According to the sources, the Bitcoin price has dropped after the news of Israeli airstrikes on Iran. This brought back fear of global conflict and has shaken the financial markets.

Due to this sudden tension in the Middle East, investors had moved their money into safer assets, which caused a big sell-off in risky investments like cryptocurrencies.

Earlier, Bitcoin’s price was showing signs of recovery, but now it is facing strong pressure as uncertainty spreads across the market.

Not only did Bitcoin decline, but several major altcoins, including Ethereum and Solana, faced a drop. Analysts warn that price swings may continue as the Middle East conflict grows.

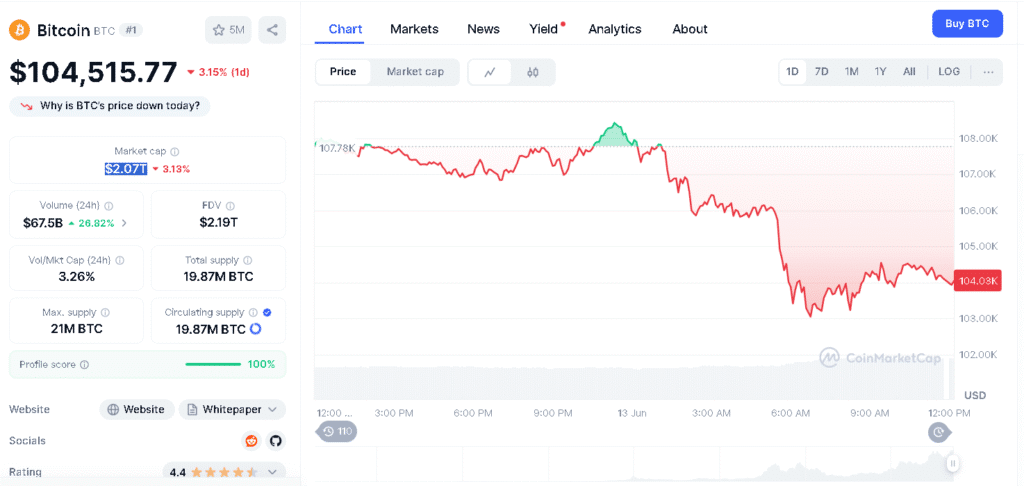

Bitcoin Slips Below $104K Amid Middle East Escalation

The Bitcoin price has recently dropped below the $104,000 level after reports surfaced that Israeli forces had carried out a military strike on Iranian targets in Tehran.

The news was first shared by Axios, and later it was confirmed by Al-Jazeera, which reported hearing explosions in the Iranian capital.

Crypto markets reacted quickly. The Bitcoin price has dropped by 4% in less than 24 hours, which shows how easily digital assets are affected by global tensions.

This sharp decline points out Bitcoin’s dual nature, that is, it can act as a risky investment or can be a safe haven, depending on the situation in the market.

Political Support Fails to Lift Bitcoin

During the ongoing market chaos, former U.S. President Donald Trump showed his support for crypto in a video message at Coinbase’s State of Crypto summit.

He also talked about the GENIUS Act, which is a new law that supports stablecoins that are backed by the U.S. dollar and aims to create a clear national plan for Bitcoin.

Still, even with Trump’s favourable remarks, the Bitcoin price kept falling. This shows that political support alone is not enough to calm the broader market fears during the uncertain times.

| Metrics | Value | Source |

| Current Price | $104,301.05 | CoinMarketCap |

| 24h Low | $102,822.03 | CoinMarketCap |

| 24h High | $108,439.78 | CoinMarketCap |

| 24 Trading Volume | $67.49B | CoinMarketCap |

| Market Cap | $2.07T | CoinMarketCap |

| Liquidations | $427 Million | CryptoNews |

Market Reactions Reflect Investor Anxiety

The big drop in the Bitcoin price caused $427 million worth of long positions to be wiped out in just one day. The traditional markets also showed signs of worry along with the fall in the Bitcoin price.

The U.S. stock futures dropped by around 1.5%, and the European markets saw similar losses. On the other hand, safer assets saw gains like gold rise by 0.75% to trade around $3,438, and crude oil jumped by 9% to $74 per barrel.

Experts think that rising tensions between countries will keep affecting the investors’ behaviour. Michael Tan, a senior market analyst, said that this is a typical reaction to the risk. Bitcoin drops when there is conflict, at least at first. It might recover later, but right now, traders are nervous.

Can Bitcoin Rebound or Will Global Crisis Push It Lower?

While the Bitcoin price is currently trading around $104,463.15, analysts advise being careful. With global tension rising, technical indicators suggest the possibility of more losses if the situation worsens.

However, some experts believe that Bitcoin is decentralized and has a limited supply; it could become a popular choice during the global crisis.

Crypto expert Leena Khoury said that Bitcoin usually acts like digital gold when there’s long-term trouble. But that does not happen immediately; it takes time. At the moment, people are reacting emotionally to the news.

Traders are advised to be careful with the price swings and should use strategies that manage risk. Market predictions are just speculations and can change quickly as the events continue to unfold.

Conclusion

Even though Donald Trump strongly supported crypto, and new laws are being discussed, the price of Bitcoin is still under pressure because of rising global tensions.

The recent Israel-Iran conflict has caused a big market reaction, with $427 million in crypto losses. This shows how easily Bitcoin is affected by world events.

Some experts think that prices might fall more, while others believe that Bitcoin’s limited supply and independence could help it in the long run. But for now, traders should remain careful and manage their risks.

FAQs

1. How did Bitcoin’s price fall below $104K?

Due to Israeli airstrikes on Iran, triggering market panic.

2. How much has Bitcoin price dropped in 24 hours?

By approximately 4%.

3. What safe assets saw gains during the conflict?

Gold and crude oil rose.

4. How did U.S. stock futures react?

They dropped by around 1.5%.

5. What did Trump say at the Coinbase summit?

He called himself the “crypto president.”

Glossary

Stock Futures- Contracts predicting the direction of stock markets, often reacting early to global news.

Coinbase State of Crypto Summit – Coinbase’s annual event showcasing major crypto developments and industry momentum.

Market Selloff- A rapid and broad-scale selling of assets due to fear or risk events.

Safe-Haven Assets- Investments like gold and oil that typically gain during market uncertainty.

Long Position- A trade where investors bet the asset price will rise; losses occur if the price falls.