Bitcoin is no longer just an asset for early adopters or speculative traders. According to Bitwise’s Chief Investment Officer Matt Hougan, we are witnessing the start of a new “megatrend” where corporate treasuries are rapidly accumulating BTC as a strategic reserve, and this could propel Bitcoin well past the $130K mark.

In a recent interview with CryptoSlate, Hougan declared, “Bitcoin is the best horse in the race,” referring to the digital asset’s unique positioning as a hedge against inflation, fiat dilution, and sovereign debt. With institutional buying accelerating and daily issuance shrinking post-halving, Hougan believes Bitcoin’s next move could be dramatic.

“We’re in innings one or two,”

he said, suggesting the market is still early in this corporate accumulation phase. “The future of treasury management is changing, and Bitcoin is at the core of it.”

Corporations Are Absorbing the Entire BTC Supply

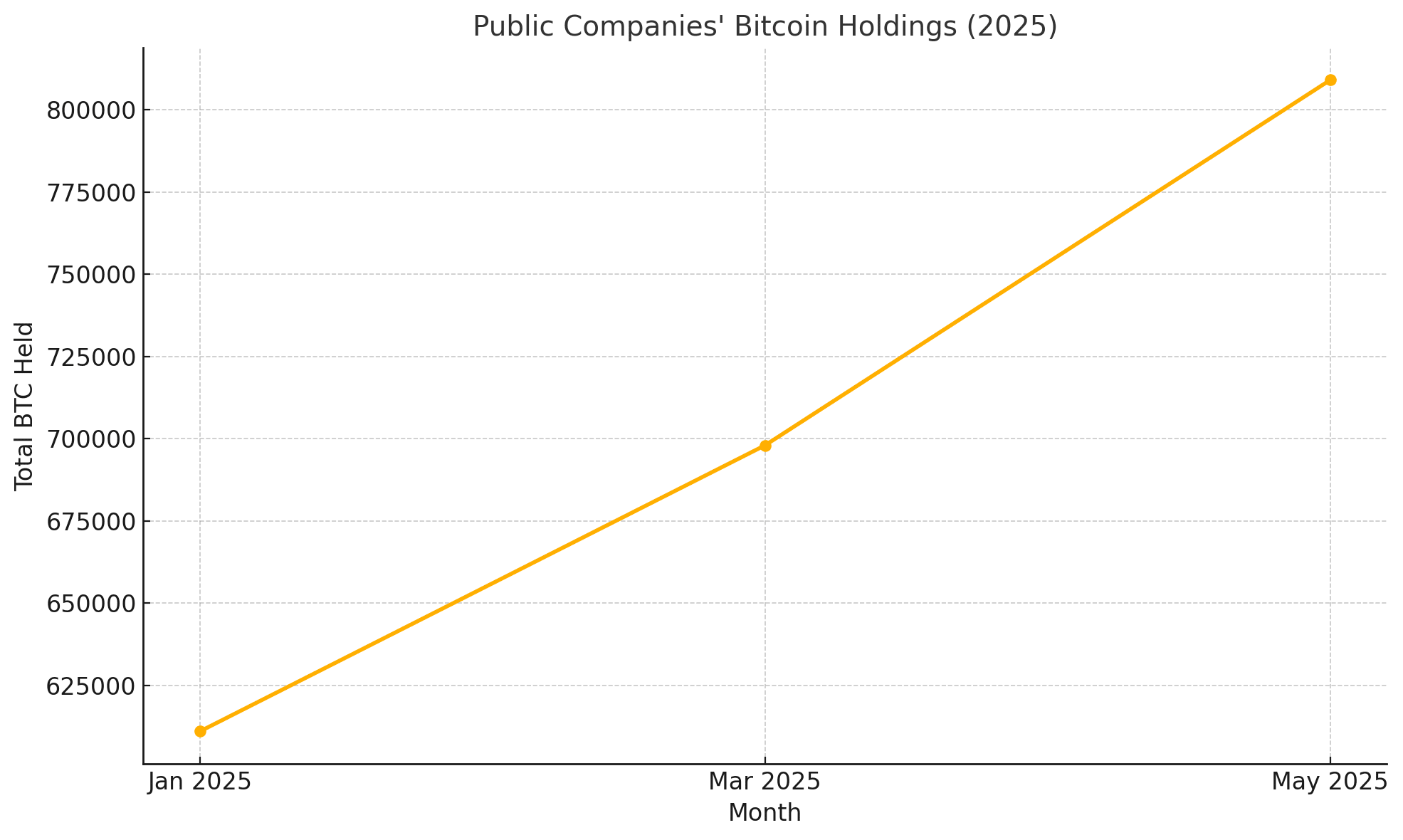

Supporting Hougan’s thesis is new on-chain data showing a rapid uptick in public company Bitcoin holdings. As of the end of May 2025, more than 116 public companies now hold 809,100 BTC, valued at over $88 billion. This represents a massive increase from just 79 companies at the end of Q1 2025.

To put that into context, only 450 BTC are mined daily—roughly $50 million in new supply. Meanwhile, Bitwise estimates that corporate buyers are already absorbing more than 100% of daily issuance.

This growing imbalance between demand and supply sets the stage for a structural price squeeze. The same dynamic helped drive Bitcoin past $65K in 2021—except this time, the players are bigger and the stakes are higher.

Bitwise CEO: Selling Will Vanish Above $130K

While many analysts remain cautious about near-term resistance, Bitwise CEO Hunter Horsley believes a key psychological shift will take place once Bitcoin reclaims the $130K–$150K zone.

In a June 10 interview with Cointelegraph, Bitwise CEO Horsley explained that current profit-taking pressure mostly comes from early, long-term holders who are cashing out in the $100K range. But this is a finite group, and he predicts that once BTC breaks above $130K, the market will experience a “sell-off cliff.”

“We believe sell pressure will peter off. People will stop selling at $130K–$150K because they’ll no longer want to exit a winning position,” Bitwise CEO Horsley said.

Instead of selling, many institutions and HNWIs are exploring borrowing against their Bitcoin through custodians and crypto lenders. This lets them unlock liquidity without parting with their BTC, further tightening the circulating supply and driving potential parabolic moves.

GameStop, MicroStrategy, and the New Treasury Playbook

GameStop’s recent $1.75 billion convertible debt raise is now rumored to be part of a broader strategy to mimic MicroStrategy’s Bitcoin-centric treasury model. The meme stock’s renewed presence in the headlines has sparked speculation that it could soon join the ranks of BTC-heavy corporations.

Michael Saylor’s MicroStrategy currently holds 226,331 BTC, worth over $24 billion, and is actively encouraging other public firms to do the same.

From Tesla to Square and now potentially GameStop, the trend is no longer fringe, it’s going mainstream.

Bitcoin Corporate Holdings Growth (Jan–May 2025)

| Month | Public Companies Holding BTC | Total BTC Held | Approx. Value (USD) |

|---|---|---|---|

| January 2025 | 73 | 611,000 BTC | $55.3B |

| March 2025 | 79 | 698,000 BTC | $64.3B |

| May 2025 | 116 | 809,100 BTC | $88.1B |

Why Bitcoin May Be Headed for $200K

With corporate treasuries accumulating faster than BTC can be mined, and traditional holders opting to borrow instead of sell, Bitwise CIO Hougan believes the environment is ripe for exponential upside.

If even a small percentage of Fortune 500 companies start allocating 1–2% of their reserves into Bitcoin, the demand spike could be catastrophic for bears.

Add in the macro backdrop, U.S. deficit spending, de-dollarization pressures, and sovereign debt concerns, and Bitcoin’s appeal as digital gold becomes even more compelling.

“We’re not just talking about another bull run,” Hougan concluded. “We’re talking about the remaking of capital allocation—and Bitcoin is at the center.”

Conclusion: Bitcoin’s New Price Catalyst Isn’t Hype, It’s Balance Sheets

Bitcoin’s future doesn’t hinge on speculative mania. It now rides on a far more powerful engine: corporate adoption, treasury diversification, and supply mechanics that favor those who accumulate, not trade.

If Bitwise’s forecast proves accurate, Bitcoin may not just reach six figures; it could explode beyond $200,000 as public companies turn to BTC as their ultimate reserve asset.

As the macro climate continues to favor decentralized value stores, the question is no longer if institutional money will push Bitcoin higher—it’s how soon and how far.

Frequently Asked Questions (FAQs)

What is causing corporations to buy Bitcoin?

Concerns about inflation, fiat devaluation, and geopolitical risk are pushing companies to consider Bitcoin as a long-term store of value.

Could Bitcoin really hit $200,000?

Yes, if corporate demand continues to outpace daily issuance and institutional investors avoid selling, a supply-driven rally is plausible.

Why would companies borrow against BTC instead of selling?

Borrowing allows them to access liquidity without triggering tax events or giving up exposure to BTC’s future gains.

Glossary of Key Terms

Supply Shock – A situation where demand significantly exceeds the available supply, driving prices up rapidly.

Convertible Debt – A type of bond that can be converted into equity shares, often used to raise funds with future upside potential.

Treasury Strategy – The approach a company uses to manage cash, debt, and assets to preserve value and hedge risk.

Corporate Adoption – The growing trend of companies integrating cryptocurrencies like Bitcoin into their balance sheets or business models.