Bitcoin, the pioneering cryptocurrency, has experienced a roller-coaster journey since its inception in 2009. Asper the market in 2025, the digital asset continues to intrigue investors, analysts, and enthusiasts alike. This article delves into Bitcoin’s current market status, historical price movements, expert predictions for 2025, and addresses common questions surrounding this digital currency.

Bitcoin’s Current Market Snapshot

As of March 4, 2025, Bitcoin is trading at approximately $83,846.63, reflecting an 8.29% decrease over the past 24 hours. This decline is part of a broader trend, with Bitcoin experiencing a 17.5% drop in February, marking its largest monthly loss since June 2022.

A Glimpse into Bitcoin’s Price History

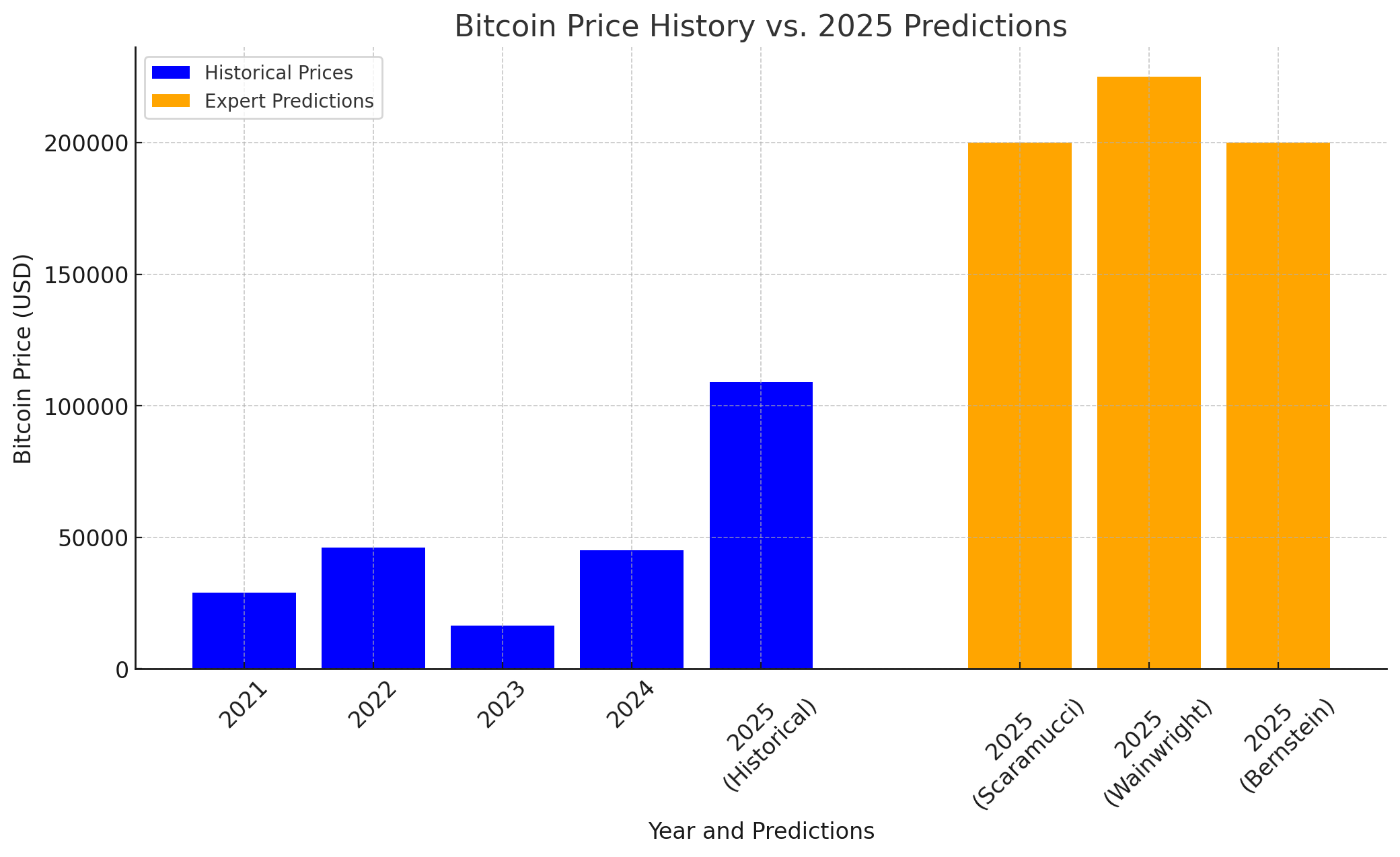

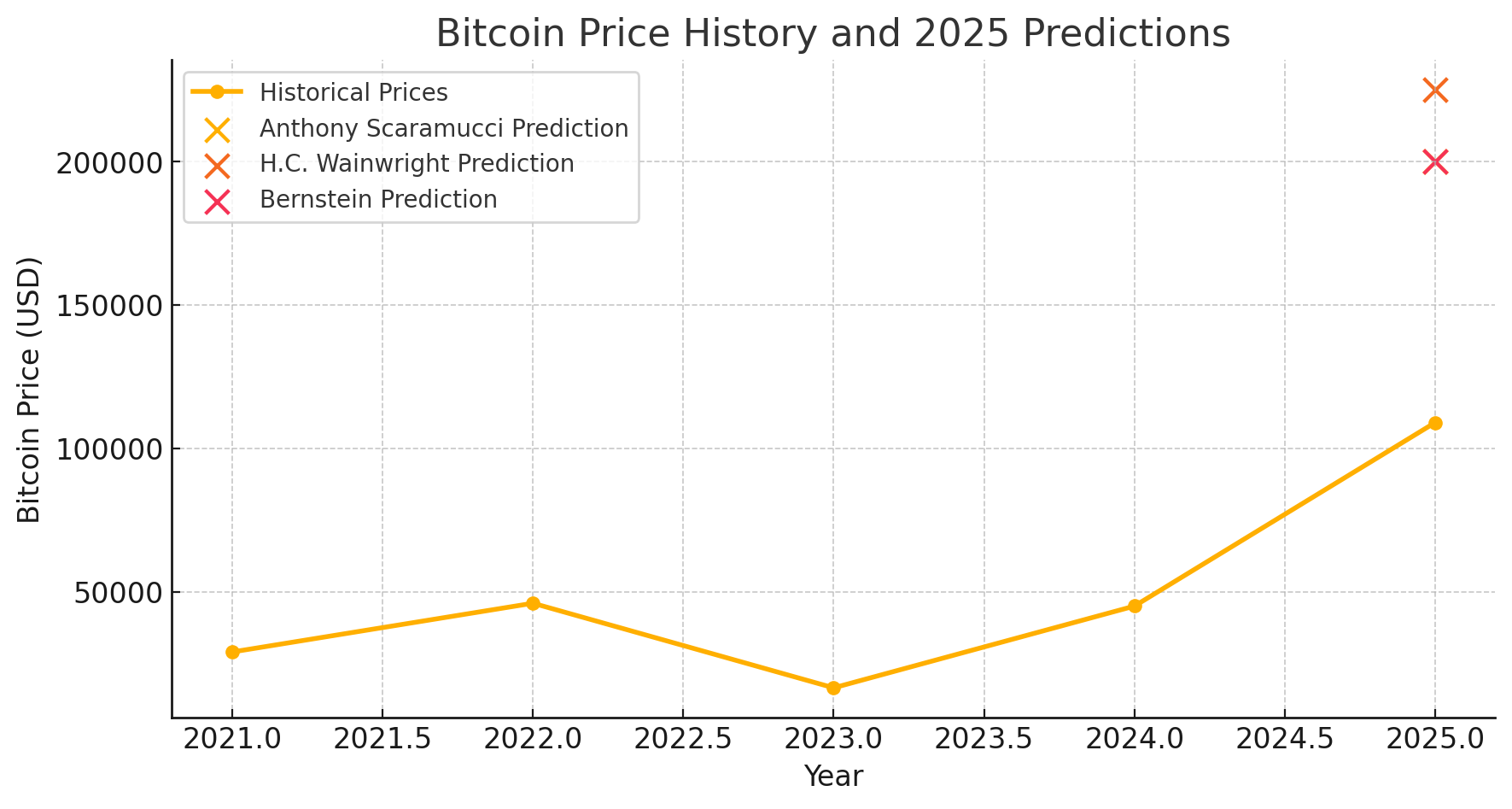

Understanding Bitcoin’s past performance provides context for its current valuation:

| Year | Price at Start | All-Time High | Notes |

|---|---|---|---|

| 2021 | ~$29,000 | $69,700 | Surge due to increased institutional adoption. |

| 2022 | ~$46,000 | $45,554 | Market correction and regulatory concerns. |

| 2023 | ~$16,500 | $44,011 | Recovery phase post-2022 downturn. |

| 2024 | ~$45,000 | $109,135 | Bull run fueled by ETF approvals and mainstream acceptance. |

| 2025 | ~$109,000 | $109,135 | Market stabilization with periodic corrections. |

Expert Predictions: What Lies Ahead for Bitcoin?

The cryptocurrency community is abuzz with varied forecasts for Bitcoin’s trajectory in 2025:

Anthony Scaramucci, founder of SkyBridge Capital, projects Bitcoin reaching $200,000 by the end of 2025, attributing this to increased institutional adoption and favorable regulatory developments.

H.C. Wainwright, a renowned financial analyst firm, anticipates Bitcoin hitting $225,000 in 2025, driven by historical price cycles and the introduction of spot exchange-traded funds (ETFs).

Bernstein, a global investment management company, has adjusted its Bitcoin price target to $200,000 by 2025, up from a previous estimate of $150,000, citing strong inflows into spot U.S. Bitcoin ETFs.

While these projections are optimistic, it’s essential to approach them with caution, given the inherent volatility of cryptocurrency markets.

Factors Influencing Bitcoin’s Future Price

Several elements are poised to impact Bitcoin’s valuation in the coming years:

Regulatory Landscape: The stance of governments worldwide towards cryptocurrencies can significantly influence market dynamics. For instance, President Trump’s proposal for a national strategic reserve of cryptocurrencies has garnered mixed reactions, reflecting the complex interplay between policy and market sentiment.

Institutional Adoption: The entry of major corporations and financial institutions into the crypto space can drive demand and legitimacy. The approval of Bitcoin ETFs, for example, has opened avenues for mainstream investors to participate in the market.

Technological Developments: Advancements in blockchain technology, scalability solutions, and security protocols can enhance Bitcoin’s utility and appeal.

Macroeconomic Factors: Global economic conditions, inflation rates, and currency fluctuations can drive investors towards or away from Bitcoin as a store of value.

Summing Up

In conclusion, while significant highs and lows have marked Bitcoin’s journey, it remains a focal point in the financial world. As 2025 unfolds, investors and enthusiasts alike are keenly watching its trajectory, balancing optimism with caution.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

Frequently Asked Questions (FAQs)

Q1: What is Bitcoin?

A1: Bitcoin is a decentralized digital currency that enables peer-to-peer transactions without intermediaries like banks. It operates on blockchain technology, which ensures transparency and security.

Q2: How does Bitcoin mining work?

A2: Bitcoin mining involves solving complex mathematical problems to validate and record transactions on the blockchain. Miners are rewarded with newly created bitcoins and transaction fees for their efforts.

Q3: Is Bitcoin a safe investment?

A3: While Bitcoin has offered substantial returns in the past, it is also known for its volatility. Potential investors should conduct thorough research and consider their risk tolerance before investing.

Q4: How can I buy Bitcoin?

A4: Bitcoin can be purchased through cryptocurrency exchanges, peer-to-peer platforms, or Bitcoin ATMs. It’s crucial to use reputable platforms and secure storage solutions, such as hardware wallets, to protect your investment.

Q5: What are Bitcoin ETFs?

A5: Bitcoin Exchange-Traded Funds (ETFs) are investment funds that track the price of Bitcoin. They allow investors to gain exposure to Bitcoin without directly purchasing the cryptocurrency.

Glossary

Blockchain: A decentralized ledger that records all transactions across a network of computers.

Cryptocurrency: A digital or virtual form of currency that uses cryptography for security.

Decentralization: The distribution of authority and decision-making away from a central entity.

Exchange-Traded Fund (ETF): A type of investment fund that is traded on stock exchanges, much like stocks.

Mining: The process of validating transactions and adding them to the blockchain, for which miners receive rewards.