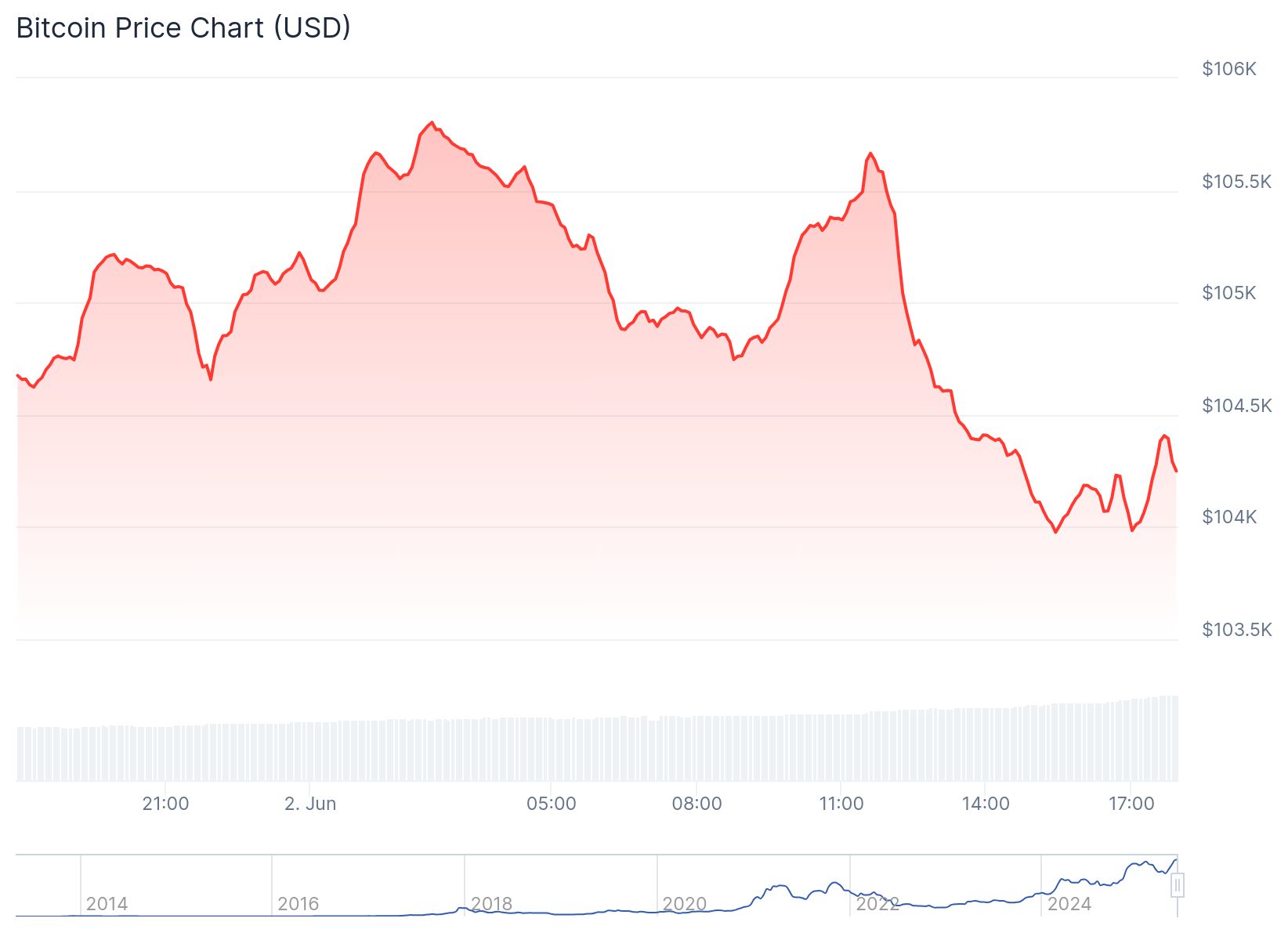

Bitcoin started June on uncertain footing, trading sideways around the $104,000 mark despite mixed signals from both technical and on-chain indicators. While the broader market sentiment remains cautiously optimistic, recent blockchain data suggests that short-term bearish pressure could hinder upward momentum.

According to CoinGecko, Bitcoin was priced at $104,211 at the time of reporting, with a modest 0.4% decline over the past 24 hours. The weekly drop of 5% underscores the fading bullish momentum, although the monthly performance remains positive at +8.2%. On a yearly scale, Bitcoin still impresses with over 53% gains, reflecting its long-term strength.

Technical Charts Send Conflicting Signals

TradingView indicators present a nuanced picture. Moving averages on the daily chart issue a “buy” signal, yet key oscillators remain neutral, suggesting investor indecision. The BTC/USD pair entered a short-term correction pattern following a late-April rally. For now, resistance around $106,000 remains firm, while the $103,000–$104,000 range acts as a strong support zone.

Market participants appear to be taking a long-term approach, with many ignoring near-term volatility in favor of broader adoption and macro trends. According to The Bit Journal, this signals a maturing investor base that’s less reactive to daily swings.

On-Chain Metrics Reveal Hidden Market Tensions

Blockchain data from IntoTheBlock shows that 96% of Bitcoin holders are still in profit, a relatively stable figure that suggests healthy investor sentiment. However, whale holdings remain modest, with large addresses controlling just 12% of the total circulating supply—indicating that institutional involvement may currently be limited.

One key concern comes from recent exchange activity. In the past week, centralized exchanges saw net inflows of $3.38 billion, indicating potential sell-side pressure. Additionally, the proportion of addresses “in the money” has dipped by 0.58%, and daily transaction volumes remain flat around $24.5 billion.

Despite these indicators, the Bitcoin network itself continues to operate with moderate growth, and its market cap holds firm at approximately $2.07 trillion. The stable circulating supply of 19.87 million BTC further reinforces the asset’s deflationary appeal.

Outlook: Watching the Key Levels

The coming days will be crucial for Bitcoin as it tests the $106,000 resistance level. A breakout could renew bullish momentum, while failure to hold above $103,000 might trigger a broader correction. For now, traders are advised to monitor both exchange flows and macro indicators to better gauge market direction.

As The Bit Journal emphasizes, blending technical analysis with real-time on-chain data is essential for making informed investment decisions in today’s crypto landscape.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

Sources:

CoinGecko (https://www.coingecko.com/)

IntoTheBlock (https://www.intotheblock.com/)

TradingView (https://www.tradingview.com/)