Bitcoin (BTC) has dropped to $76,600 on March 10 and is now bouncing back. Some are panicking, others see history repeating itself. According to Bill Barhydt, CEO of Abra, this is nothing new; this looks 100% Like the 2017 cycle.

In a post on X (formerly Twitter), Barhydt dismissed fears of a prolonged downturn:

“Bitcoin is now experiencing its 11th 25%+ correction in ten years and every time everyone reacts like the sky is falling. Every time everyone screams that it’s different this time.”

He explained that the current market structure; rising fiat liquidity, economic uncertainty and government policy shifts looks like 2017 when Bitcoin had a series of big corrections before going to new all-time highs.

With major trends lining up with past cycles, some think BTC could be setting up for another big move.

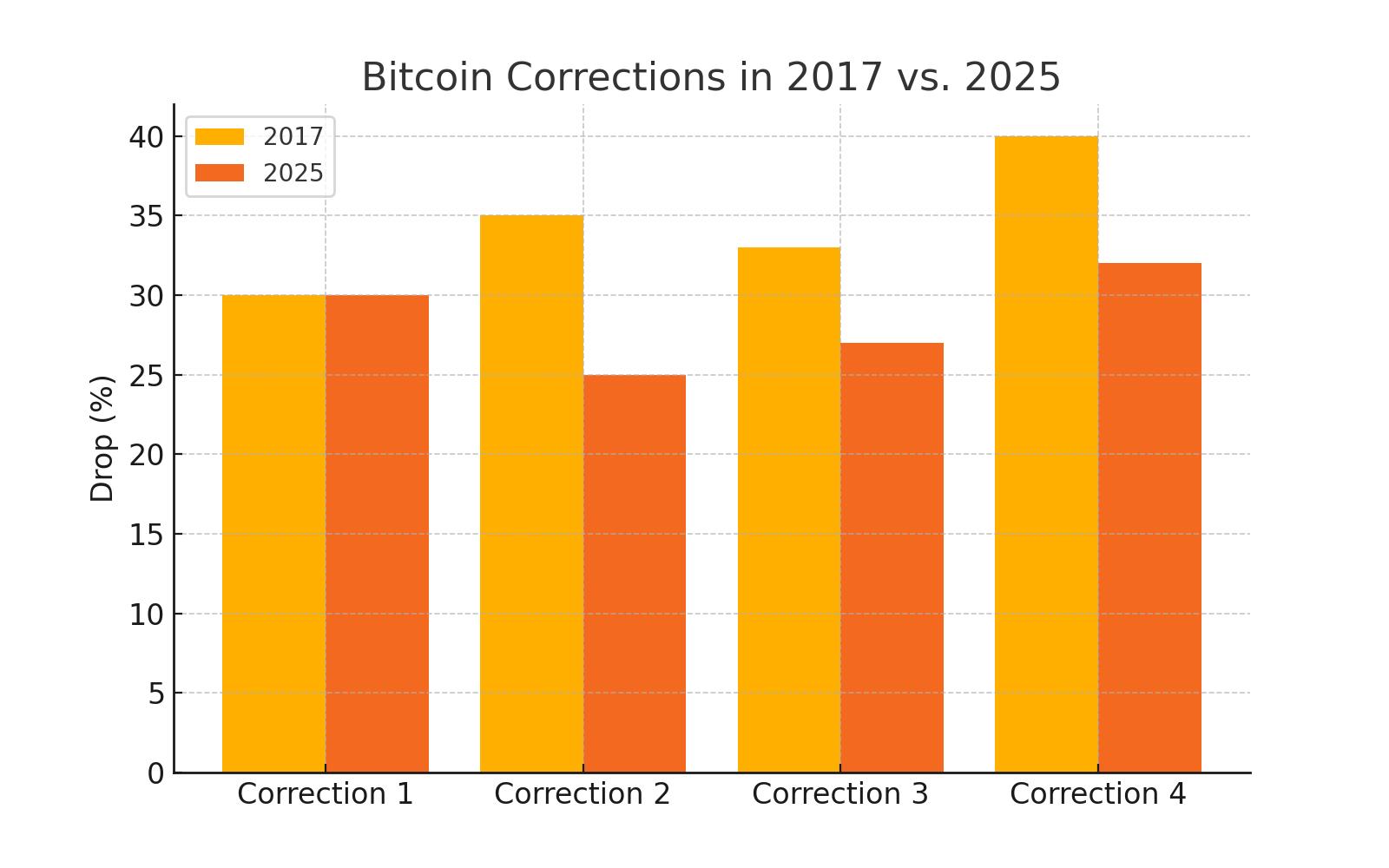

Bitcoin’s 2025 Drop vs 2017 Market Cycle

Bitcoin’s market has historically followed four year cycles, largely driven by the Bitcoin halving; which reduces new BTC supply every four years. In 2017 Bitcoin had multiple corrections above 30% but ultimately went from $1,000 to nearly $20,000 by the end of the year.

2025 vs 2017 Bitcoin Cycle

1. High Volatility After an All-Time High:

– 2017: BTC corrected multiple times before new highs.

– 2025: BTC went to $109,356 in January and then corrected 30%; just like before.

2. Fiat Liquidity & Economic Shifts:

– 2017: Central banks added liquidity and the market grew.

– 2025: U.S. Treasury policies, Fed rate decisions and China’s economic struggles are adding fiat liquidity; could be good for Bitcoin.

3. Bitcoin Halving Cycle:

– The 2024 halving reduced BTC mining rewards and supply.

– Historically Bitcoin has gone up 6-12 months after a halving.

Macroeconomic Factors to Watch

1. U.S. Economic Policy & Treasury Rates

Barhydt said the U.S. government’s fiscal strategy is to:

– Lower Treasury rates to ease government refinancing.

– Reduce mortgage rates to support housing and real estate.

– Ensure bank solvency to prevent financial instability.

This is expected to inject liquidity into the system and benefit Bitcoin, stocks and real estate.

2. China’s Economic Crisis & Liquidity Expansion

Barhydt says China’s recession will get worse and Beijing will print money to stabilize. If they do that, global liquidity could surge and benefit Bitcoin.

3. Layoffs & Market Shifts

Barhydt warns that massive job cuts across industries, government, tech and housing; will add short term economic uncertainty. But if liquidity keeps flowing these layoffs won’t derail markets but will fuel speculation in crypto and equities.

“That liquidity will flow into stocks, Bitcoin, crypto and real estate.”

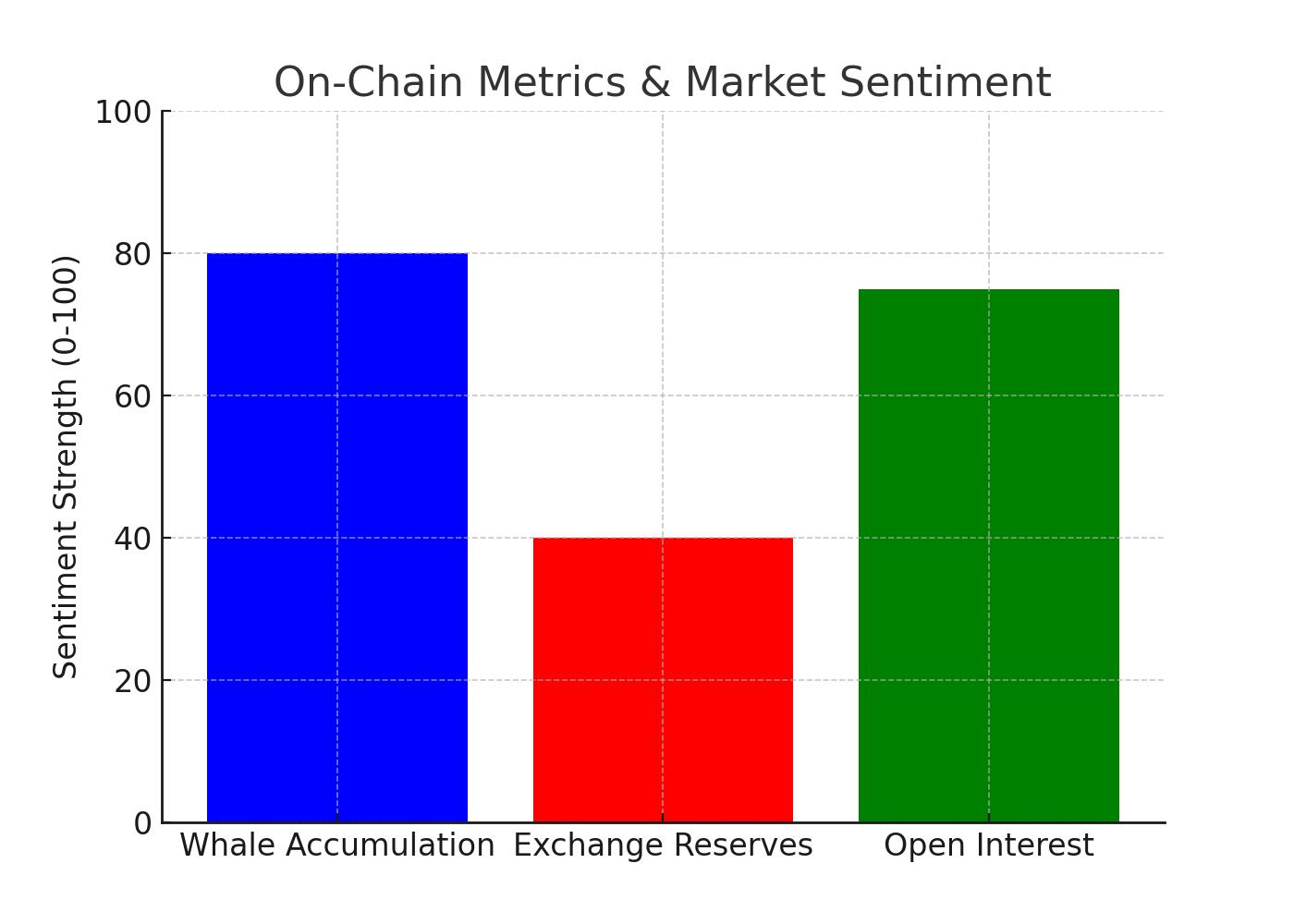

Market Sentiment: Rebound Imminent?

On-Chain Data & Derivatives Markets

Despite the drop, on-chain metrics show investor confidence is strong:

– Whale Accumulation: Large Bitcoin holders (wallets with 1,000+ BTC) are buying the dip.

– Exchange Reserves Dropping: Fewer BTC on exchanges means long term holding not panic selling.

– Open Interest Rising: Bitcoin futures Open Interest (OI) is still high, traders are positioning for the next move.

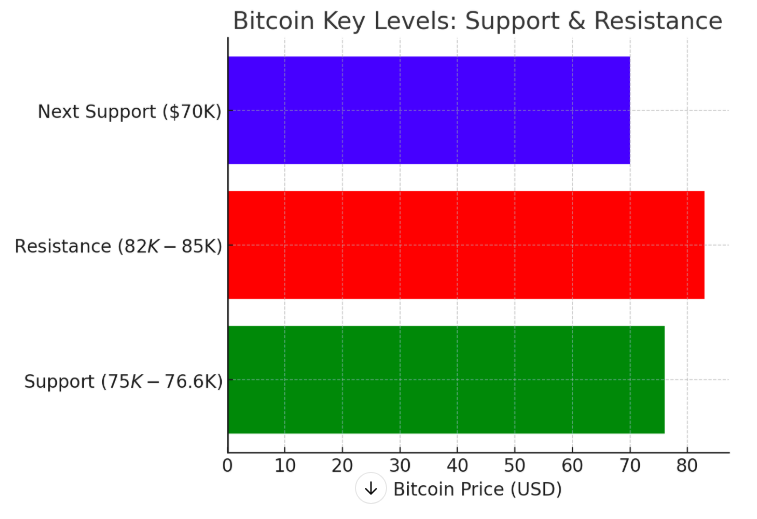

Technical Analysis: Key BTC Levels to Watch

| Indicator | Current Reading | Implication |

|---|---|---|

| Support Levels | $75,000 – $76,000 | Bulls need to hold this zone to prevent further declines. |

| Resistance Levels | $82,000 – $85,000 | A breakout above this level could trigger a rally. |

| Relative Strength Index (RSI) | 42 (Neutral-Bearish) | A move above 50 would signal recovery. |

| MACD | Bearish Crossover | Downward momentum unless reversed. |

If BTC goes below $75,000, it will test $70,000 as the next big support. But above $85,000 and it might just be back up.

Will Bitcoin Follow the 2017 Pattern?

If history repeats itself, BTC is in the middle of a correction before another big rally.

Bull Scenario: For BTC to break $120,000+

– Liquidity driven market expansion pushes BTC above resistance.

– Institutions buy as macro conditions stabilize.

– Bitcoin follows post-halving pattern to new highs.

Bear Scenario: BTC to $65,000–$70,000

– Economic instability causes short term panic.

– Global liquidity slows, impacts risk assets.

– Bitcoin visits lower support before resuming the up trend.With macro conditions favoring liquidity growth, many think Bitcoin’s long term trend is still up.

Final Thoughts: Is Bitcoin About to Rebound?

Short term volatility continues but historically Bitcoin is in a strong macro up trend. If the 2017 cycle is any guide, BTC could be setting up for another parabolic move; but buckle up before the next leg up.

As Barhydt said: “Once again… buckle up.”

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why is Bitcoin dropping in 2025?

Bitcoin has had a 30% correction from its $109,356 all time high due to profit taking, macro uncertainty and market cycles.

2. Does this mean Bitcoin is in a bear market?

No, historical data shows Bitcoin often drops deep before new highs, especially post-halving cycles.

3. What levels to watch?

– Support: $75,000, then $70,000.

– Resistance: $82,000–$85,000. Breakout could trigger a rally.

4. What does Bill Barhydt think?

He thinks liquidity will flow into assets like Bitcoin and we’ll see new highs after this correction.

Glossary

– Bitcoin Halving: An event that happens every 4 years, reduces BTC mining rewards, historically leads to bullish trends.

– Whale Accumulation: Large investors buying BTC, means long term confidence.

– Open Interest (OI): Total value of outstanding Bitcoin futures, shows trader positioning.

– RSI (Relative Strength Index): Momentum indicator to see if BTC is overbought or oversold.