Bitcoin price failed to surpass the $100,000 level in early February thus cooling down investor interest. The analysts point to USDT dominance as the key deciding factor that will drive the next major market rally.

USDT dominance defines the cryptocurrency market capitalization allocation that exists within Tether (USDT) the biggest stablecoin. Renewed Bitcoin inflow from declining USDT dominance tends to initiate future major market price moves.

Bitcoin’s Re-Accumulation Phase: What Analysts Say

Per TradingShot – an expert analyst on TradingView – Bitcoin price is actively undergoing buildup by its investors. Such phases have previously occurred before major price appreciation periods according to historical data. TradingShot indicates that Bitcoin displays similar price patterns which have occurred during previous accumulation phases with subsequent price breaks while the market stabilizes.

The market sees Bitcoin investors prefer to maintain their positions rather than engage in sales during re-accumulation, thus producing a scarcity that boosts price levels. The continuous buying behavior of institutional investors positions the Bitcoin market for its upcoming price increase.

How USDT Dominance Influences Bitcoin Price Trajectory

The measurement of USDT dominance represents the percentage of crypto market value that is invested into USDT. The indicator demonstrates how willing investors are to take risks through their positioning.

| USDT Dominance Level | Market Implication |

| High USDT Dominance | Traders prefer stablecoins, indicating risk aversion |

| Declining USDT Dominance | Investors shifting to Bitcoin, increasing buying pressure |

According to Glassnode analysis, USDT market dominance has shown a downward trend throughout the last few weeks, indicating rising Bitcoin purchase activity.

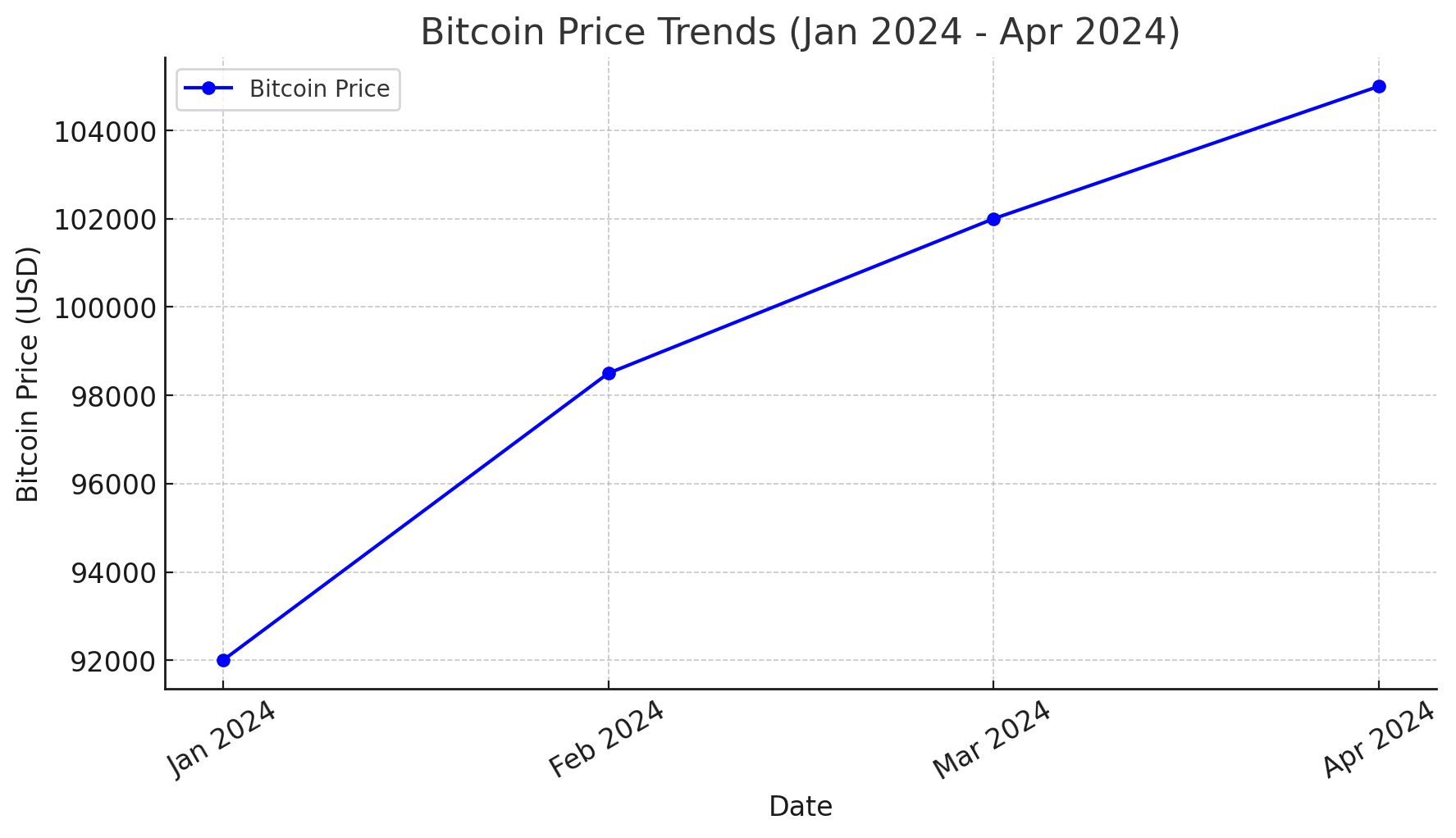

Bitcoin Price Trends and Projections

Market tendencies directly affect Bitcoin price because support and resistance levels act as vital elements for its price movement.

| Date | Bitcoin Price | Market Sentiment |

| Jan 2024 | $92,000 | Bullish |

| Feb 2024 | $98,500 | Neutral |

| Mar 2024 | $102,000 | Slightly Bullish |

| Apr 2024 | $105,000 | Bullish |

Professional analysts confirmed that Bitcoin price will likely reach $150,000 based on its gradual upward movement displayed in this data.

Institutional Investors and Market Sentiment

Various financial institutions track the relationship between Bitcoin market prices and the USDT dominance ratio. Bloomberg Intelligence expects Bitcoin to increase toward $150,000 because major financial institutions continue entering the market.

The institutional adoption of Bitcoin price continues its path toward stronger growth according to the Bitcoin advocate Anthony Pompliano. The decreasing prominence of USDT creates conditions for an extensive market uptrend.

Regulatory Developments and Market Impact

Bitcoin’s price fluctuations remain directly affected by government regulations and policy adjustments. Multiple Bitcoin exchange-traded funds (ETFs) from the U.S. Securities and Exchange Commission (SEC) now provide institutional investors with greater access to Bitcoin investments.

The worldwide percentages of interest rates determine how Bitcoin performs in the market. The implementation of accommodative monetary policies by central banks leads investors to redirect their funds into risk assets which includes Bitcoin.

Will Bitcoin Price achieve $150,000 as its price target?

Experts predict the Bitcoin price will reach $150,000 through past accumulation patterns accompanied by decreasing USDT dominance during the following year to eighteen months. Market sentiment, macroeconomic conditions, regulatory decisions, and other factors will strongly influence the Bitcoin price. Keep following The Bit Journal and keep an eye on crypto updates.

| Factor | Impact on Bitcoin |

| USDT Dominance Decline | Positive (More BTC Buying) |

| Institutional Investment | Positive (Increased Demand) |

| Regulatory Uncertainty | Negative (Short-Term Volatility) |

| Global Interest Rates | Mixed (Depends on Policy Direction) |

FAQs

What is USDT dominance?

USDT dominance represents the share of total cryptocurrency market cap that belongs to USDT which demonstrates investor sentiment together with their risk-taking behavior.

2. How does USDT dominance affect Bitcoin price?

The level of USDT dominance within the market corresponds to Bitcoin price fluctuations. When investors transfer capital from USDT into Bitcoin, USDT dominance decreases, which creates stronger buying pressure and tends to push Bitcoin’s price upward.

Which elements trigger price fluctuations in the Bitcoin market?

The price fluctuations of Bitcoin result from the dynamics of USDT dominance together with institutional investment regulation changes while surrounding macroeconomic conditions play a significant role.

Can Bitcoin reach $150,000?

Experts suggest that, based on market forces and economic conditions, Bitcoin’s price will reach $150,000 during the following 12-18 months.

Glossary of Key Terms

USDT Dominance: The percentage of the cryptocurrency market composed of USDT assets amounts to USDT Dominance.

The Re-Accumulation Phase: represents a time during which investors maintain their Bitcoin holdings which creates reduced selling pressure and hence supports price appreciation.

Institutional investments: Large financial corporations along with institutional investors such as hedge funds and financial firms make substantial capital investments into Bitcoin.

A stablecoin: refers to digital currency that functions to maintain a predictable worth by linking itself to traditional currencies such as the American Dollar.

References

- TradingShot – TradingView Market Analysis

- Bloomberg Intelligence – Institutional Bitcoin Adoption Report

- Glassnode – USDT Dominance and Crypto Market Trends

- SEC – Bitcoin ETF Approvals

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!