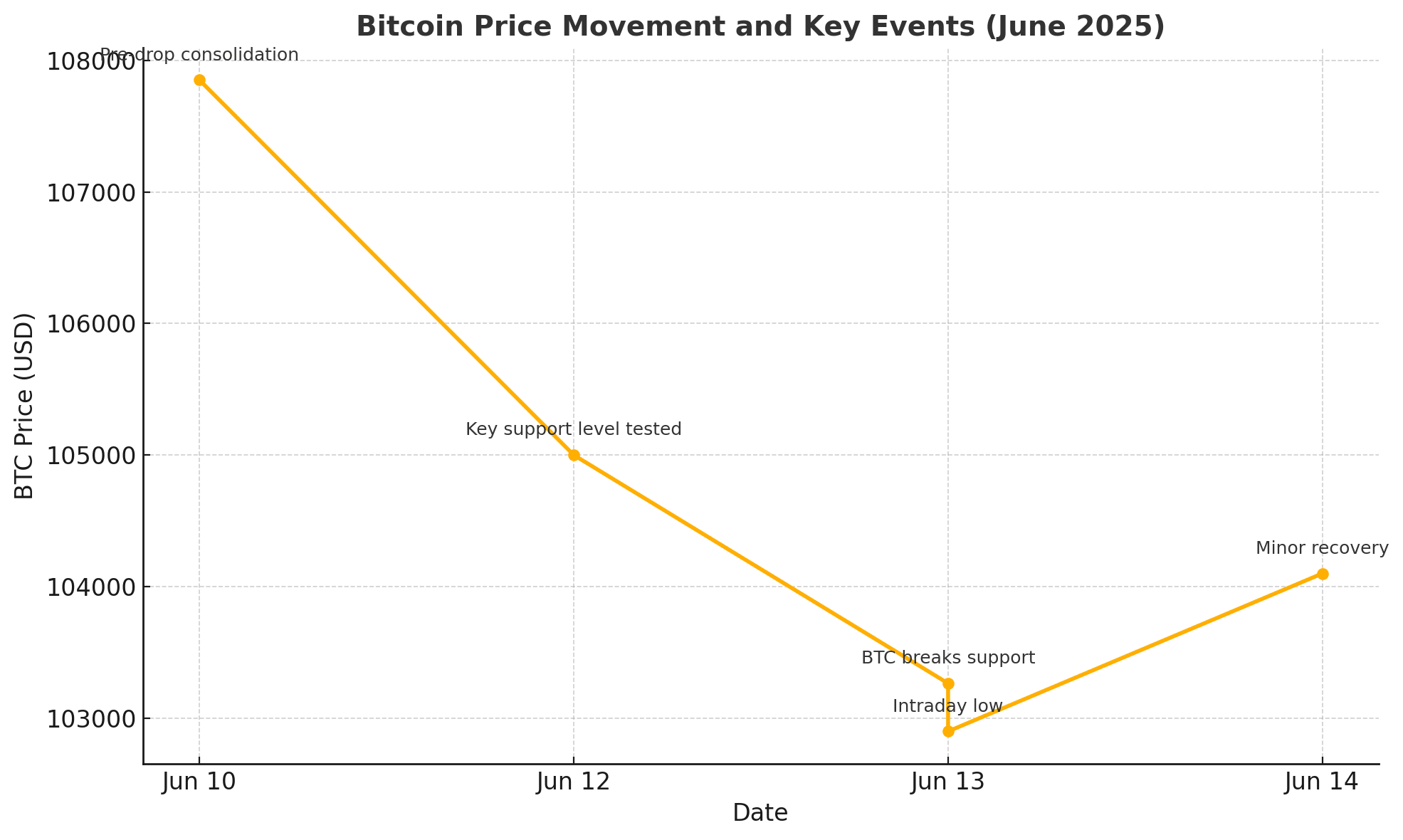

Bitcoin faced renewed downward pressure this week, plummeting below $103,000, as a combination of technical weakness and major institutional news events weighed on the market.

On June 13, 2025, Bitcoin tumbled through key support levels after failing to hold above $105,000, a threshold previously seen as a consolidation zone. According to technical indicators, BTC broke below both its 50-period exponential moving average (EMA) and formed a bearish MACD crossover, triggering a wave of algorithmic and retail sell orders.

This technical collapse was accompanied by intensified geopolitical market activity, most notably, Binance’s official launch in Syria and BlackRock’s bold push to become crypto’s top institutional player.

Bitcoin Price Analysis: Levels to Watch

| Date | Price (USD) | Technical Status |

|---|---|---|

| June 12, 2025 | $107,850 | Trading above support; neutral trend |

| June 13, 2025 | $103,265 | Support broken; bearish reversal |

| Key Support | $103,132 | Tested and breached |

| Next Support | $101,705 | Danger zone before $100K level |

If $101,700 fails to hold, analysts warn of a possible retest of the psychological $100,000 level. However, volume remains high—suggesting both panic selling and strategic accumulation may be at play.

Binance Launches in Syria: A Controversial but Bold Expansion

In a major geopolitical twist, Binance officially entered the Syrian market, offering residents full access to its suite of services: spot trading, futures, staking, peer-to-peer transactions, and Binance Pay. The launch follows the recent easing of U.S. and EU sanctions, which had long restricted financial activity in Syria.

Over 300 cryptocurrencies, including Bitcoin, Ethereum, and stablecoins like USDT, are now accessible to Syrian users, marking a transformative moment in the region’s economic outlook. The platform also includes Arabic-language educational materials, supporting digital literacy and KYC compliance.

Binance’s move is being viewed as both an economic lifeline and a political signal, positioning crypto as a vehicle for financial inclusion in war-torn economies.

“This isn’t just business—it’s digital diplomacy,” one regional analyst told CryptoNews.

BlackRock: From Wall Street to Crypto World Domination?

While Binance expands eastward, BlackRock is doubling down westward. During its June investor day, the world’s largest asset manager unveiled its long-term crypto strategy, with the goal of becoming the top global crypto asset manager by 2030.

BlackRock’s crypto moves include:

IBIT (iShares Bitcoin Trust), which saw $260.9 million in BTC inflows in early June

USDC Treasury oversight, managing $53 billion in reserves backing the Circle stablecoin

Signals of expansion into tokenized funds, Ethereum staking products, and other digital yield instruments

This dual-pronged approach—ETFs plus stablecoin infrastructure—places BlackRock at the heart of crypto’s institutionalization.

“BlackRock isn’t just dipping its toes—it’s building the pipes,” commented fintech strategist Amira Khan.

Strategic Context: A Tale of Two Forces

This week’s market turbulence highlights the dual forces shaping crypto today:

Short-term volatility, driven by bearish technicals, macro headwinds, and reactive sell-offs

Long-term conviction, fueled by institutional expansion and decentralized adoption

While Bitcoin’s price may appear weak on the charts, underlying fundamentals are growing stronger. Binance’s reach into emerging markets and BlackRock’s Wall Street integration show that crypto is no longer confined to speculation, it’s becoming financial infrastructure.

What’s Next?

Watch BTC Support at $101,705: A break below could accelerate declines to $98K–$100K range

Monitor Binance’s Syria Launch Metrics: User growth and volume could indicate untapped demand

Track BlackRock’s ETF Flows: Institutional behavior may provide a price floor even in choppy waters

Geopolitical Risk Factors: Ongoing Israel–Iran tensions continue to influence investor sentiment globally

Final Thoughts: Volatility Meets Validation

Bitcoin’s dip below $103K may have triggered alarms, but under the surface, crypto’s global story is accelerating. Binance’s bold move into Syria and BlackRock’s crypto playbook point to one clear narrative: crypto is no longer an experiment—it’s a strategic asset class.

Whether it’s rising from conflict zones or sitting in boardrooms at BlackRock HQ, digital assets are shaping economies and portfolios alike.

Investors should expect short-term turbulence, but those watching the long game see a market still building, expanding, and hardening under pressure.

FAQs

Why did Bitcoin fall below $103,000?

Bitcoin dropped due to technical breakdowns, bearish momentum, and broader market uncertainty following institutional moves and macro shifts.

What is the significance of Binance launching in Syria?

Binance’s expansion into Syria marks a bold push into emerging markets, offering financial access in a previously restricted economy.

How is BlackRock influencing the crypto market?

BlackRock is increasing its crypto presence through ETF inflows and stablecoin treasury oversight, aiming to lead institutional crypto adoption by 2030.

Glossary of Key Terms

Bitcoin (BTC):

The first and largest cryptocurrency, often seen as a digital asset hedge and speculative investment.

Support Level:

A technical chart level where a falling asset typically finds buying interest; if broken, further declines may occur.

Binance:

The world’s largest cryptocurrency exchange by trading volume, now expanding services into Syria.

BlackRock:

A global investment firm managing trillions in assets; now a major player in crypto via ETFs and USDC reserve management.

IBIT (iShares Bitcoin Trust):

BlackRock’s Bitcoin ETF, offering institutional investors exposure to BTC without direct custody.

USDC (USD Coin):

A regulated stablecoin pegged 1:1 to the U.S. dollar, partially managed by BlackRock’s Circle Reserve Fund.

MACD (Moving Average Convergence Divergence):

A technical indicator used to identify momentum changes in asset prices.

KYC (Know Your Customer):

A regulatory compliance process used by exchanges to verify user identities.