Bitcoin’s recent rally towards new highs has caught the attention of both bulls and bears. While the cryptocurrency surged to a weekly high of $69,000, some analysts are warning of a potential price drop. According to crypto analyst Justin Bennett, Bitcoin could pull back to $63,000, despite its recent performance. His analysis comes as the crypto market shows signs of heightened volatility.

Bennett’s warning is based on several technical indicators, including a rising wedge pattern and bearish divergence, which suggest a retracement might be on the horizon. He shared on X that the leverage in the market could lead to liquidations, causing Bitcoin to revisit lower price levels. Specifically, his chart points to a drop towards $63,276, which could spell trouble for short-term traders.

What Could Trigger the Bitcoin Price Drop?

The anticipated pullback is primarily driven by the futures market, where a rally in perpetual futures contracts has raised concerns about sustainability. Bennett highlights that the open interest (OI) is approaching levels last seen in late July, a time when Bitcoin experienced a significant correction. This rise in OI is a potential red flag for further price reductions, particularly for investors operating with heavy leverage.

Another crypto analyst, CrediBULL Crypto, echoes these concerns. He points out that the current increase in OI could signal an imminent price correction, similar to what happened when Bitcoin dropped from $70,000 to $49,000 earlier this year. According to CrediBULL, the derivatives market is a key driver behind the recent rally, but it may not sustain the current price levels for much longer, potentially leading to a drop as low as $50,000.

Bull Market on the Horizon? Not All Analysts Agree

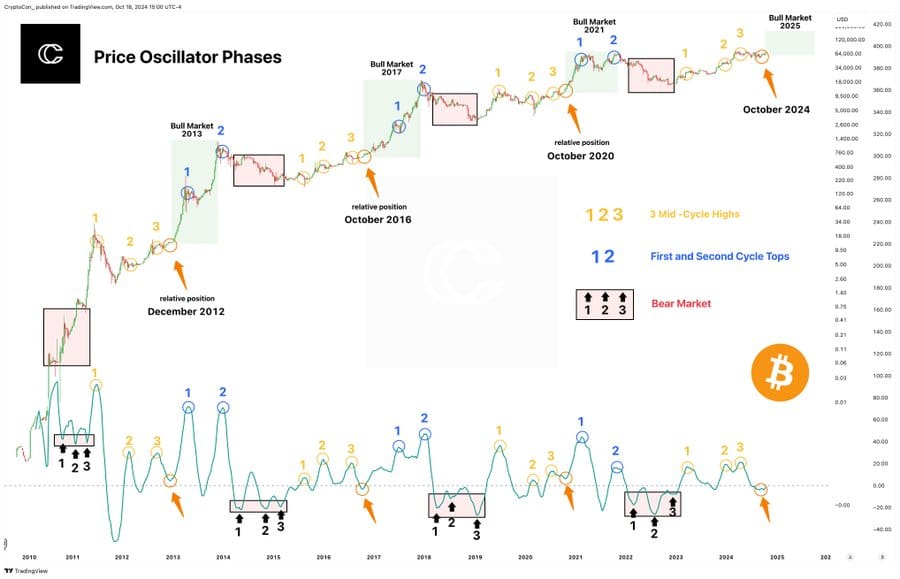

While short-term predictions lean bearish, other experts believe that Bitcoin is on the cusp of a new bull market. For instance, CryptoCon, a respected figure in the space, believes Bitcoin will not fall below $40,000 and could see significant gains in the near future. He cites the Price Oscillator, a technical indicator, which confirms that Bitcoin has completed its local peaks in the current cycle and is ready for a significant upward trend. According to CryptoCon, the next leg could see Bitcoin rallying to as high as $120,000.

Matt Hougan, CIO of Bitwise, and Jamie Coutts, a leading crypto analyst at Real Vision, also share an optimistic outlook. Hougan believes that factors such as the upcoming U.S. elections, Spot Bitcoin ETFs, and increased institutional demand could push Bitcoin to new all-time highs. Coutts forecasts that Bitcoin could reach $110,000 by 2025, driven by global money supply growth and other macroeconomic factors.

Long-Term Outlook: Could Bitcoin Hit Six Figures?

Despite short-term volatility, the long-term outlook for Bitcoin remains bullish according to several prominent analysts. With a growing institutional interest and potential regulatory clarity, many believe that Bitcoin is poised for a substantial price increase in the coming years. The possibility of reaching six figures is no longer a distant dream but a realistic target, given the right market conditions.

The crypto market remains unpredictable, but for now, investors will need to navigate both bullish optimism and bearish caution as the next move for Bitcoin unfolds.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!