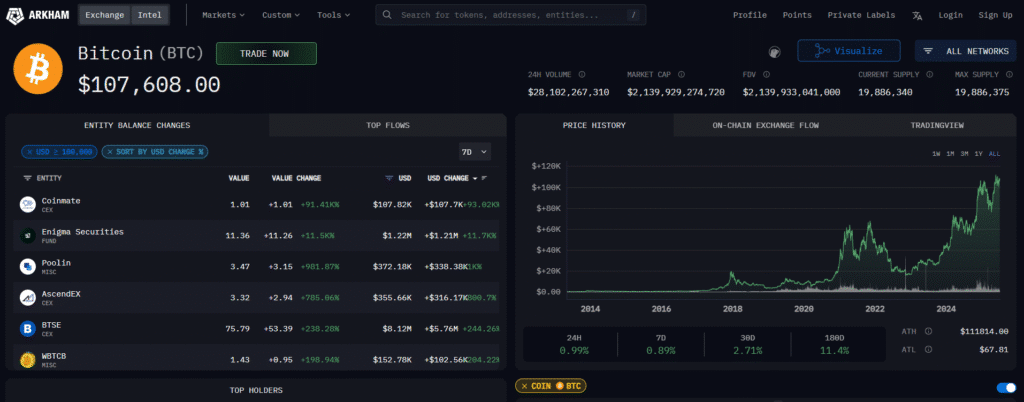

Bitcoin Price today, as it has precipitously fallen, came as a surprise to many following its close in June at an all-time high of $107,171. But the combination of economic, political, and market-specific conditions resulted in an abrupt price turn.

The fall was not the result of a specific event rather, it was a perfect storm. From good U.S. numbers and ETF redemptions to Elon Musk’s battle with Donald Trump, investors had enough reasons to remove risk from the equation.

Macroeconomic Stress Due to Strong U.S. Data

Trouble first began when stronger-than-expected U.S. economic data emerged. Recent employment market and manufacturing data indicated the economy is still strong. That should be welcome news but not for Bitcoin.

That’s because a healthy economy implies the Federal Reserve is not going to lower interest rates in the near future. The lower interest rates go, the better off Bitcoin and other risk assets are. Thus, the rate cut delay has emerged as a headwind for BTC, making institutional and retail investors nervous.

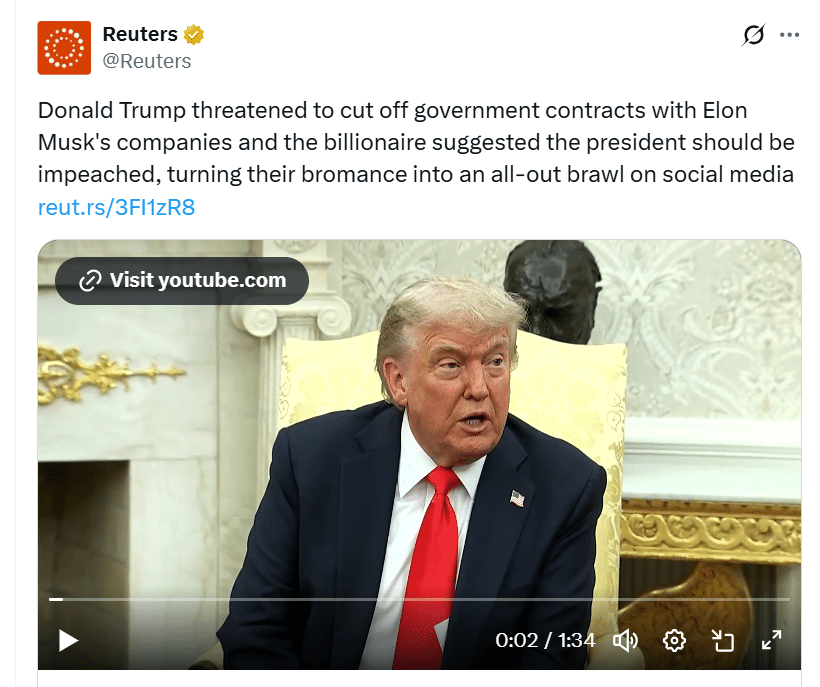

Trump vs. Musk Political Feud with Bitcoin Price Today

To add to the market jitters, there was a growing public war of words between Elon Musk and President Donald Trump. Musk had slammed Trump’s “Big Beautiful Bill,” even going to the extent of threatening to start a new political party if it becomes law.

Trump responded by implying a reduction of subsidies to Musk’s enterprises and deporting him. Such inflammatory remarks sent a jolt to investor sentiment and further fueled market confusion. Political chatter such as this can change risk mood rapidly, particularly with a volatile instrument such as Bitcoin.

Delay in Interest Rate Cuts

As per the CME FedWatch Tool, more than 75% of market players currently anticipate the Fed holding rates unchanged in July. While initial projections had seen up to three cuts in 2025, this has now been moderated.

The notion that easy money may not be around the corner anymore is hindering new money from entering Bitcoin.

It’s a primary reason why, even with robust fundamentals and increasing adoption, BTC is experiencing downward pressure in the short run.

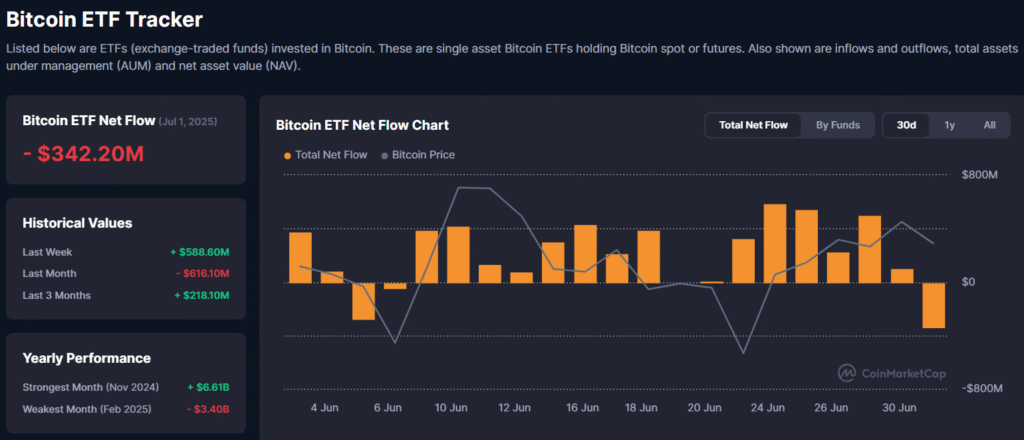

Bitcoin ETF Outflows Following 15-Day Inflow Streak

Following 15 days of inflows to spot Bitcoin ETFs, $342 million left in a single day. Fidelity’s FBTC lost $172.7 million, while Grayscale’s GBTC lost $119.5 million. Even tiny funds such as Bitwise and Ark 21Shares experienced $20M+ in outflows.

This abrupt turn from consistent ETF demand spooked investors particularly those monitoring institutional sentiment. ETFs had previously been a source of strength for BTC in early 2025, so this decline was palpable.

Large Bitcoin withdrawals to exchanges also instilled concern. On-chain statistics showed that a whale transferred 1,595 BTC worth more than $168 million to Binance. Such large transactions are usually interpreted as getting ready to sell, which can unsettle retail traders.

CoinMarketCap statistics indicate $85 million in liquidations occurred within the past 24 hours — the majority of them of long positions. More than 100,000 traders were liquidated. These sellouts support a bearish storyline and contribute to panic selling.

Institutional Accumulation Reflects Long-Term Trust

Even with the price decline, large institutions keep on accumulating BTC an indicator of long-term faith.

* MicroStrategy purchased 4,980 BTC, demonstrating that corporate adoption has strong momentum.

* Japanese company Metaplanet purchased 1,005 BTC and now possess 13,350 BTC, replacing Cleanspark as the 5th largest corporate BTC owner.

These companies aren’t responding to short-term price fluctuations. Rather, they’re taking dips as a chance to buy. Their ongoing participation indicates that the institutional base of Bitcoin price today as adoption is expanding, particularly in regulated markets and long-term investment portfolios.

This is the institutional base that might propel BTC’s next leg higher, even with today’s price weakness.

Summary

Bitcoin fell to $105,100 amid a record June close, propelled by macro pressure, lagging interest rate reductions, whale disposals, and Elon Musk-Donald Trump political tensions. Spot ETF redemptions and excessive trader liquidations contributed to the strain. Institutions such as MicroStrategy and Metaplanet are, however, adding BTC. Short-term ambiguity remains while institutional support and favorable trends suggest possible rebounding and long-run expansion towards $168K in case of stabilization in overall conditions.

FAQs

1. Why did Bitcoin fall even after reaching a record monthly close?

A combination of macroeconomic news, delayed rate cuts, political tensions, ETF outflows, and liquidations by “whales” helped fuel the pullback.

2. Is Bitcoin a good long-term investment still?

Yes. Short-term volatility notwithstanding, robust institutional buying and adoption indicate long-term faith is not shaken.

3. How do ETFs affect Bitcoin price action?

ETFs provide regulated access to BTC. When inflows are robust, BTC goes up. Outflows, as we just witnessed, tend to result in dips.

4. What’s ahead for Bitcoin in Q3?

Q3 historically has been wild. But if BTC is staying above $104K and macro jitters subside, a breakout to $120K+ can happen.

5. How significant is institutional adoption currently?

Significant. Institutions such as MicroStrategy and Metaplanet accumulating more BTC on dips are a vote of confidence in long-term upside.

Glossary

Rate Cut:

When a central bank reduces interest rates, so borrowing becomes less expensive, it frequently stimulates asset prices such as Bitcoin.

Liquidation:

Compelled closure of trading positions because of too little collateral, prevalent in leveraged crypto trading.