Bitcoin’s recent price action has sparked renewed debate among market analysts, with some suggesting the cryptocurrency is replaying its 2021 script. One of the most compelling voices, crypto analyst Quantum Ascend, believes Bitcoin is poised for one final corrective wave before it catapults toward new all-time highs. This scenario, if accurate, could also ignite the long-awaited altcoin season.

Echoes of 2021: The “Pain Box” Theory

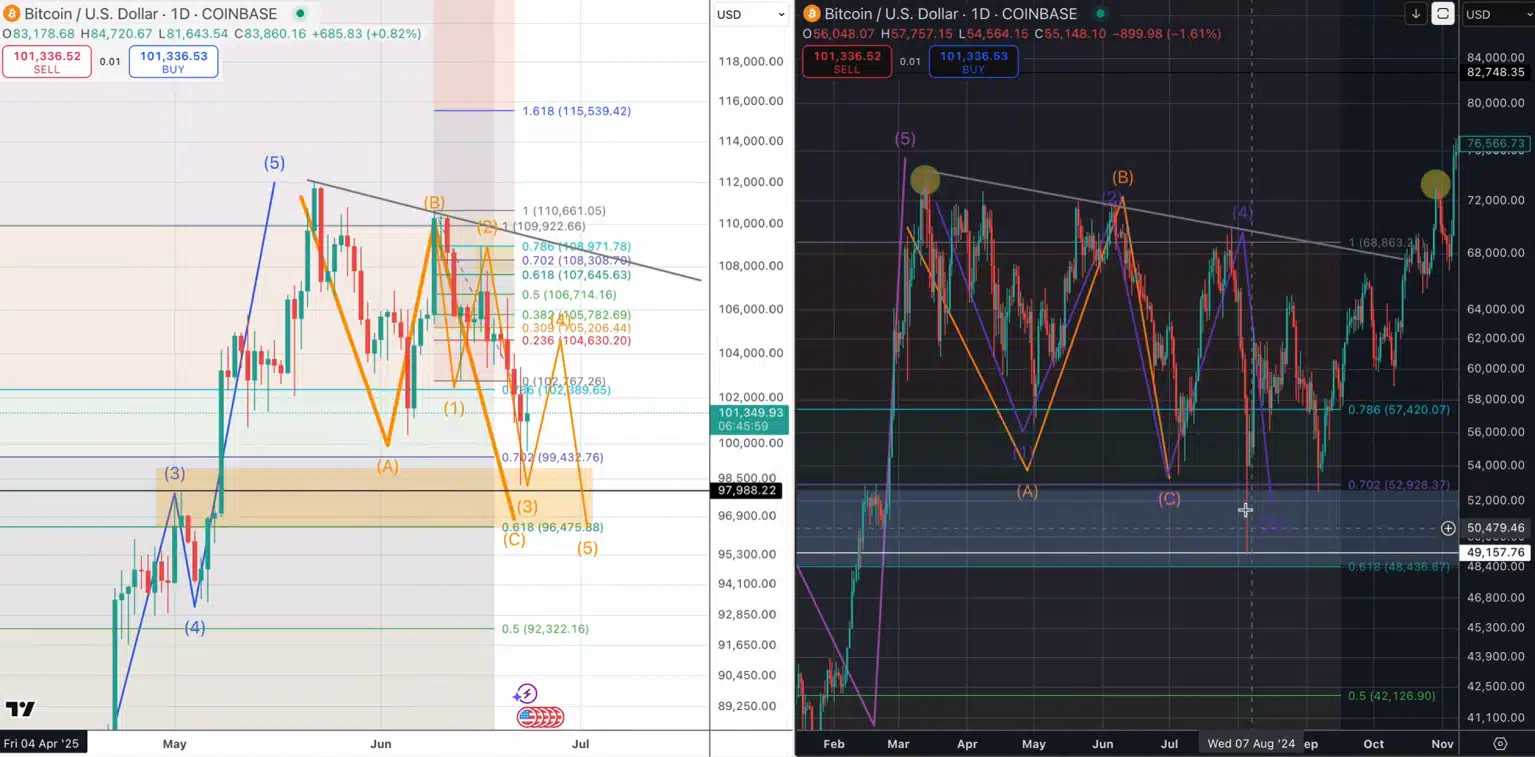

According to Quantum Ascend, Bitcoin is currently exhibiting a price structure eerily similar to the 2021 bull cycle. After peaking and undergoing a sharp correction, Bitcoin may be staging a short-lived rally that could push prices to the $107,000–$108,000 range. But this is where caution is warranted.

The analyst introduces a key concept dubbed the “Pain Box”—a predicted drop to the $92,000–$96,500 zone designed to flush out weak hands before the real breakout begins. This pullback would mimic 2021’s shakeout phase, serving as a final stress test for market participants.

Short-Term Altcoin Relief, but Don’t Be Fooled

While Bitcoin prepares for this last downward wave, altcoins could see a brief period of strength. Historically, temporary Bitcoin rallies have allowed altcoins to outperform in the short term. However, Quantum Ascend warns investors not to mistake this for the start of a sustained bull run. The upcoming correction could be painful for the broader market, especially for overleveraged positions.

$132K Target: A Launchpad for the Next Altcoin Season

Despite the short-term turbulence, Quantum Ascend remains bullish on the long-term trajectory. Once the anticipated correction is complete, the analyst sees Bitcoin surging to the $132,000 level—a target that aligns with key technical and psychological thresholds. More importantly, this price point could mark the beginning of a full-scale altcoin season, providing significant upside potential for diversified crypto portfolios.

Stay the Course: Strategic Accumulation Over Panic

In light of this forecast, the analyst recommends strategic accumulation rather than panic selling. For long-term investors, this correction may offer a rare opportunity to enter or increase exposure at discounted prices. As always, risk management remains essential—especially in a market as volatile and sentiment-driven as crypto.

Final Thought

Market cycles are never identical, but patterns often rhyme. Whether this is a repeat of 2021 or a new era with familiar characteristics, preparedness and level-headed strategy will separate successful investors from shaken speculators.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

References:

CoinDesk. “Bitcoin Technical Analysis: Is a Retest of Lower Levels Imminent?” www.coindesk.com

CoinTelegraph. “Altcoin Markets React as Bitcoin Rises Briefly.” www.cointelegraph.com

Bloomberg Crypto. “Bitcoin’s Volatile Path to $100,000.” www.bloomberg.com/crypto