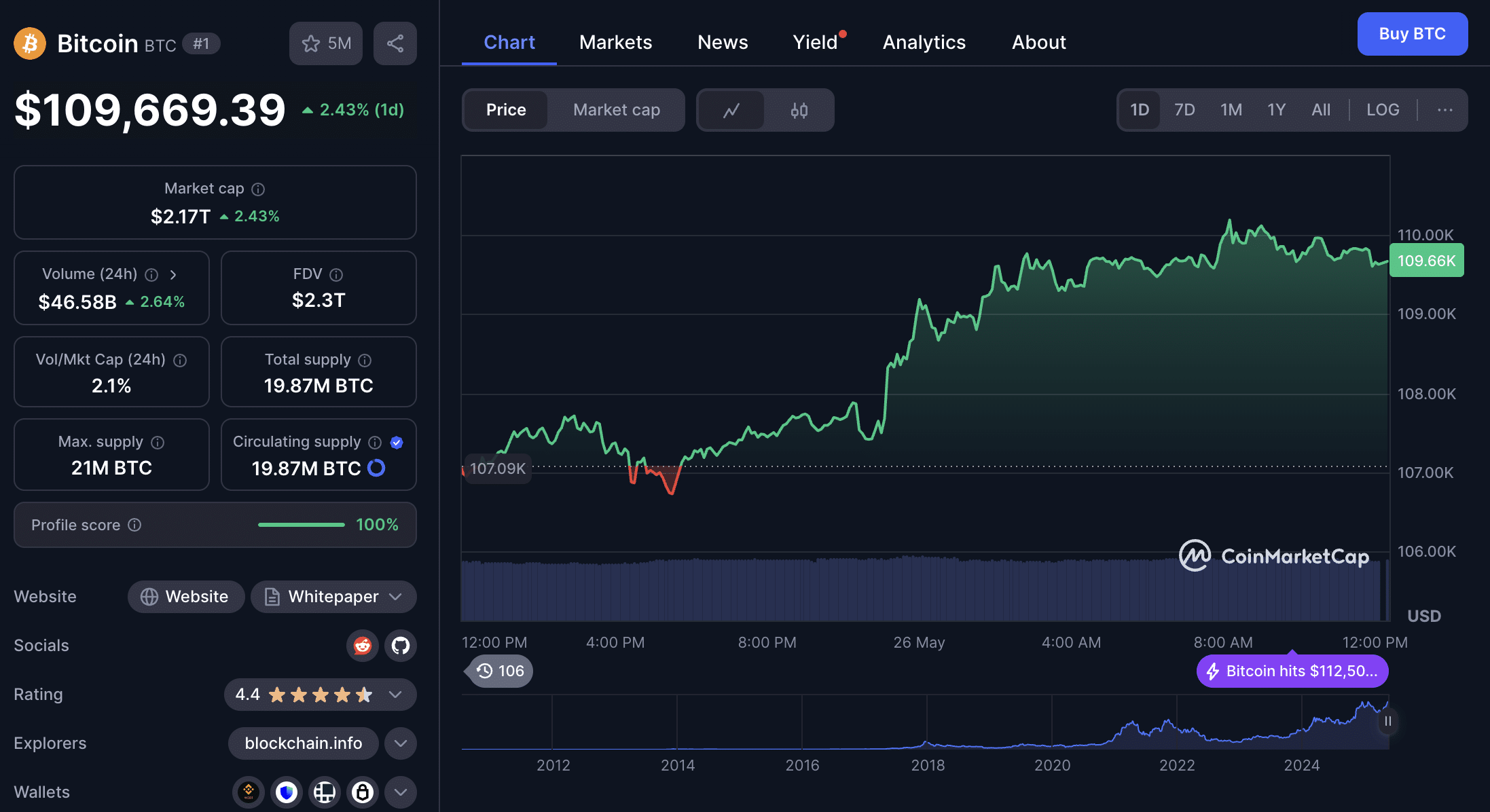

Bitcoin price rebounded to just under $110,000 on Monday following a steep weekend sell-off caused by trade tensions. President Donald Trump’s unexpected threat of imposing a 50% tariff on goods imported from the European Union had shaken global markets, leading to a broad sell-off in risk assets, including cryptocurrencies.

However, his decision to delay the tariff implementation until July 9 helped calm investor nerves, allowing the Bitcoin price to recover as sentiment shifted back toward optimism.

In the hours following the announcement, U.S. and European equity futures gained over 1%, signaling broader risk appetite returning to the markets. Bitcoin price responded similarly, reversing losses and inching closer to the key $110,000 resistance level. Analysts noted that the move signaled the market’s resilience and its ability to quickly recalibrate in response to macroeconomic news.

Market Sell-Off and Crypto Liquidations

The weekend sell-off had seen the Bitcoin price tumble from over $111,000 to a low of $108,600, triggering more than $500 million in long liquidations across major cryptocurrency futures markets. Bitcoin wasn’t alone in the drop, other top tokens like ether (ETH), Cardano’s ADA, Solana’s SOL, and Dogecoin (DOGE) also suffered significant declines during the macro-driven retreat.

The risk-off sentiment was fueled by fears of a trade war between the U.S. and EU, with concerns that consumer electronics, including iPhones, would face increased levies. This drove investors to rotate into safe-haven assets like gold and U.S. Treasuries, further weakening the crypto market. Yet, the quick policy delay by the U.S. administration offered just enough reprieve for the market to find support and begin to climb.

Currently, Bitcoin’s price is around $109,700, and crypto market observers noted that this sudden volatility highlights how vulnerable digital assets remain to geopolitical developments.

Bitcoin price, which had been consolidating around the $110,000 mark before the announcement, was quickly knocked off course before recovering its footing. This pattern of sharp drawdowns followed by fast rebounds is becoming more common in a maturing yet still highly reactive asset class.

ADA and DOGE Outperform in the Bounce

Among the top ten cryptocurrencies, Cardano’s ADA and Dogecoin led the recovery, each gaining as much as 3% over the past 24 hours. Their rebound showed a broader return of confidence in risk assets and marked a short-term shift in momentum for high-beta altcoins.

As sentiment improved, ADA traded near $0.76 and DOGE approached $0.24, reflecting renewed buying interest from retail traders.

Bitcoin price bounce also coincided with a pullback in the U.S. dollar to multi-month lows and declining demand for traditional safe havens, reinforcing the recovery narrative.

These macro factors continue to influence digital asset performance as Bitcoin becomes more tightly linked with global economic developments. Risk-sensitive assets like ADA and DOGE often outperform in such environments, especially when optimism returns quickly after a panic.

Traders pointed out that the coordinated recovery across both traditional and digital markets demonstrates how deeply interconnected global financial instruments have become. It’s a reminder that while Bitcoin and its peers often move on their own catalysts, they are increasingly swayed by broader geopolitical forces.

Options Activity and Institutional Confidence

Market structure data revealed that optimism is returning among professional traders. Singapore-based QCP Capital highlighted a surge in demand for topside exposure in Bitcoin price, reporting that 1,000 contracts of the September $130,000 BTC call were recently acquired. This aggressive positioning suggests confidence in further gains as investors bet on upside scenarios.

In addition to bullish derivatives activity, institutional flows remain robust. Asset manager Strategy raised $2.1 billion to expand its Bitcoin holdings, signaling sustained interest from large-scale investors. Combined with steady ETF inflows and regulatory developments in the U.S., these factors contribute to a “constructive” outlook for Bitcoin price in the medium term.

Moreover, options data has become a leading indicator of sentiment. The surge in call option interest at higher strikes suggests that sophisticated market participants are preparing for potential bullish extensions. This aligns with on-chain signals that show steady accumulation by long-term holders.

Conclusion

As macro headwinds temporarily subside, the market appears poised for cautious accumulation. Traders will continue to watch global policy developments closely, as the Bitcoin price remains sensitive to external events. However, the current rebound shows that even amid uncertainty, appetite for crypto remains strong.

Market analysts agree that the next major test will be whether Bitcoin can break above the $110,000 barrier and sustain its momentum. Success on that front could open the door to revisiting previous highs, while failure may trigger another round of consolidation. Regardless, the return of institutional confidence and bullish positioning signals that the market’s underlying structure remains resilient.

FAQs

What caused the recent Bitcoin price drop?

President Trump’s unexpected threat of EU tariffs triggered risk-off sentiment, causing bitcoin to fall below $109,000.

Why did the Bitcoin price rebound?

The delay in tariff decisions to July 9 reduced immediate macroeconomic pressure, allowing traders to re-enter the market.

Which Altcoins led the recovery?

Cardano (ADA) and Dogecoin (DOGE) outperformed, each rising over 3% during the bounce.

What is the short-term outlook for the Bitcoin price?

With institutional buying and favorable options positioning, many expect bitcoin to challenge the $110,000 resistance in the coming days.

Glossary

Bitcoin price – The current trading value of bitcoin in global markets, reflecting supply and demand.

Liquidation – The automatic closing of leveraged positions due to price movements.

ETF inflow – Net capital entering bitcoin exchange-traded funds, indicating investor interest.

Call option – A financial contract that gives the holder the right to buy an asset at a specified price.

Macro risk – Broader economic or geopolitical events that impact asset prices globally