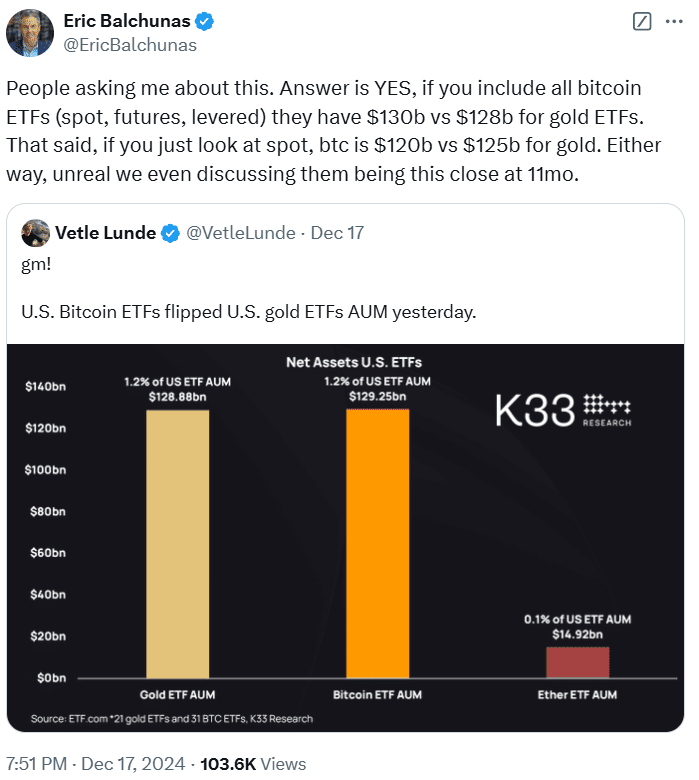

Bitcoin spot ETFs in the US have now taken the lead over gold ETFs in terms of the assets managed. This is a big change in the investment strategy. While gold ETFs have been in existence for 20 years, Bitcoin ETFs have raced past them in under a year since their inception in January 2024. The emergence of Bitcoin ETFs is just evidence of the increasing demand for crypto assets as an innovative asset class by investors.

K33 Research and Bloomberg analyst Eric Balchunas estimates that by December 17, 2024, assets under management of the US Bitcoin ETFs are $129 billion which is higher than the $128 billion in gold ETFs.The launch of BTC spot ETFs in the United States has been the key driver in connecting the digital currency with the institutional finance world. For the first time, investors can invest in BTC with a regulated investment product without having to purchase and hold the cryptocurrency.

Gold Vs. Bitcoin: A New Battle

Investment giants such as BlackRock, Fidelity, and Ark Investment have joined the Bitcoin ETF space. Their participation enhances the perception of BTC as a real investment asset, and the competition in the market will also attract more investors.

Gold ETFs have been popular for a while now and are especially popular with investors during inflation and economic turbulence. Gold has always been considered as a store of value and this gives them backing. However, BTC that is often referred to as “digital gold” became the decentralized option. The fact that it has a total cap of 21 million coins makes it a good store of value against inflation. In particular, BTC presents a new and exciting investment opportunity to young investors seeking new and higher-yielding investments.

This has also come in the wake of a favourable price performance of BTC in 2024. Experts attribute the change in investor attitude to a change in generation. According to the research, the younger population of investors is more likely to be attracted to the BTC due to its technological advancement and future. At the same time, the traditional investors looking for diversification continue to buy Bitcoin ETFs.

Bitcoin ETF Growth and Demand

The expansion of the Bitcoin ETF market is the result of increasing demand for cryptocurrency in the financial world. The US ruling on Bitcoin spot ETFs in 2024 has put the regulatory authorities on track and made a legal benchmark. This step has gained attention from other areas as international regulators want to emulate the U.S. Due to the clear regulation of BTC, investors have gained confidence in it.

Although Bitcoin is often criticized for its price volatility, the fact that more and more institutions are investing in it means that the market is growing up. There are more institutional investors coming into the Bitcoin market, this could lead to even more Bitcoin taking market share from gold in the ETF space. Other people believe that more funds from conventional investors are likely to pour into Bitcoin, hence cementing its position as a conventional asset.

The rise of BTC is symptomatic of changes that are taking place in the financial markets. It is no longer considered as an unconventional asset. It is, however, testing the traditional notion of gold as the best form of storing value. This change in preferences is evidence of how the processes of innovation and decentralization are changing the face of finance.

The defeat of gold ETFs by Bitcoin ETFs is, therefore, a historic moment in the world of finance. It proves that cryptocurrency is not only an object of investment but also a tool to do business. They are restructuring global markets for investors to take advantage of. This appears to imply that such traditional assets as gold may not continue to enjoy this status as the go-to store of value.

Conclusion

Growing with Bitcoin ETFs, they become one of the main factors that affect the change in the perception of value among investors. The increase in the price of BTC may be an indication of the world now embracing decentralized financial systems that contain both conventional and new cryptocurrencies. The increased adoption of BTC in the ETF market is also consistent with this change as more investors are now confident with cryptocurrencies as a legitimate form of investment.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

Why are Bitcoin ETFs outperforming gold ETFs?

Bitcoin ETFs have led the way as investors look for regulated and new methods to invest in cryptocurrencies over the more conventional asset class like gold.

What role do institutional investors play in Bitcoin ETF growth?

Large investors like BlackRock and Fidelity are making Bitcoin ETFs more acceptable, and this is boosting investment and the market’s expansion.

What makes BTC a reliable store of value?

The limited supply of Bitcoins at 21 million and the fact that the asset is not tied to a central bank give it a unique advantage over other investments in times of economic volatility.

Can BTC replace gold as a safe-haven asset?

Despite the fact that BTC is more volatile, its ability to provide higher returns and entice investors as a store of value is a threat to the traditional king of assets, gold.