According to latest reports, over the past 72 hours, a total of 801 BTC, worth around $82.98 million, was transferred from wallets that have been inactive since 2017. These Bitcoin movements have triggered discussions about the implications of these reactivated addresses, especially when considering Bitcoin’s current market value.

Speculation Surrounding the Bitcoin Movements

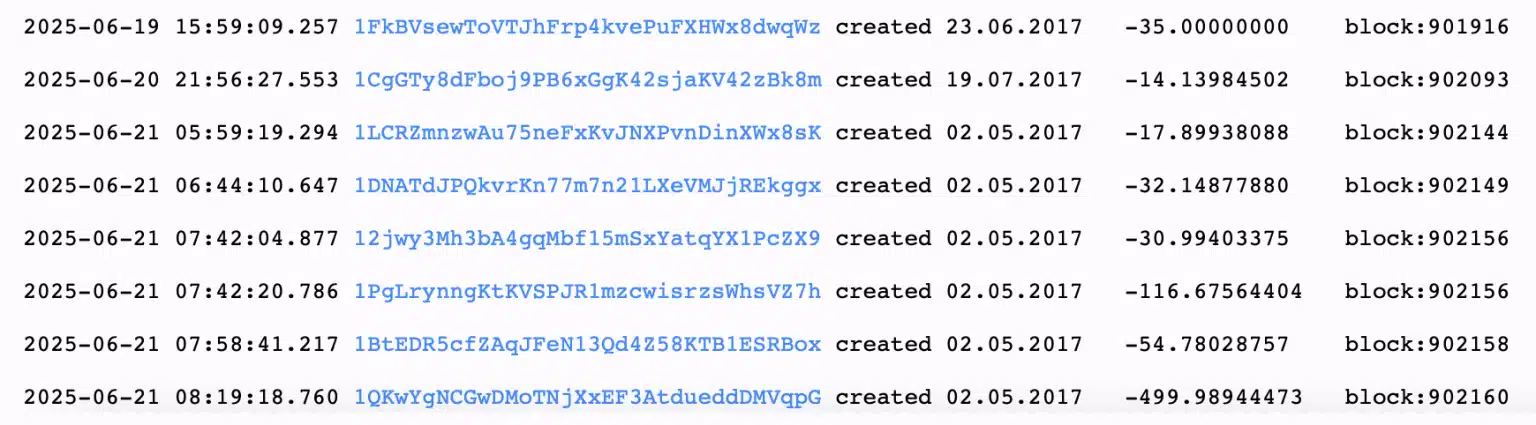

These Bitcoin movements began on June 19, 2025, after dormant wallets, which had remained untouched for nearly eight years, sprang to life. The first transaction saw approximately 35 BTC moved from a wallet created on June 23, 2017. This wallet had been inactive since its creation, but with Bitcoin’s price stability hovering just above $10o,000, these early Bitcoin holders decided it was the right time to move their funds.

What followed was a series of Bitcoin movements across different wallets, with transfers continuing through June 20 and 21. On June 21, 2025, six legacy wallets, which were all created on May 2, 2017, moved 752.45 BTC in total. The largest transaction involved a wallet containing 499.98 BTC. The synchronized nature of these Bitcoin movements points to deliberate actions by long-term holders of Bitcoin.

As with any large-scale Bitcoin movements, the crypto community has been abuzz with speculation regarding the motivations behind these transfers. One theory suggests that these early Bitcoin adopters might be capitalizing on favorable market conditions. With Bitcoin’s price remaining relatively stable for now, these long-term holders may be opting to liquidate or reposition their investments.

Another theory points to these holders, often called “Hodlers,” have long been seen as patient investors, holding onto their assets through market volatility. The sudden activity of these dormant wallets could indicate that these early investors are finally ready to diversify their portfolios or take profits. The increased movement of funds from older wallets spells that these holders remain influential in the market and still play a role in shaping Bitcoin’s liquidity.

The Impact of Bitcoin Movements on the Market

Bitcoin’s price is largely influenced by supply and demand dynamics. The recent Bitcoin movements, which involved large amounts of Bitcoin being transferred from dormant wallets, have raised concerns about the potential impact on the market. Large transactions can significantly affect the liquidity of the market, especially when these funds are moved to exchanges for selling or re-investment.

When such significant Bitcoin movements occur, traders often worry about the risk of downward price pressure. However, since the wallets in question have been dormant for years, their market impact is likely to be more about the sudden availability of these Bitcoin assets rather than an immediate effect on the price.

While some analysts view these Bitcoin movements as a bearish indicator, others see it as a sign of confidence from early Bitcoin investors, demonstrating their willingness to engage with the current market environment.

An interesting aspect of these dormant Bitcoin movements is the shift of funds into Bech32 wallets, which offer greater security and efficiency. Bech32 addresses are a modern form of Bitcoin wallet address that have gained popularity due to their more secure nature and lower transaction fees.

The fact that these dormant Bitcoin holders are moving their funds to Bech32 wallets suggests a growing trend toward adopting more advanced, secure forms of Bitcoin storage.

Bitcoin Movements and Institutional Influence

The reawakening of dormant Bitcoin wallets is also indicative of the growing influence that institutional investors are having in the Bitcoin market. While these wallets were once controlled by early Bitcoin adopters and retail investors, the recent movements could be signaling a shift in ownership patterns.

Bitcoin’s increasing institutional adoption means that more sophisticated investors are now participating in the market. As institutional players continue to enter the Bitcoin space, their presence could further influence the frequency and size of Bitcoin movements. Institutional investors typically move larger amounts of capital, which could lead to higher volatility and more price fluctuations.

The influence of these institutional investors is not to be underestimated. They have the ability to shape the liquidity and pricing of Bitcoin, and as these dormant Bitcoin wallets continue to move funds, the presence of institutional investors will likely become more pronounced.

Conclusion: Bitcoin Movements as a Sign of Maturing Market

The movements of dormant Bitcoin wallets are an exciting development in the world of cryptocurrency. These Bitcoin movements demonstrate that even long-term holders continue to influence the market, and their actions will likely have lasting implications for Bitcoin’s liquidity and market dynamics.

While these movements may cause short-term volatility, they also signal growing confidence in Bitcoin as a long-term investment. As Bitcoin’s market matures, these movements will play an increasingly important role in shaping the future of the cryptocurrency.

FAQs

Why are dormant Bitcoin wallets being reactivated now?

Dormant Bitcoin wallets may be reactivated due to favorable market conditions, strategic decisions, or long-term holders looking to capitalize on Bitcoin’s price surge.

How do these movements affect the Bitcoin market?

The movement of large amounts of Bitcoin from dormant wallets could impact market sentiment, causing volatility, but could also lead to a supply-demand imbalance, pushing prices higher.

What is the significance of Bech32 wallets?

Bech32 wallets are more secure and efficient than older wallet formats, making them a popular choice for modern Bitcoin transactions.

What could these movements mean for Bitcoin’s future?

These movements suggest a strong long-term outlook for Bitcoin, with ongoing participation from early holders influencing the market dynamics.

Glossary

Bech32 Wallet: A Bitcoin wallet address format that provides enhanced security and efficiency for transactions.

Hodlers: Refers to individuals who hold onto their Bitcoin for the long term, regardless of market fluctuations.

Supply-Demand Imbalance: A situation where the supply of an asset does not meet demand, which can cause price fluctuations.

Market Liquidity: The ability to buy or sell an asset without causing significant price changes.