Bitcoin price has seen a notable decline recently, dropping by 4.41% in the past 24 hours. This dip comes in the wake of a significant event: the US authorities have moved over $2 billion worth of Bitcoin. The Bitcoin price has slid to around $66,639, down from a high of $69,769 just a day ago. This sharp drop has caught the attention of traders and market analysts alike, sparking concerns about potential market instability.

Volume Surge Amidst Uncertainty

Despite the Bitcoin price decline, trading volume for the token has surged dramatically. According to CoinMarketCap (CMC) data, there has been an 82.86% increase in daily trading volume. This rise in volume highlights the heightened activity in the market, as traders react to the recent Bitcoin price movements. The large-scale transfer of Bitcoin by US authorities has undoubtedly influenced this surge, as market participants attempt to navigate the shifting landscape.

Impact of US Authorities’ Transfer

The recent Bitcoin price dip is closely tied to the US authorities’ actions. The $2 billion worth of Bitcoin transferred was seized from the Silk Road, a notorious dark web marketplace. This transfer involved splitting the Bitcoin into two addresses, with a significant portion of 10,000 BTC believed to be deposited into institutional custody. Such large transactions often trigger FUD (Fear, Uncertainty, Doubt) in the market, as traders worry about a potential sell-off.

The fear surrounding these large movements is compounded by the fact that the US government now controls a substantial amount of Bitcoin, approximately $12.65 billion. This situation has led to concerns about potential increased selling pressure, which could further depress the Bitcoin price. However, it’s essential to remember that while these fears might drive short-term volatility, they also present opportunities for strategic investors.

Technical Analysis and Future Outlook

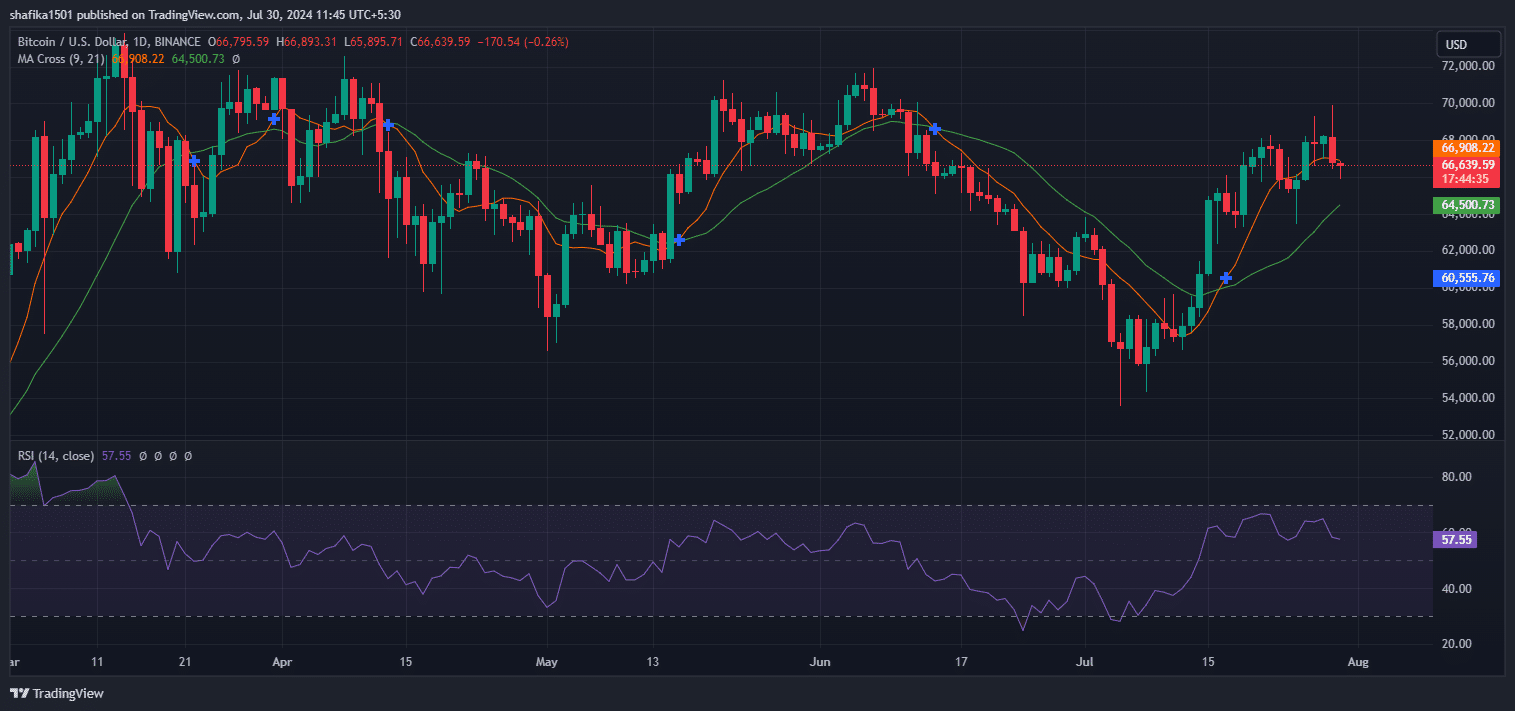

Looking at the technical side of things, the Bitcoin price remains in a critical phase. The recent dip brings the token to a crucial point where a short-term correction could occur, but the overall trend still shows strong bullish signals. The Relative Strength Index (RSI) stands at 57.55, suggesting that market sentiment leans towards buying. Moreover, the 9-day moving average is currently above the 21-day moving average, which indicates a bullish trajectory.

In the broader context, Bitcoin has shown a 9.37% increase in price over the past month. The token has experienced several ups and downs, including major whale movements. For instance, the German government recently sold 50,000 BTC over three weeks, and the Mt.Gox exchange began transferring Bitcoin to creditors who lost funds during a hack a decade ago. Despite these disruptions, Bitcoin price has managed to maintain a generally positive trend.

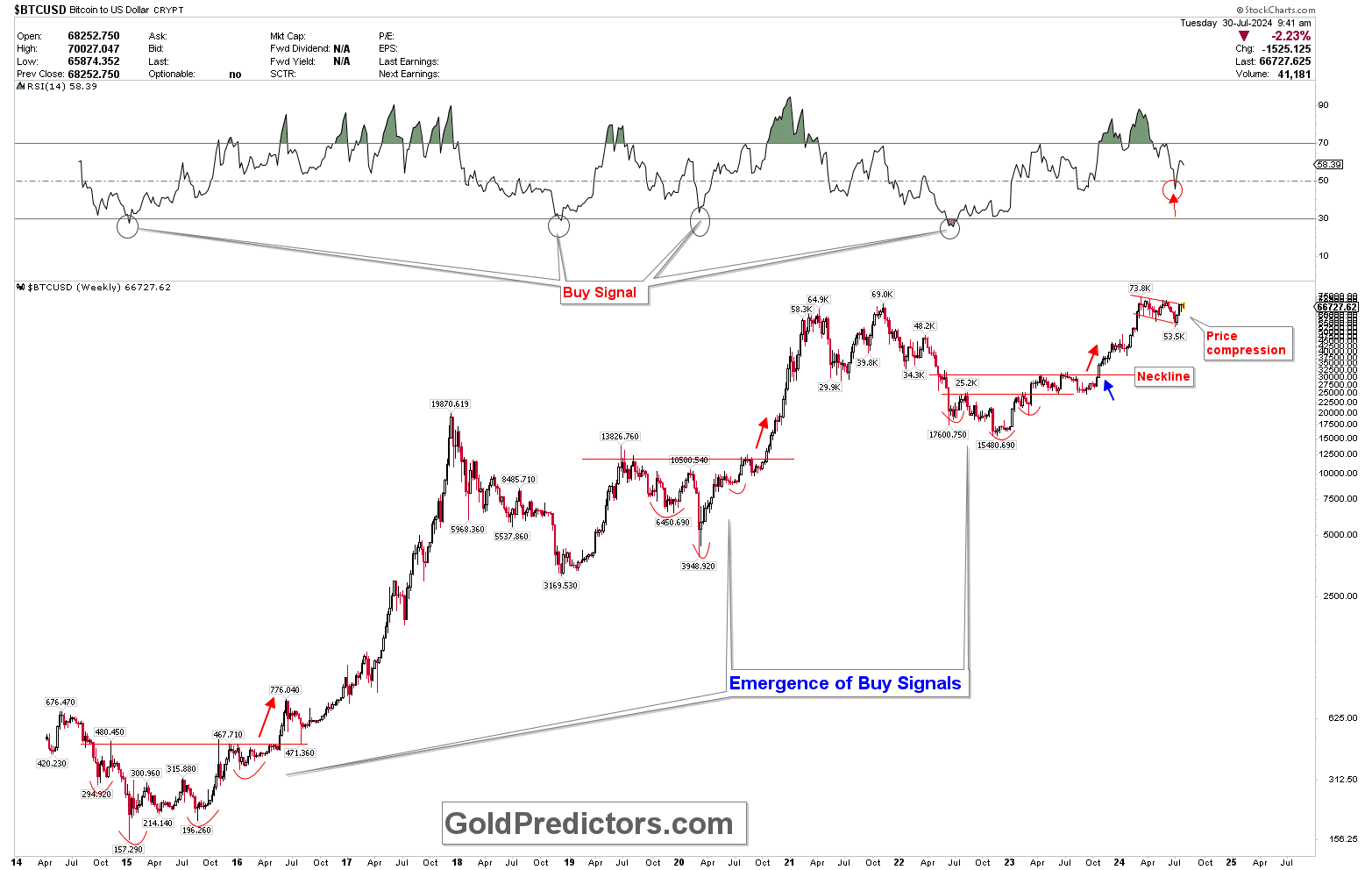

The Bitcoin price chart also reveals a bull flag pattern, a technical signal that suggests the potential for a significant upward movement if current resistance levels are breached. Historical patterns support this view; similar patterns observed in 2015, 2020, and 2023 led to substantial price rallies. This consolidation at record highs within a downtrend channel further reinforces the bullish outlook.

Bottom Line

In summary, the Bitcoin price has experienced a decline recently, largely driven by the US authorities’ transfer of $2 billion worth of Bitcoin. This transfer has introduced a level of uncertainty and fear in the market, as traders speculate about potential sell-offs. However, despite the immediate concerns, the technical analysis paints a more optimistic picture. The RSI and chart patterns suggest that Bitcoin may be poised for a rebound, making any short-term corrections potentially attractive buying opportunities for investors.

While the market reacts to these developments, it’s crucial for traders to stay informed and consider both the immediate risks and long-term potential of Bitcoin. The current volatility might present challenges, but it also offers chances for those who closely monitor the Bitcoin price trends and technical indicators. Stay tuned for more updates on this evolving story on The Bit Journal