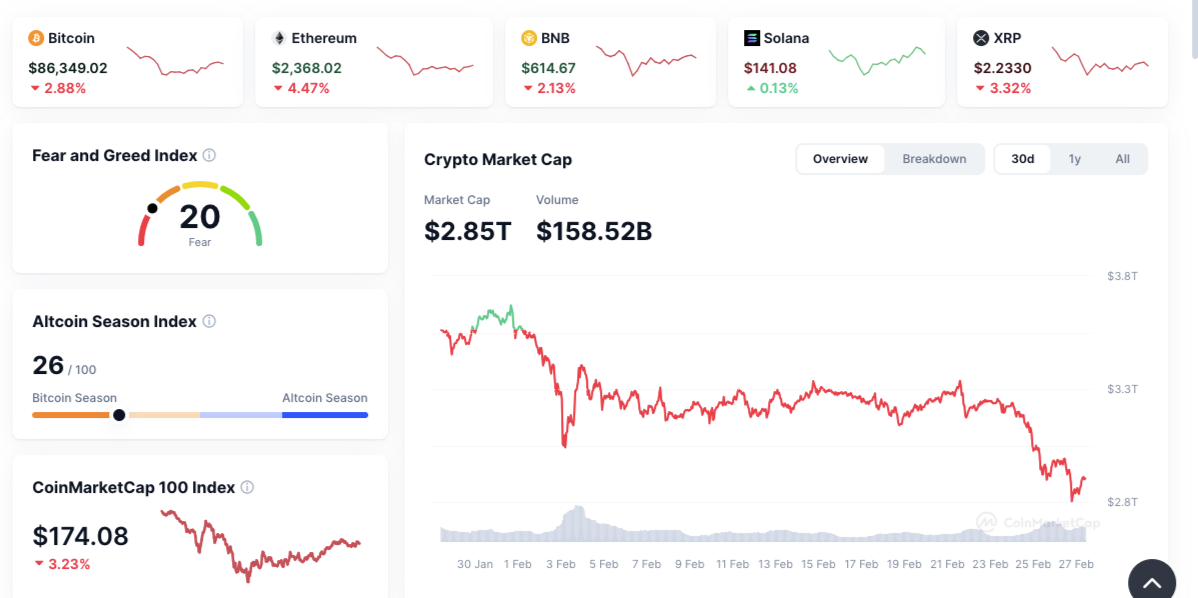

In the midst of Trump’s tariff announcement, Bitcoin price dropped below $84,000, down 5% in 24 hours, after U.S. President Donald Trump said he’s going to put a 25% tariff on the European Union. The sell off hit traditional markets too, as S&P 500 is at session low. The broader digital asset index are seeing widespread selling from investors. Many think Trump’s aggressive trade policy will make things worse and more volatility will follow.

Trump Announces 25% EU Tariff Plans Amid Global Uncertainty

Trump announced the tariff during his first cabinet meeting on Wednesday, according to a report from Financial Times. He said:

“We have made a decision, and we’ll be announcing it very soon. It’ll be 25.”

This trade war escalation is freaking out investors, who are worried about the ripple effects on global trade, inflation and risk assets like Bitcoin and stocks. The uncertainty around a second Trump presidency is just adding to the market anxiety.

Bitcoin’s Price Reaction—Is This a Short Term Dip or Trend Reversal?

While Bitcoin was showing signs of bottoming out after the recent dip, Trump’s tariff announcement has brought more selling pressure. This means macro events, not crypto specific are driving the price.

Bitcoin’s Performance Over the Last 24 Hours

| Time Period | Bitcoin Price (USD) | % Change |

|---|---|---|

| 24 Hours Ago | $88,500 | — |

| 12 Hours Ago | $84,200 | -5.2% |

| 6 Hours Ago | $85,100 | -3.8% |

| At press time | $86,221 (short resistance) | -2.96% |

Key Market Factors Behind Bitcoin Price Drop

- Tariff Concerns: Tariffs create economic uncertainty and effect investor sentiment across traditional and digital markets.

- Risk-Off Sentiment: Equities and risk assets like Bitcoin tend to fall when investors move to safer assets like the U.S. dollar or gold.

- Market Corrections: After Bitcoin’s rally to $88,000, traders might have been looking to take profits.

How Tariffs Affect Bitcoin and the Crypto Market

Historically, tariffs and trade wars have impacted risk assets, including Bitcoin, in several ways:

| Factor | Impact on Bitcoin |

|---|---|

| Economic Uncertainty | Investors become cautious, leading to risk-off sentiment. |

| Stock Market Correlation | When stocks drop, Bitcoin price often follows due to institutional trading patterns. |

| U.S. Dollar Strength | If tariffs strengthen the USD, Bitcoin (often seen as a hedge) may weaken. |

| Inflationary Pressures | Long-term, tariffs can increase inflation, potentially driving Bitcoin demand. |

Trump’s tariffs in 2018 and 2019 caused short term volatility across all markets. But Bitcoin bounced back strongly afterwards, so while this sell off is notable, it may not be a trend.

Expert Reactions—What They’re Saying

Economists Warn of Trade War Fallout

Macroeconomic analysts say tariffs will disrupt global trade flows and lead to higher inflation and slower growth. Michael Gapen, chief U.S. economist at Bank of America, said:

“Trade restrictions at this scale introduce a lot of uncertainty into the markets, which leads to risk-off behavior.”

That uncertainty is reflected in the markets, as investors flee high-risk assets like Bitcoin for safer ones.

Crypto Bulls See Opportunity

While short-term looks bad, some crypto analysts are still optimistic. Matthew Sigel, head of digital assets research at VanEck, sees this as a buying opportunity:

“Geopolitical tensions and economic uncertainty have historically strengthened Bitcoin’s long-term narrative.”

Sigel thinks if things get even worse economically, Bitcoin could regain its appeal as a hedge against traditional financial risk.

What’s Next for Bitcoin? Key Levels to Watch

Short-Term Chart

Bitcoin price is approaching $83,000 support. If that fails, next level is $80,000. But if buyers show up, a bounce to $86,000-$88,000 could be possible.

| Key Level | Significance |

|---|---|

| $88,000 | Recent local high—strong resistance |

| $86,000 | Short-term recovery target |

| $83,000 | Current support—could hold if buyers return |

| $80,000 | Major support—potential bounce zone |

U.S. economic data and Fed decisions will also be important to watch.

Conclusion

Bitcoin price fell 5% after Trump’s 25% EU tariff announcement, as investors get cautious. While the broader crypto and stock markets are selling, analysts are split on whether this is a short-term dip or a bigger problem.

– Uncertainty and risk-off is hurting Bitcoin.

– Some see long-term buying opportunities.

– Key levels to watch for Bitcoin price: $83,000 and $88,000.

With markets getting volatile, investors should wait for policy news and macro data before making big decisions.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why did Bitcoin go down after Trump’s tariff announcement?

Bitcoin dropped below $84,000 because higher tariffs could harm global markets and investor caution and risk-off sentiment.

2. How do tariffs affect Bitcoin?

Tariffs cause economic uncertainty, stock market declines and U.S. dollar fluctuations which can impact Bitcoin prices.

3. Can Bitcoin recover from this?

Analysts say if Bitcoin holds $83,000 it could bounce to $86,000-$88,000. But more downside possible.

4. Does Bitcoin like economic instability?

Over the long-term Bitcoin is a financial hedge, meaning it could increase in value if things get worse economically.

5. What are the key levels to watch for Bitcoin at the moment?

Support: $83,000 and $80,000; Resistance: $86,000 and $88,000

Glossary

Tariff: A tax on imported goods, can affect trade and economy.

Risk-Off: A market trend where investors flee from volatile assets to safer investments.

Support Level: A price where buying interest may stop the decline.

Resistance Level: A price where selling may cap the uptrend.

Exchange-Traded Fund (ETF): A financial product that tracks an asset, like Bitcoin, and is traded on stock exchanges.

References

Legal Disclaimer

This is informational article only and not financial advice. Cryptocurrency investments are high risk. Always do your own research before making any investment decisions.