The “Bitcoin Power Law,” a prominent analytical model, has predicted a significant surge in BTC prices, with potential gains of up to 300% by late 2025. This forecast comes amidst a period of subdued price momentum, which analysts believe will last for at least another three months. However, the long-term outlook remains highly promising for Bitcoin bulls.

The Bitcoin Power Law, a model revered by crypto analysts, is showing a remarkable future for Bitcoin. According to a recent analysis, Bitcoin (BTC) is poised for a substantial price increase, potentially reaching gains of up to 300% by late 2025. This model, which has been reliable in past market cycles, suggests that despite the current lull in BTC price momentum, significant growth is on the horizon.

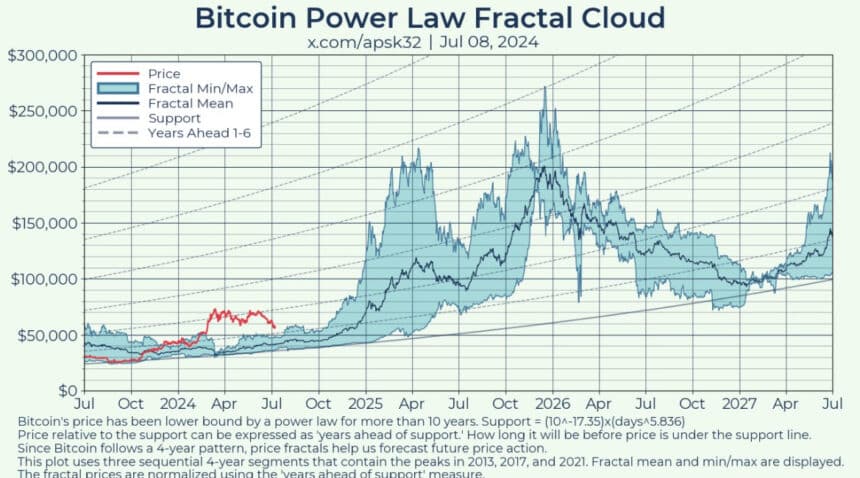

These conclusions can be seen on an X post made by pseudonymous engineer Apsk32. On July 9, Apsk32 consulted his power law metric to determine the potential future performance of Bitcoin.

The Bitcoin power law essentially establishes a lower support band for BTC prices, which has remained intact since BTC/USD was valued at only $1. Additional bands, or “time contours,” offer further price insights, ultimately projecting a $1 million price target for 2036.

“Time contours tell us how long it will be before the support forces current prices upward. For 12 years, every bear market has returned to this support line,” part of a previous X post from June explains.

“The support passes one million dollars in 2036, and bitcoin isn’t stopping there.”

Relaying past price movements onto the current four-year cycle, as defined by Apsk32, helps explain the current market behaviour, including the ongoing 25% decline from March’s all-time high of $73,800.

“If bitcoin’s cycle pattern continues, price should remain inside or near this blue cloud,” the latest post summarized.

“The ETFs pushed us out of the cloud and now we’re reverting back. We’re 3+ months away from upward acceleration, and we could see prices go up 4x by the end of 2025.

Currently, Bitcoin is experiencing a phase of price consolidation, with momentum not expected to return for at least three months. Nevertheless, the underlying fundamentals and broader market dynamics indicate a bullish future. Credible sources have highlighted the Bitcoin Power Law as a critical tool for understanding these long-term price movements.

Bitcoin Power Law: The Role of Bitcoin and Ethereum in the Market

Bitcoin (BTC) and Ethereum (ETH) continue to dominate the cryptocurrency market, each playing a crucial role in the broader adoption of digital assets. As the pioneer cryptocurrency, Bitcoin’s price movements are closely watched by investors and traders alike. Ethereum, with its smart contract functionality, complements Bitcoin by enabling a wide range of decentralized applications.

The Bitcoin Power Law model takes into account various factors, including historical price trends and market cycles. According to this model, the current phase of subdued price activity is a natural part of Bitcoin’s cyclical behaviour. Analysts suggest that this period of consolidation is an opportunity for long-term investors to accumulate BTC at relatively lower prices.

Bitcoin Power Law: Implications for Crypto Investors

For investors, the Bitcoin Power Law’s forecast offers a compelling reason to remain optimistic about Bitcoin’s future. While short-term price movements may be unpredictable, the long-term trajectory, as indicated by this model, suggests substantial growth. This outlook is particularly encouraging for those who have adopted a buy-and-hold strategy, often called “HODLing” within the crypto community.

Furthermore, the anticipated gains underscore the importance of staying informed about market trends and analytical models like the Bitcoin Power Law. Investors who understand these dynamics are better positioned to make informed decisions and maximize their returns.

Staying informed is crucial in cryptocurrencies. Analytical models like the Bitcoin Power Law offer valuable insights into market trends and future price movements. By leveraging these tools, investors can make more informed decisions and improve their chances of success.

In conclusion, the Bitcoin Power Law’s prediction underscores the potential for substantial growth in BTC prices over the coming years. This forecast provides investors a clear roadmap for navigating the market and maximizing returns. By staying informed and leveraging analytical tools, investors can make more informed decisions and capitalize on the opportunities presented by the dynamic world of cryptocurrencies.

For the latest crypto updates and news about Bitcoin’s price movement, visit The BIT Journal.