As November kicks off, the crypto market is off to a fast but somewhat tense start. While Bitcoin (BTC) strives to reach its record $73,000, investors are navigating a tricky week. Uncertainties around the U.S. presidential election results and anticipated Fed rate cuts have heightened market volatility, keeping traders on edge.

Bitcoin’s Price Movements and Market Dominance

Last week saw Bitcoin in a battle to surpass the critical $73,000 mark, only to be thwarted as bulls failed to break through. The weekly close formed an inverted hammer pattern, sending mixed signals to investors. Despite the volatility, Bitcoin’s market dominance surged past 60%, solidifying it as the strongest asset in the space and reflecting sustained investor confidence.

Altcoin Market Slows Down

Meanwhile, the altcoin market has appeared stagnant. Bitcoin’s increasing dominance is overshadowing other digital assets, limiting their momentum. For now, altcoin investors might need to stay cautious. With Bitcoin’s influence still significant, the direction of altcoins remains uncertain, fueling concerns among traders.

Why Are Altcoins Stuck?

The recent approval of several spot Ethereum (ETH) ETFs initially raised hopes, but the altcoin market has yet to experience a major rally. Similar products for Solana (SOL), XRP, and Litecoin (LTC) are in the pipeline, yet overall demand remains lower than in past bull markets. Investors are left wondering why altcoins are stagnant and when a new altcoin bull run might emerge.

Crypto analyst Benjamin Cowen suggests that a full-fledged altcoin season might not materialize until early 2025. He points to the ALT/BTC pair losing a crucial support level, which could signal continued market softness. However, Cowen notes that any shifts in Fed policy could offer a recovery opportunity for altcoins, adding a glimmer of hope despite the current market outlook.

Macro Factors and Market Outlook

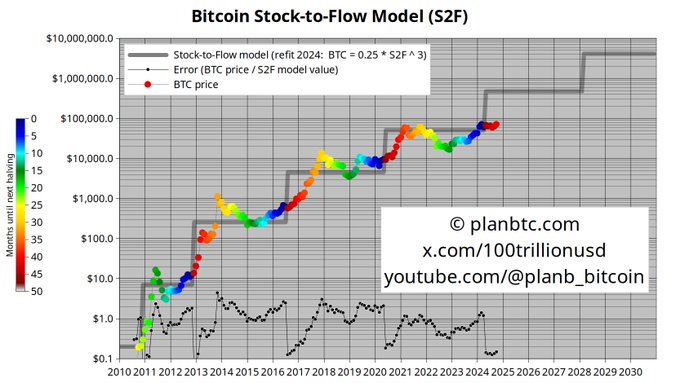

Macro influences continue to drive the crypto market. It’s been seven months since Bitcoin’s fourth halving, but the market remains in search of equilibrium. Influential analyst PlanB believes that the 2024 U.S. presidential election could have substantial effects on the crypto sector. New policies and possible regulations could shape investor decisions and price movements.

Should the Fed cut interest rates, it might signal the start of a new economic cycle, bringing both opportunities and risks for investors. As macroeconomic uncertainties persist, it’s crucial for investors to keep the bigger picture in mind and approach with caution. As The Bit Journal previously reported, Bitcoin’s price continues to influence the broader market. With unpredictable trends, strategic thinking is more important than ever.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!