Bitcoin price prediction patterns have once again grabbed center stage, as the cryptocurrency edged closer to an all-time high amid renewed confidence in US-China trade discussions.

The most recent round of negotiations, held in Stockholm on July 28, aimed to prolong the existing 90-day tariff ceasefire beyond August 12. Market experts have hailed these events as a significant stimulus for restored investor confidence in global markets.

Bitcoin Bounces as U.S.–China Trade Talks Offer Relief

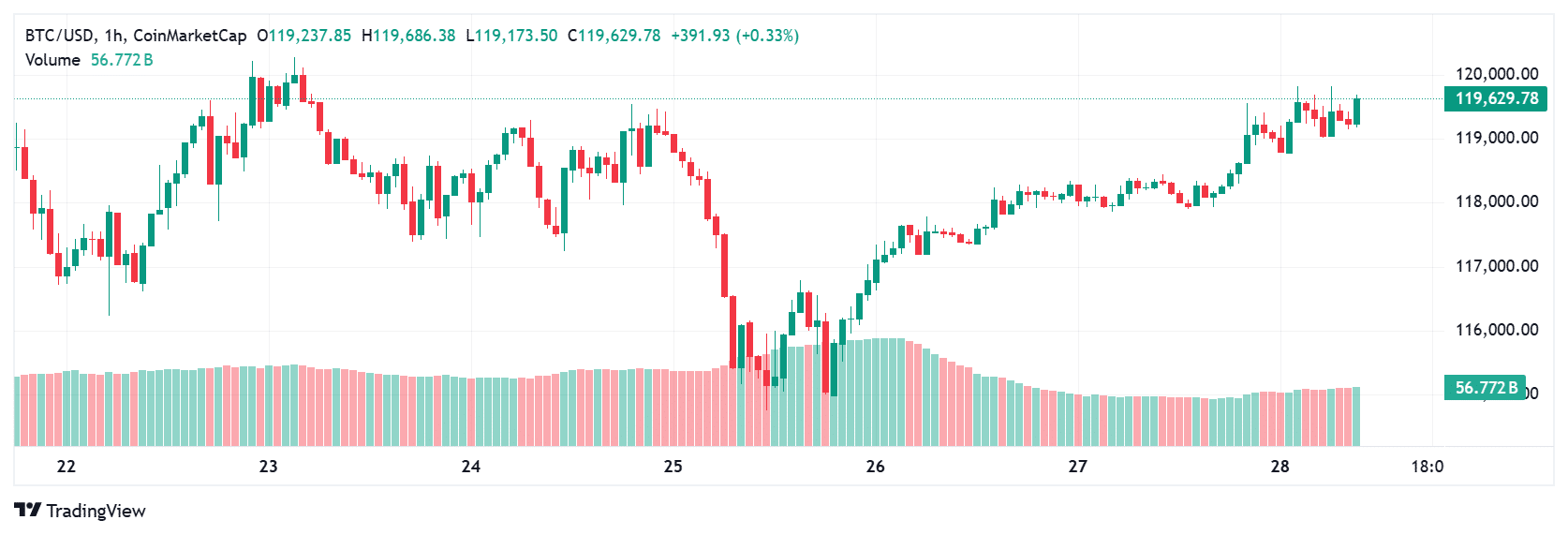

Bitcoin surged to an intraday high of $119,700, riding a wave of confidence as US and Chinese officials started discussions in Stockholm to prolong the tariff freeze for another 90 days. This increased communication has served to calm market concerns, reviving investor interest and increasing virtually all major risk assets, including digital currencies.

The recently announced U.S.-EU trade agreement, which reduced tariffs to 15% from 30%, boosted markets, sending the S&P 500 above 6,400 and encouraging cryptocurrency sentiment. Analysts see these occurrences as signs of lower macroeconomic uncertainty, which has historically been a big tailwind for Bitcoin.

Global Trade Developments Fuel Bitcoin Price Prediction Discussions

The negotiations between US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng have caused a rippling effect in the market. The continuing trade tensions between the world’s two largest economies have traditionally had a substantial impact on Bitcoin price prediction models. If these conversations result in a long-term truce, analysts anticipate Bitcoin will surpass its current highs and maybe set a new all-time record.

Other related trade events, such as the completion of a US-EU agreement with 15% tariffs on specified imports, have boosted broader market confidence. This worldwide risk-on mood has boosted stocks as well as cryptocurrencies.

Market Analysis

The latest Bitcoin price prediction projections point to an optimistic prognosis for the remainder of the year. Technical experts have noted that Bitcoin is presently only a few percentage points below its all-time high set in mid-July. Institutional investors are once again displaying a strong appetite, as trade volumes have increased dramatically during the last surge.

Below is the projected price table based on quarterly market conditions:

| Quarter 2025 | Bitcoin Price prediction(USD) |

|---|---|

| Q3 | $121,000 – $125,000 |

| Q4 | $127,000 – $132,000 |

| Q1 2026 | $135,000 – $142,000 |

| Q2 2026 | $145,000 – $153,000 |

“Bitcoin’s fundamentals remain robust with record-high hash rates and growing institutional inflows,” noted one crypto strategist. Analysts caution, however, that any breakdown in trade negotiations could trigger market volatility.

What This Means for Investors and Traders

The ongoing geopolitical debates present both opportunities and risks for investors and traders. The prospect of a longer-term settlement to trade hostilities would boost Bitcoin price prediction, perhaps leading to steady increase through 2026. Experts recommend having a diversified portfolio to reduce the possible negative of unanticipated policy developments.

With the whole cryptocurrency market capitalization approaching $4 trillion, Bitcoin remains the dominant driver of overall market sentiment. “Bitcoin continues to be a hedge against macroeconomic uncertainty, and we expect its dominance to remain strong in the coming quarters,” according to an investment manager.

Conclusion

The revived US-China trade discussions have injected new hope into the markets, supporting Bitcoin price prediction trends. If a 90-day extension is granted and progress toward a long-term settlement is reached, Bitcoin may break new territory and reassert its status as a crucial macro hedging asset.

FAQs

Q1: Why are U.S.-China tariff talks affecting Bitcoin?

Tariff negotiations impact global markets, and Bitcoin often benefits as a hedge against economic uncertainty.

Q2: What is the Bitcoin price prediction for the coming quarters?

Analysts project Bitcoin could surpass $125,000 by Q3 and reach as high as $153,000 by mid-2026.

Q3: Should traders buy Bitcoin now?

Experts suggest a cautious approach, considering both bullish fundamentals and potential volatility from geopolitical events.

Glossary

Tariff Truce: A temporary halt on trade tariffs between nations.

Hash Rate: The computational power securing the Bitcoin network.

Institutional Inflows: Investments made by large financial institutions into Bitcoin.