Recently, Bitcoin has been on the rise owing to the stimulus measures by the People’s Bank of China (PBOC), and analysts are bullish on its price. The cryptocurrency forecast indicates a possible breakout towards $78,000 in the next few weeks, aided by positive technical indicators and China’s recent economic recovery drive.

On September 24, the PBOC outlined policies to provide about $140 billion to the financial system through a 50-basis-point cut in the recently constituted reserve requirement ratio.

Expert Insights on Bitcoin’s Future

This is part of a larger plan to cut down the cost of borrowing and relax the measures instituted regarding property purchases, which is intended to help the country recover from its real estate industry and economic recession.

In his analysis, Real Vision Chief Crypto termed this development positive for BTC. He pointed out that China’s economic measures may trigger some nations to execute similar actions, affecting Bitcoin’s growth.

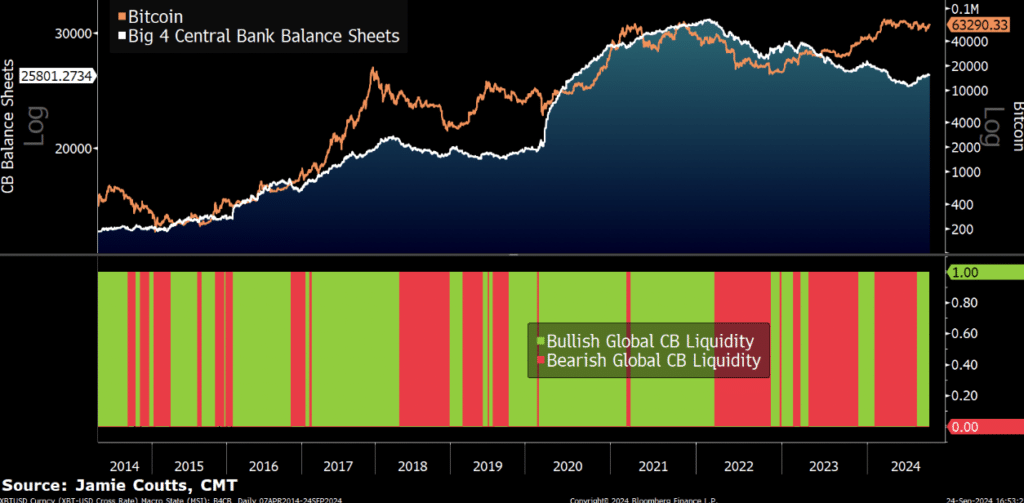

Regarding monetary policy announcements or pronouncing further quantitative easing measures, the reaction has always been positive regarding risk assets, including BTC. For instance, when the PBOC injected liquidity into the economy via reverse repos to the tune of $367.7B in October 2023 and followed it up with a further $140B infusion via the RRR cut in January 2024, the price of Bitcoin climbed by more than a hundred percent.

While China continues its attempts to manage the economy, BTC’s value is also expected to increase further. The burst and cleanse of the sponge let strong lava liquid undermine domes of erecting unconventional.

Analyzing Bitcoin’s Recent Performance

In a report analyzed recently, some experts highlighted that after the prohibition of Bitcoin mining in China circa 2021, it is clear that there is no more direct causation channel from Chinese liquidity to Bitcoin demand.

However, when asked regarding China, Coutts pointed out that Bitcoin’s price continues to be mainly determined by worldwide liquidity conditions. Therefore, interest rate cuts in China may determine the direction in which the investors risk.

Lastly, on the speculative side, Bitcoin is getting support from a growing appreciation of global bull flags on Bitcoins in longer periods. This means such formation predominantly occurs when prices, after a sharp ride up, especially break highs, move into a contracting trend like the downsloping one. The typical upward breakout after the downward movements leads to as much level rise as was the length of previous uptrend levels.

On September 24th, BTC fell short by a few dollars of breaking the flag’s upper trend line and rating for over $78,000 historically high price. On the other hand, if the asset’s price recoils against the upper trend line, it may find support around the lower trend line near the 0.0 fib level of $5. According to market analysts, BTC must surpass $80,000 to record another all-time high price when inflation is factored in.

Bitcoin Price Surge and Key Levels

Last week, Bitcoin experienced a significant rally, rising by 7.5% and having a basis between $62,000 and $64,700. As Tuesday closed, the cryptocurrency’s price stood at $63,800.

If BTC breaks above the upper boundary of this range of $64,700, analysts predict that the price will at least attempt a quick rise to $65,379. It is expected to achieve another remarkable milestone of $75,000 by the end of the close on October 25. It will put $70,079 close to its July 29 peak in a bullish rally of approximately 7%.

On the daily timeframe, in the structure of daily charts, the Relative Strength Index (RSI) is currently at a level of more than 50 (63) which remains relatively neutral and thus attempts to rise. Typically, a movement above 60 reflects more views in a bullish phase. All traders should be careful because Rsis near 70 indicates overbought.

However, if expanding more than $62,000 and staying under the $62,000 global range is violated and taken below it, there can be a drop of approximately 7 % back to its September 17 ready level of $57610.

Conclusion

All in all, Bitcoin’s evolution also favours China’s measures of boost in spending, which means that an important breakout could well occur in the upcoming weeks. With market analysts watching increased key price levels and bullish patterns, the cryptocurrency seems ready to take advantage of the overall change in the liquidity regime.

Stay updated with TheBit Journal by following us on Twitter and LinkedIn and joining our Telegram channel.