60% rally represents “more than just short-term momentum.” He emphasized that staking yields and clearer regulation are driving increased interest.

Ethereum’s appeal has broadened as companies begin running validator nodes and utilizing native staking rewards. This move introduces structural demand for ETH, beyond speculative or hedging interest. Institutions are no longer viewing Ethereum as an alternative but as a primary infrastructure asset.

The capital rotation from Bitcoin to Ethereum suggests a rebalancing of institutional exposure in the digital asset space. However, both assets continue to show strength within their respective markets. The combined ETF inflows illustrate growing diversification and maturing investor strategies.

Summary

On July 28, Bitcoin ETFs logged a third straight day of gains with $157 million in inflows, led by BlackRock’s IBIT. Ethereum ETFs saw $65.14 million in net inflows, marking their 17th consecutive positive day. BlackRock’s ETHA drew $131.95 million, reflecting a broader structural shift as institutional investors increasingly adopt Ethereum.

For more crypto news, visit the platform.

FAQs

1. What are Bitcoin ETFs?

Bitcoin ETFs are exchange-traded funds that track the price of Bitcoin and allow investors to gain exposure without owning the asset.

2. How did Bitcoin ETFs perform on July 28?

Bitcoin ETFs posted $157 million in net inflows, marking the third consecutive day of gains, led by BlackRock’s IBIT.

3. What caused the rise in Ethereum ETF inflows?

Ethereum ETFs saw inflows due to corporate treasury interest, staking yields, and improved regulatory clarity in the U.S. market.

4. Which Ethereum ETF led the market on July 28?

BlackRock’s ETHA led Ethereum ETFs with $131.95 million in inflows, pushing its total assets under management to $11.22 billion.

5. How much ETH do corporate treasuries hold?

Corporate treasuries have acquired at least $1.6 billion in ETH in the past month, signaling a shift toward Ethereum adoption.

Glossary of Key Terms

Bitcoin ETF – A financial instrument that allows investors to trade shares representing Bitcoin without directly buying the cryptocurrency.

Ethereum ETF – An exchange-traded fund that tracks the price of Ethereum, offering similar exposure as a Bitcoin ETF.

Staking Yield – Earnings generated by holding and staking cryptocurrency to support blockchain network operations.

Golden Cross – A bullish technical indicator where a short-term moving average crosses above a long-term moving average.

AUM – The total market value of assets that an investment fund manages on behalf of its clients.