Bitcoin is showing signs of strength beneath the surface, with mid-cycle metrics indicating undervaluation and resilience. As BTC trades around $105,000; recent behavior from miners, valuation metrics and broader liquidity levels suggest this consolidation may be setting up for another leg up. These Bitcoin mid-cycle metrics are being watched by institutional investors and long-term holders to determine the next direction BTC would take.

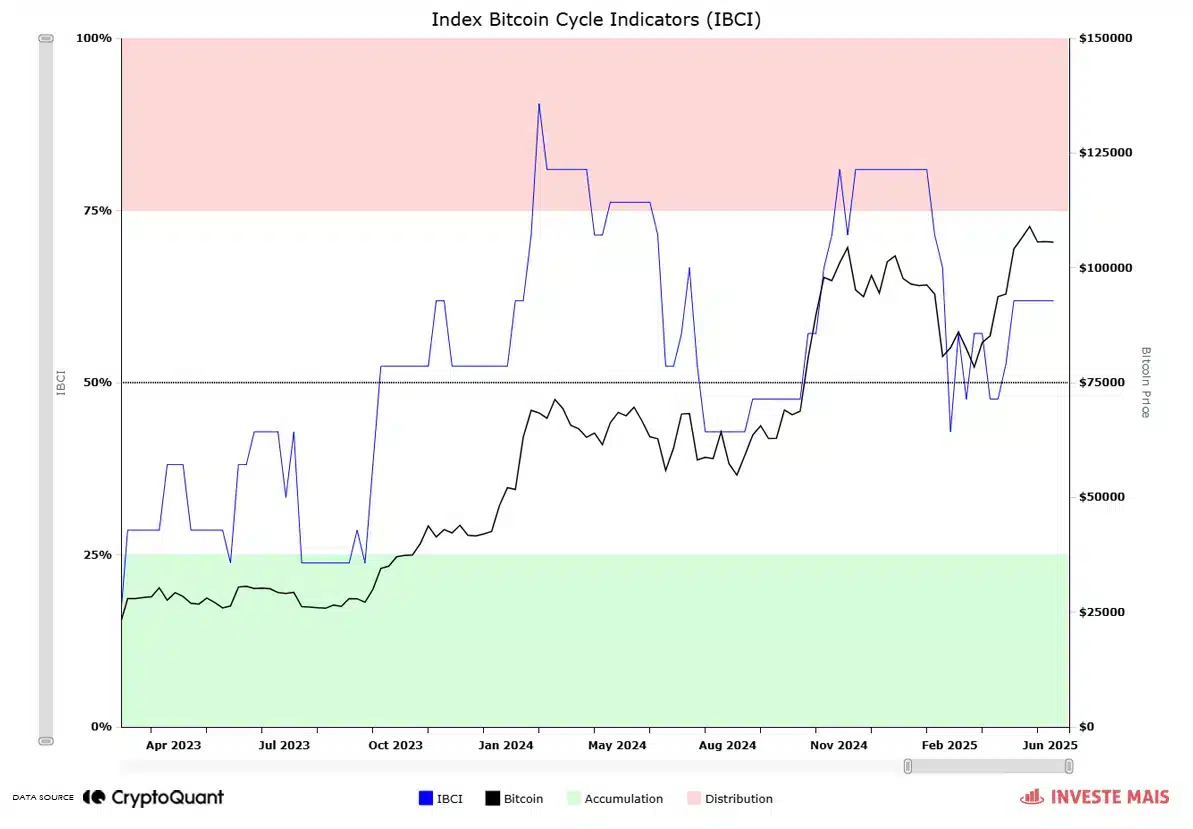

IBCI Stability Means Healthy Market Reset

The Index Bitcoin Cycle Indicator (IBCI) has stabilized at 50% – a level that often means mid-cycle. After peaking above 75% earlier this year, this means neither overheating nor exhaustion. In previous times, this midpoint has been a pause before the next big move. Instead of weakness, analysts see this as a natural consolidation in an ongoing uptrend, meaning market participants are repositioning not exiting.

Technically, Bitcoin is above the ascending channel from early April and holding support at the midline. Price is flirting with the $105,000-$106,000 range and resistance at $112,000. Despite small dips, the structure remains intact. RSI is oscillating between 49.8 and 53.1 – no direction but not overbought. This zone has previously preceded breakouts when accompanied by macro signals.

Valuation Ratios Show Undervaluation Before Next Rally

Two metrics long term investors use to value Bitcoin – Network Value to Transactions (NVT) and Network Value to Metcalfe (NVM) – have corrected sharply. NVT is down 52.6% to 33.87 and NVM is down 43.3% to 2.49. These types of moves happen when price lags behind actual transaction activity and user growth on the network.

According to Glassnode, these levels have previously preceded big rallies, meaning there is latent value not priced in yet. One counter to the current market structure is the decline in exchange-stablecoin balances. The Exchange Stablecoin Ratio is down 2.4% to 5.60. While this may mean slightly less buying power in the short term, it doesn’t mean a liquidity crisis.

Stablecoin reserves are still healthy, with CryptoQuant noting only minor fluctuations in USDT and USDC inflows. This means capital is still available, and buyers may be waiting for macro signals or key levels before deploying.

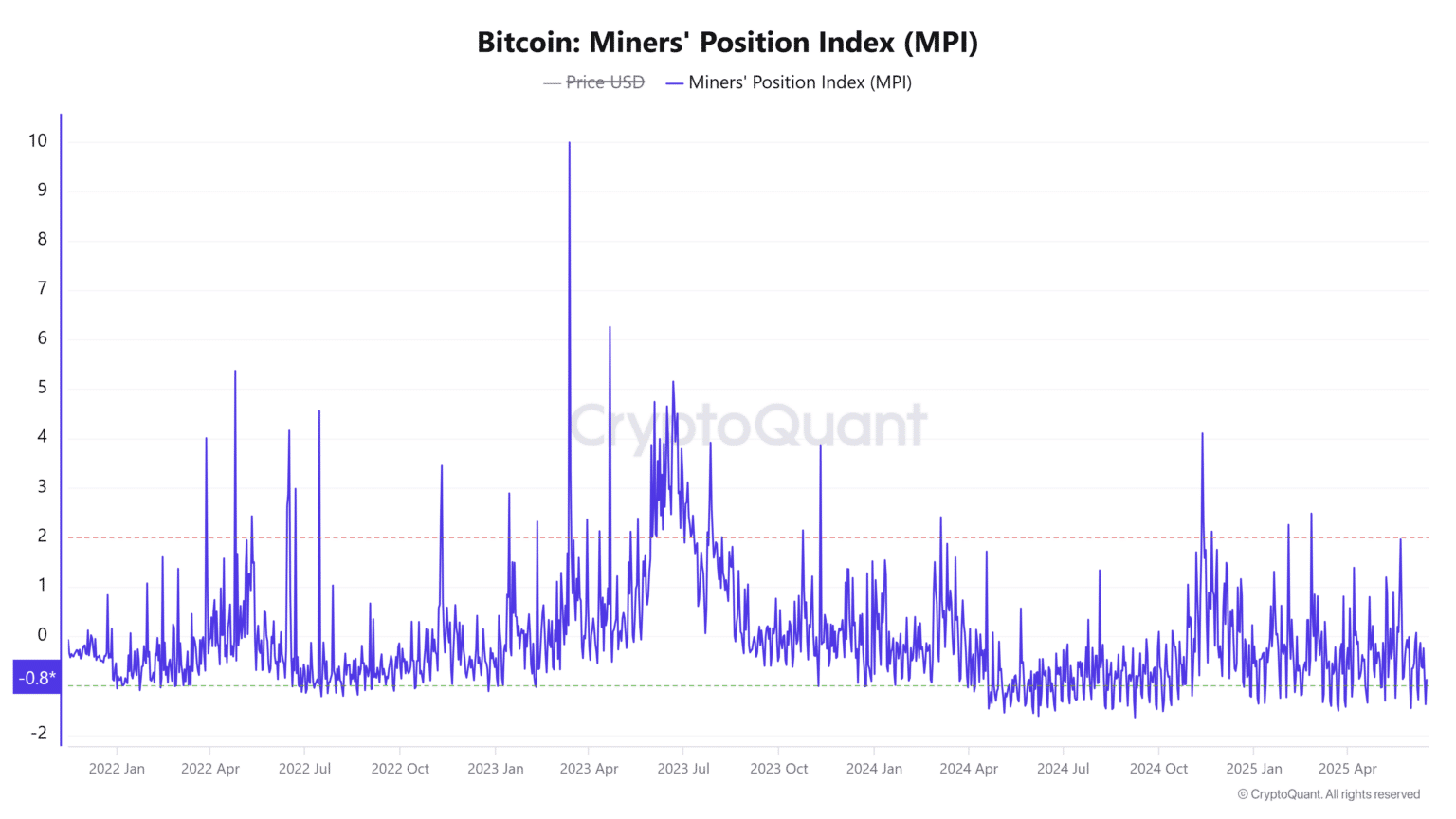

Miner Behavior Is Bullish

Another positive metric is miner behavior. Miners often precede big moves in the market. The Miners’ Position Index (MPI) is up 49.8% to -0.88. Still below zero but miners are selling much less than their one year average.

Historically, a low MPI with rising prices means miners are holding, as a result, there’s confidence in further upside. As liquidity providers, when miners stop selling, it reduces market pressure and can help price resilience.

Conclusion

The current Bitcoin mid-cycle metrics setup says it’s not at a top but preparing for the next move up. Stabilization at the IBCI midpoint, Bitcoin’s ascending channel still intact, undervaluation from on-chain ratios and reduced sell pressure from miners all point to a bull case. Stablecoin balances have declined slightly but the overall structure is still good.

Institutional interest is still high and volatility is compressing so all eyes are on macro factors and if Bitcoin can get above $112,000. If it does, a retest of all-time highs before the end of Q3 may not be far-fetched.

FAQ

Why is the IBCI important for Bitcoin price predictions?

The IBCI shows Bitcoin’s cyclical behavior. A reading around 50% means healthy consolidation and setup for future upside.

What does a falling NVT or NVM ratio mean?

Declines in these ratios mean Bitcoin is being underpriced relative to its network activity and user base.

Are lower stablecoin reserves on exchanges bearish?

Not necessarily. A little decline can mean consolidation before capital re-enters the market. Broader reserves are still good.

What does a negative MPI mean for miners?

Negative MPI means miners are selling less than their historical average, so they’re holding and reducing market pressure.

Glossary

Bitcoin mid-cycle metrics: Data points to measure Bitcoin’s position in the current price cycle, IBCI, NVT, NVM, MPI, Exchange Stablecoin Ratio.

IBCI (Index Bitcoin Cycle Indicator): A composite of market cycle status—early, mid or late cycle.

NVT (Network Value to Transaction Ratio): Market cap to on-chain transaction volume.

NVM (Network Value to Metcalfe Ratio): Market cap to square of active users.

MPI (Miners’ Position Index): Miners’ outflows relative to historical average to measure sell pressure.

Exchange Stablecoin Ratio: Stablecoins to BTC on exchanges to measure buying power.