Bitcoin price surged to a new all-time high on July 11, touching $118,403.89 after a sharp daily gain. The jump followed a strong rebound from a 24-hour low of $110,660.75, adding nearly $8,000 in value. This dramatic spike caused over $1 billion in short positions to get liquidated across major trading platforms.

Bitcoin Price Rises on Institutional Demand

Bitcoin price guidelines continue to shape investor behavior amid strong ETF inflows driving institutional activity across U.S. markets. BlackRock’s iShares Bitcoin Trust recorded $448.49 million in net inflows on July 10 alone. These large inflows suggest rising confidence from major players and continue to push prices higher.

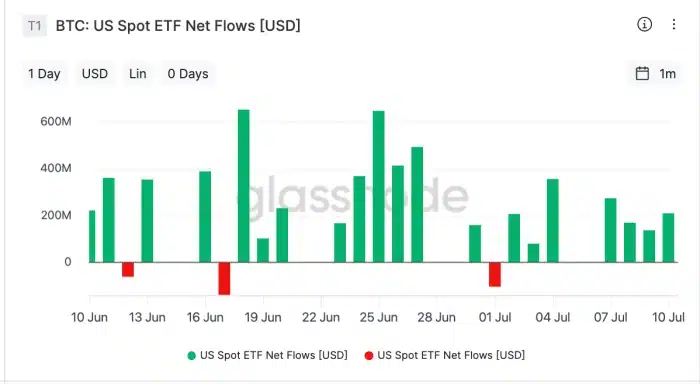

According to Glassnode data, net inflows into U.S. spot Bitcoin ETFs have shown consistent strength over the past 30 days. These inflows are contributing to steady buying pressure, helping Bitcoin test the $120,000 psychological mark. ETF-driven demand appears to be leading the charge in Bitcoin’s current price climb.

Bloomberg analyst Eric Balchunas stated,

“The ETFs did all the heavy-lifting,” attributing most of the buying pressure to their ease of access. He added, “You wake up, click a button, and you’re in,” emphasizing investor comfort with simple exposure to Bitcoin.

This trend shows how Bitcoin price guidelines continue influencing modern investment decisions.

Short Sellers Suffer Over $1B in Liquidations

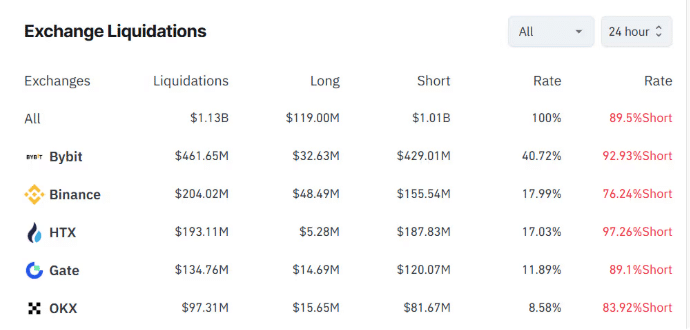

The sharp price jump caught many traders off guard, triggering $657.16 million in total liquidations in just 24 hours. Coinglass data confirmed an additional $2.03 million was wiped out within a single hour, worsening the loss impact. Of the $1 billion liquidated, Bitcoin futures alone accounted for $590 million.

Around 237,000 traders saw their positions closed, as nearly 90% of liquidated trades were short bets against the price. The biggest single liquidation was a short position of $88.5 million BTC-USDT on HTX. Bybit saw the largest losses, with $461 million liquidated, followed by Binance and HTX.

Short sellers borrow assets to bet on falling prices, but rising prices force those positions to close, fueling upward pressure. This reflexive effect magnifies rallies, locking in short losses while pushing Bitcoin price higher. Bitcoin price guidelines continue to define volatility patterns and market behavior.

Rising Open Interest Signals Bullish Market Momentum

Open interest in BTC-tracked futures rose by $2 billion in just four hours, indicating growing confidence among leveraged traders. The long-short ratio stood at 52% in favor of bullish bets, suggesting a tilt toward continued upward movement. Future action is sometimes an indicator of the near-term trend and is also price confirmation.

Bitcoin’s rise has also lifted other cryptocurrencies, including ether, XRP, DOGE, and SOL, each gaining as much as 5%. This market optimism has also skyrocketed because of the improvement of policies in the United States and the resultant increase in equity markets. This broader bullish sentiment is reflected in current Bitcoin price guidelines and trader positioning.

With the unstable condition, institutional demand is exhibiting support and stabilizing the market. Retail activity remains choppy, but ETF-based inflows and futures bets still dominate the day-to-day price movements.

Summary

Bitcoin set a new all-time high at $118,403.89, driven by strong ETF inflows and rising institutional interest. This rapid surge triggered over $1 billion in short liquidations, with Bybit and HTX absorbing the bulk of the damage. As open interest rises and ETF flows continue, Bitcoin price guidelines point to further bullish momentum in the market.

FAQs

What caused Bitcoin to surge past $118,000?

Strong ETF inflows, especially from BlackRock’s iShares Bitcoin Trust, helped push Bitcoin past its all-time high.

How much was liquidated in short positions?

More than $1 billion in short positions were liquidated, with Bybit experiencing $461 million of those losses.

What role did ETFs play in the rally?

ETFs simplified Bitcoin exposure for institutional investors, fueling massive demand and contributing to price gains.

How many traders were affected by the liquidations?

Around 237,000 traders were liquidated, with the majority holding short positions that bet against rising prices.

Are traders expecting further gains?

Yes, open interest and long-short ratios show increased bullish sentiment, indicating traders expect prices to keep rising.

Glossary of Key Terms

Bitcoin Price Guidelines – Standards or patterns used by investors and analysts to understand price behavior in the Bitcoin market.

Liquidation – Forced closing of a trading position due to insufficient margin or adverse price movements.

ETF (Exchange-Traded Fund) – A financial product allowing investors to buy into assets like Bitcoin without owning them directly.

Open Interest – The total number of active futures contracts that have not been settled.

Short Position – A trade that profits from a decline in the asset’s price.

Long-Short Ratio – A measure comparing the number of bullish (long) positions to bearish (short) ones in the market.

Psychological Price Level – A round-number price point that traders often treat as significant, like $120,000 for Bitcoin.