Bitcoin’s remarkable rally could just be getting started, with institutional momentum and market sentiment fueling speculation of a run to $150,000. Bitcoin has surprised yet again and has climbed to a new high of 112,000 Wednesday, a high that sent bullish voices into Bitcoin enthusiasts once again.

The price surge signals a major psychological boost after weeks of consolidation that left traders doubting Bitcoin’s strength to surpass its May highs. Consequently, a great number of people alter their Bitcoin price prediction during the upcoming months.

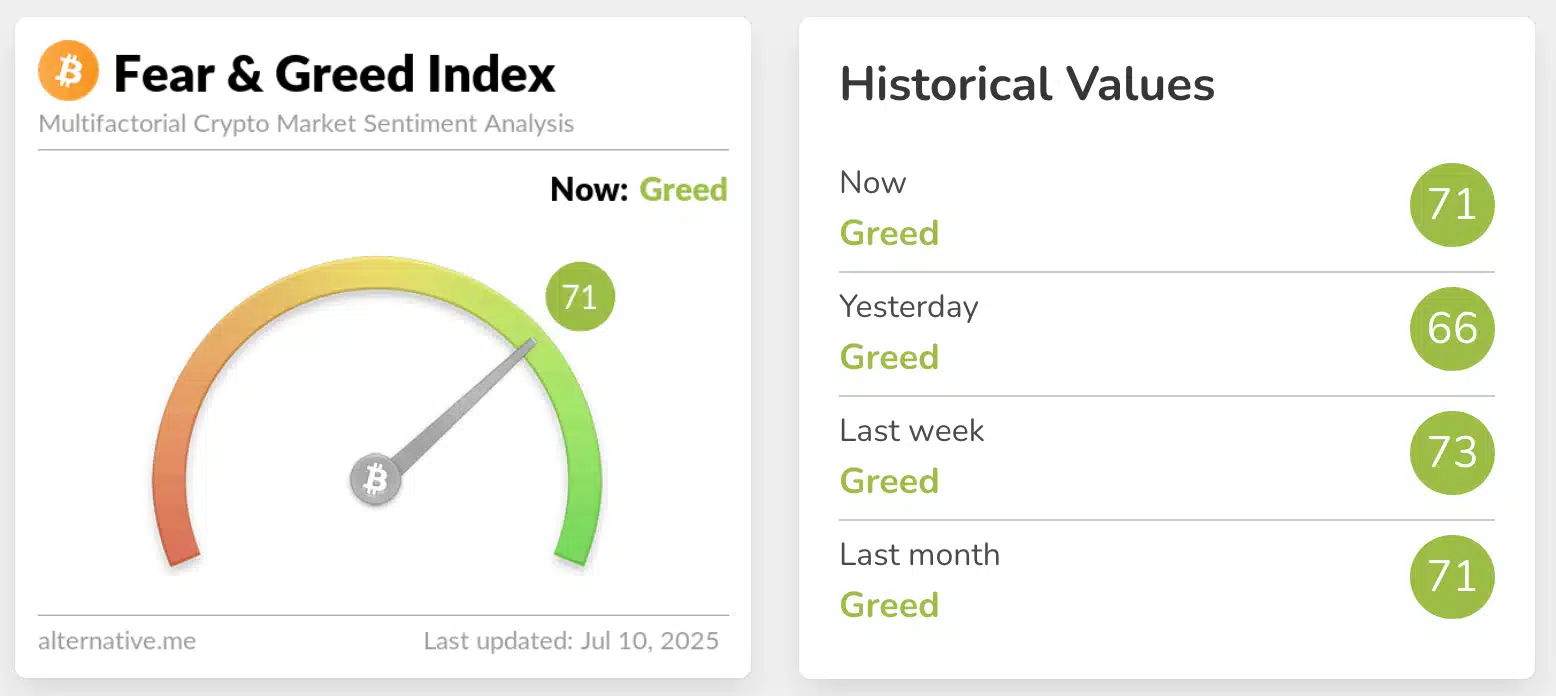

Fear and Greed Index Fuels Bitcoin Price Prediction

Co-founder of Milk Road, Kyle Reidhead, wrote on X to the tune of, see you at $150K, marking a cup and handle bullish pattern that the entrepreneurizing establishment had noticed in late June. Reidhead is an ardent bull about Bitcoin and the recent development seems to justify his Bitcoin price prediction.

Only hours before the breakout, an economist Timothy Peterson argued that unless Bitcoin established a new high in two weeks, it would not do so soon again until October. The timing, it seems, couldn’t have been better.

Momentum has shifted sharply in Bitcoin’s favor. On Wednesday, the Crypto Fear & Greed Index surged five points to a score of 71 in the category of Greed indicating increasing confidence among investors.

Altcoin Index Supports Bitcoin Price Prediction

In the meantime, the CoinMarketCap Altcoin Season Index suggests that the market is still dominated by BTC since its index records only 26 out of 100 implying that it is still in the “Bitcoin Season,” as well. This is also playing into a more bullish Bitcoin price prediction.

Matthew Hyland, a crypto analyst, considered the breakout significant to be technical. In a post, he said, BTC verified higher high daily and affirms an end of the downtrend that began in late May. Bulls are in control.

#BTC confirms daily higher-high and confirms an end to the downtrend that started in late May

Bulls are in control pic.twitter.com/AYJo3aTAWS

— Matthew Hyland (@MatthewHyland_) July 10, 2025

According to TradingView, Bitcoin is trading at around 111,383 as of now but many analysts are citing 150,000 as the next goal in their Bitcoin price prediction. This bull market is unique in one aspect: the involvement of institutions. eToro analyst Josh Gilbert stated that it is no longer retail, but institutions driving the rally of Bitcoin and changing the usual Bitcoin price prediction models.

ETF Inflows Fuel Bitcoin Bull Market

Gilbert told Cointelegraph that this is indeed the first genuine bull market, and institutional participation is in the centre of the attention. The powerful ETF inflows and relatively good macro environment have continued to support market momentum but the biggest change yet may be who is buying.

📈The Cointelegraph Markets Show!

🔥 Burning question: Will Bitcoin hit $150K by year-end or is it just hopium?@HorusHughes and @bitcoinwallah join @rkbaggs to break it all down in 15 minutes or less on this week’s episode.https://t.co/YVesqoLwnA

— Cointelegraph (@Cointelegraph) July 9, 2025

There have been inflows into U.S-based spot Bitcoin ETFs of more than 1.04 billion in the month of July alone as per the Farside data. Such inflows have been one of the core reasons why major financial institutions have been upgrading their Bitcoin price predictions.

Coinstash co-founder Mena Theodorou shared the sentiment of Gilbert. It is clear that this momentum is being driven by institutions, not retail investors, he said. Even in the face of global uncertainty from escalating trade tensions to rising geopolitical risks Bitcoin has remained resilient.

Bitfinex Warned of Resistance Before Breakout

Despite the bullish excitement, not everyone saw this breakout coming. A day ago, analysts at Bitfinex pointed out traders would not have wanted to purchase Bitcoin at its previous value as they were skeptical of whether the coin has a pending power to surmount resistance to any Bitcoin price prediction on the short-term.

They were costly lessons to short sellers. CoinGlass shows that Bitcoins short positions totaling around $217.55 million have been liquidated in the last 24 hours. There is also a risk of an additional $1.6 billion in short positions that will be lost as soon as Bitcoin gains another few thousand dollars to the height of $115,000.

Santiment data points also are indicative of maximum optimism in traders, which can be cautious. According to analyst Brian Quinlivan, previous bullish sentiment rises on June 11 and July 7 were accompanied by visible pullbacks, so the short term Bitcoin price predictionis more unstable.

Conclusion

The rally of Bitcoin to over 112,000 has restored bullish energy and has analysts projecting 150,000 as the bullish target. There is optimism on the part of institutional interest, quality inflows in ETFs and technical breakouts. Though there are threats of high sentiment and liquidation, market conditions indicate that bulls still have a tight grip on the market, at least at this time.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

Bitcoin has continued to make a fresh ATH at 112,000 and bulls are now targeting 150,000. Kyle Reidhead of Milk Road and other analysts cite upward technical formations and an increased institutional demand. The mood in the market is shifting positive, with a last month flows of more than $1billion into ETFs in July. But the short sellers were surprised as they were liquidated by $217 million. After the optimism, some have cautioned of possible rebates as the sentiment soars to record levels of late and the short term view remains volatile.

FAQs

1. Why are analysts predicting $150K for Bitcoin?

Bullish patterns and strong ETF inflows support a \$150K target.

2. What’s fueling Bitcoin’s latest price surge?

Institutional buying and over \$1B in ETF inflows.

3. Is Bitcoin’s short-term outlook risky?

Yes, due to high sentiment and potential short liquidations.

Glossary Of Key terms

Bitcoin Bull

Someone confident Bitcoin’s price will rise.

Cup and Handle

A bullish chart pattern signaling a price breakout.

All-Time High (ATH)

The highest price Bitcoin has ever reached.

Consolidation

A period of sideways price movement before a breakout.

Fear & Greed Index

Measures crypto market sentiment from fear to greed.

Bitcoin Season

When Bitcoin outperforms most altcoins.

Altcoin Season Index

Shows if the market favors altcoins or Bitcoin.

ETF (Exchange-Traded Fund)

A tradable fund that can hold assets like Bitcoin.