Bitcoin dropped 2% over the weekend and is now below $68,000 as Trump’s U.S. election chances wane drawing fresh concerns. Bitcoin price was up big last week and briefly hit an all time high. The political dynamics and election probabilities are affecting the broader crypto market and there’s a lot of liquidation and volatility to come.

Bitcoin’s Reaction to U.S. Election Uncertainty

After hitting $73,000 last Tuesday, Bitcoin has lost some steam and is now below $68,000 as new polls are casting doubt on Trump’s re-election chances. A poll from respected pollster Ann Selzer has Trump losing Iowa, a traditionally Republican stronghold, to Kamala Harris. With Harris leading Trump 47% to 44% in this poll, people are speculating about surprises in other swing states.

This shift is weighing on crypto markets thus affecting Bitcoin price, especially since Trump is a self declared crypto advocate and many in the crypto space think he would be good for Bitcoin’s growth in the U.S. So, the recent political shifts are having a bigger impact on Bitcoin price.

Prediction Markets and Trump’s Declining Odds

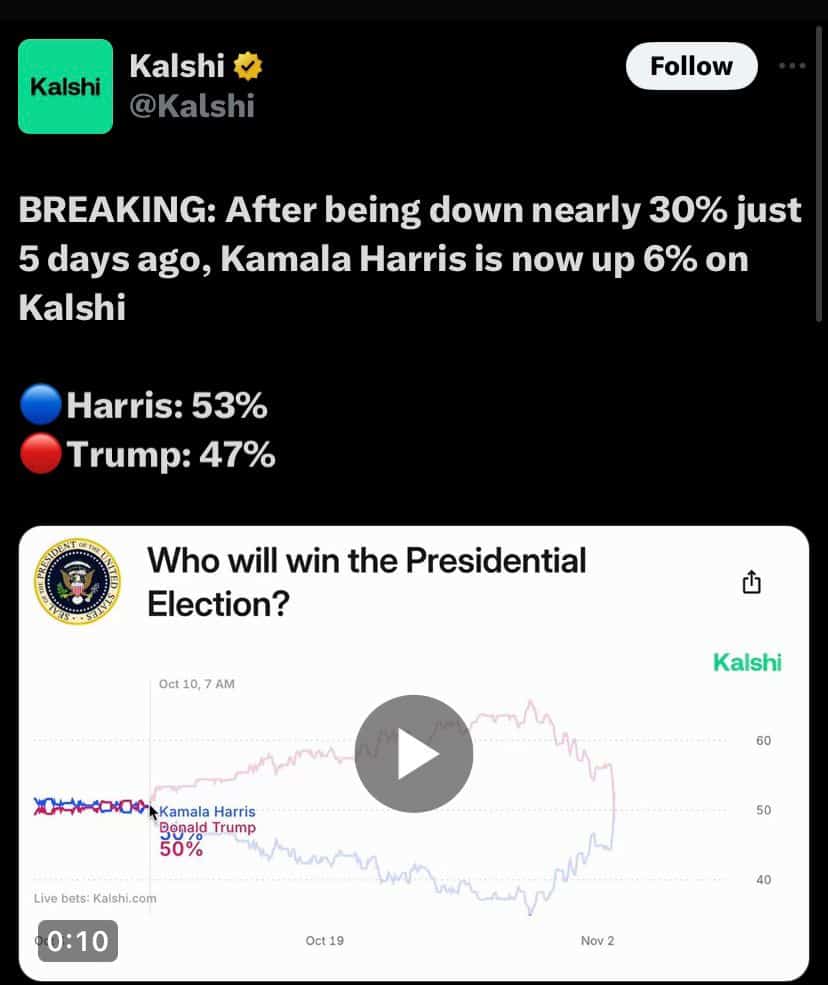

Political prediction platforms are reflecting this too, reporting that Trump’s odds have gone down. On Polymarket, a popular blockchain based prediction market, Trump’s lead has gone from 67% last Wednesday to 54% Sunday. Polymarket has seen over $3 billion in trading volume on election related bets, which is a big number showing how interested the crypto community is in this year’s tight race.

Kalshi, a CFTC regulated prediction market that just added crypto support via USDC, is reporting similar shifts. Trump’s odds on Kalshi have gone down, the race is now a near tie with 51% for Trump and 49% for Harris. This is different from some national polls where Harris is up 51% to 47% according to the ABC News/Ipsos poll from October 22. This shows how unpredictable the election is, keeping Bitcoin traders on their toes.

Crypto Market Repercussions and Liquidations

As the election uncertainty increased, crypto markets saw a big liquidation of over $315M in 24 hours. According to analytical sources, long positions were the majority of the liquidations with $250M being lost as Bitcoin price dropped. Bitcoin positions alone lost $76M, showing how volatile the market is as traders are responding to political events that affect the asset’s value.

Bitcoin’s recent high at $73,000 and the subsequent liquidation wave shows how sensitive the asset is to external factors, especially geopolitical. The crypto market has a lot of leverage positions which makes it even more sensitive. Unexpected price movements can trigger big liquidations. Some traders are reevaluating their strategy as they expect more volatility in the coming days as U.S. election results come in.

Broader Crypto Market

As Bitcoin’s price settles, the crypto market is still subject to the ongoing US political landscape. Investors and analysts are watching the elections closely with many saying a Trump win could be good for Bitcoin’s regulation.

Some experts say pro-crypto leaning under a Trump administration could mean good times ahead and institutional interest and adoption.

With the election on November 5th, the crypto market will be volatile. The narrowing of the prediction markets and the poll discrepancies add more uncertainty that will keep Bitcoin and other coins on a rollercoaster. Market participants will be watching the polls and prediction platforms to adjust their strategy based on the emerging trends.

Looking Ahead

Bitcoin’s price drop due to Trump’s decreasing odds has caused a lot of liquidations across the crypto market. As the election day approaches Bitcoin’s sensitivity to events is showing how much it’s tied to global events and investor sentiment. Traders are expected to be careful.

TheBITJournal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.