Bitcoin mining difficulty has surged to a staggering 90.67 trillion hashes, setting a new record despite the cryptocurrency’s recent price declines. This dramatic increase highlights the escalating computational power required to maintain the security of the Bitcoin blockchain, even as the broader crypto market struggles.

As Bitcoin’s price experiences a downturn, the cryptocurrency industry faces increased challenges. The record-breaking mining difficulty compounds these difficulties, creating a complex interplay between network security, miner profitability, market pressures, and technological advancements. The growing discrepancy between bitcoin mining difficulty and Bitcoin’s market value underscores the intricate dynamics at play in the Bitcoin ecosystem.

Effects of Rising Bitcoin Mining Difficulty on Miners

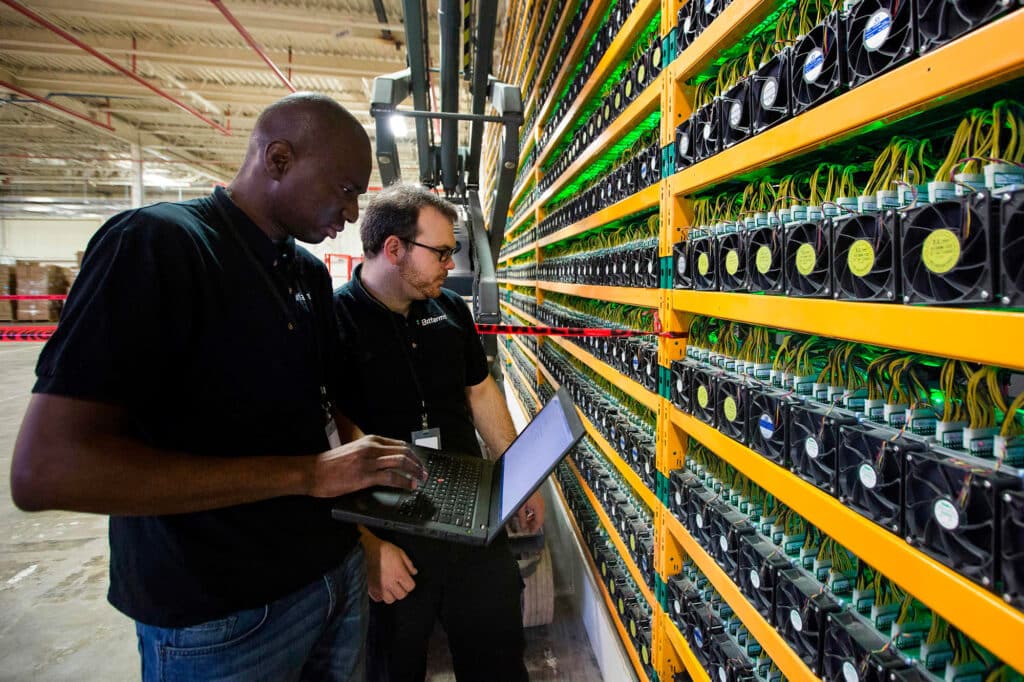

The sharp rise in Bitcoin mining difficulty has significantly impacted the mining community, especially publicly traded mining companies. To remain competitive in this increasingly challenging environment, miners are investing in more powerful and energy-intensive hardware. This trend reflects the growing demands of mining operations amid fluctuating market conditions and increasing computational requirements.

With mining becoming more challenging, miners are exploring various strategies to maintain profitability. Some are diversifying their infrastructure to accommodate high-performance computing tasks beyond cryptocurrency mining, such as artificial intelligence (AI) processing. This strategic shift allows miners to repurpose their hardware for potentially more lucrative applications, enhancing their overall revenue potential.

Additionally, following the lead of companies like MicroStrategy, some miners are choosing to hoard their Bitcoin rather than selling it. By adopting a “HODL” (hold on for dear life) strategy, akin to the approach taken by certain exchange-traded funds (ETFs), they are betting on Bitcoin’s long-term value appreciation. This strategy reflects a belief that despite current high mining costs, Bitcoin’s price will eventually rise, making the investment worthwhile.

The Halving Event: A Double-Edged Sword for Miners

Bitcoin’s most recent halving event in April has further intensified the Bitcoin mining difficulty. The reward for mining each block has been reduced from 6.25 BTC to 3.125 BTC, compounding the financial pressure on miners. This halving event, designed to regulate Bitcoin’s inflation rate, has heightened the challenge of maintaining profitable mining operations.

The combination of increased Bitcoin mining difficulty and reduced block rewards forces miners to reassess their strategies and operational efficiencies. Only the most optimized and well-capitalized mining operations may survive this period of heightened Bitcoin mining difficulty, potentially leading to greater centralization within the mining ecosystem.

Conversely, the halving event supports Bitcoin’s scarcity narrative, which could enhance its long-term value proposition. By reducing the rate at which new bitcoins are introduced into circulation, the halving is expected to contribute to future price increases. This potential for higher future rewards may motivate miners to persevere despite the current high difficulty and lower payouts.

Technological Advancements and Their Impact on Mining Difficulty

The increase in Bitcoin mining difficulty can be attributed to network growth and advancements in mining hardware. The overall hash rate of the Bitcoin network has risen due to the development of more efficient and powerful application-specific integrated circuits (ASICs). These technical advancements boost miners’ throughput, improving their chances of solving blocks and earning rewards.

However, the widespread adoption of advanced mining technology has also raised the overall mining difficulty. This ongoing arms race among miners to deploy the latest hardware continues to push the difficulty higher. For the Bitcoin network to remain secure as block rewards decrease over time, mining hardware must evolve to become increasingly efficient. Despite financial pressures, these advancements are crucial for sustaining network security and decentralization.

Environmental Considerations and the Future of Bitcoin Mining

The record-high Bitcoin mining difficulty has raised concerns about the environmental impact of Bitcoin mining. As miners upgrade to more powerful hardware to stay competitive, the energy consumption associated with mining operations has increased. This rise in energy use has drawn scrutiny from environmentalists and policymakers, potentially influencing regulations and the locations of mining operations.

In response to these concerns, many mining companies are exploring greener energy solutions and innovative cooling systems to mitigate their environmental impact. Some operations are relocating to regions with abundant renewable energy resources, while others are investing in carbon offset programs to reduce their overall carbon footprint.

The push towards more sustainable mining practices reflects a broader effort to balance network security with environmental responsibility. As the industry adapts to these challenges, the potential for a more eco-friendly and resilient Bitcoin network emerges. However, the sector must navigate the ongoing challenge of reconciling high Bitcoin mining difficulty with environmental sustainability.

Navigating the High Difficulty Landscape

Bitcoin’s record-breaking mining difficulty amid a market downturn highlights the complex dynamics facing the cryptocurrency industry. As miners grapple with increased computational demands and reduced rewards, their strategies evolve to address these challenges. Technological advancements and environmental considerations further shape the future of Bitcoin mining. As we continue to monitor these developments, TheBITJournal remains committed to providing insights into the evolving landscape of digital assets. Stay informed about the latest trends and opportunities as the cryptocurrency world navigates this challenging and dynamic environment.