Bitcoin’s price has fallen below the $104,000 mark ahead of the U.S. Federal Reserve’s highly anticipated interest rate decision. Market expectations lean towards a 25 basis point rate cut, which could provide a short-term boost for markets. However, traders remain cautious as uncertainty looms over the Fed’s longer-term monetary policy. Let’s dive into the details.

Bitcoin Slides as Fed Decision Nears

In the hours leading up to the Fed’s announcement, Bitcoin (BTC) experienced a notable sell-off, dropping below $104,000. Bank of America’s Mark Cabana speculates that concerns over the prolonged restrictive monetary policy might prompt the Fed to announce a 25 basis point rate cut. While the U.S. labor market shows signs of moderation, sticky inflation remains a concern, with the Consumer Price Index (CPI) rising from 2.4% in September to 2.8% in November.

Markets have already priced in the expected rate cut, but analysts are closely watching Federal Reserve Chair Jerome Powell’s commentary on the outlook for 2025. Experts suggest the Fed might reduce its forecasted four rate cuts to three, signaling a more hawkish stance to bring inflation closer to the 2% target. Kurt S. Altrichter of Ivory Hill Wealth notes:

“Tomorrow’s Fed meeting is not just about the expected rate cut but also about how committed the Fed will remain to its 2025 rate reduction plans. More cuts mean better conditions for stocks and bonds. Fewer cuts suggest markets will need to adjust expectations.”

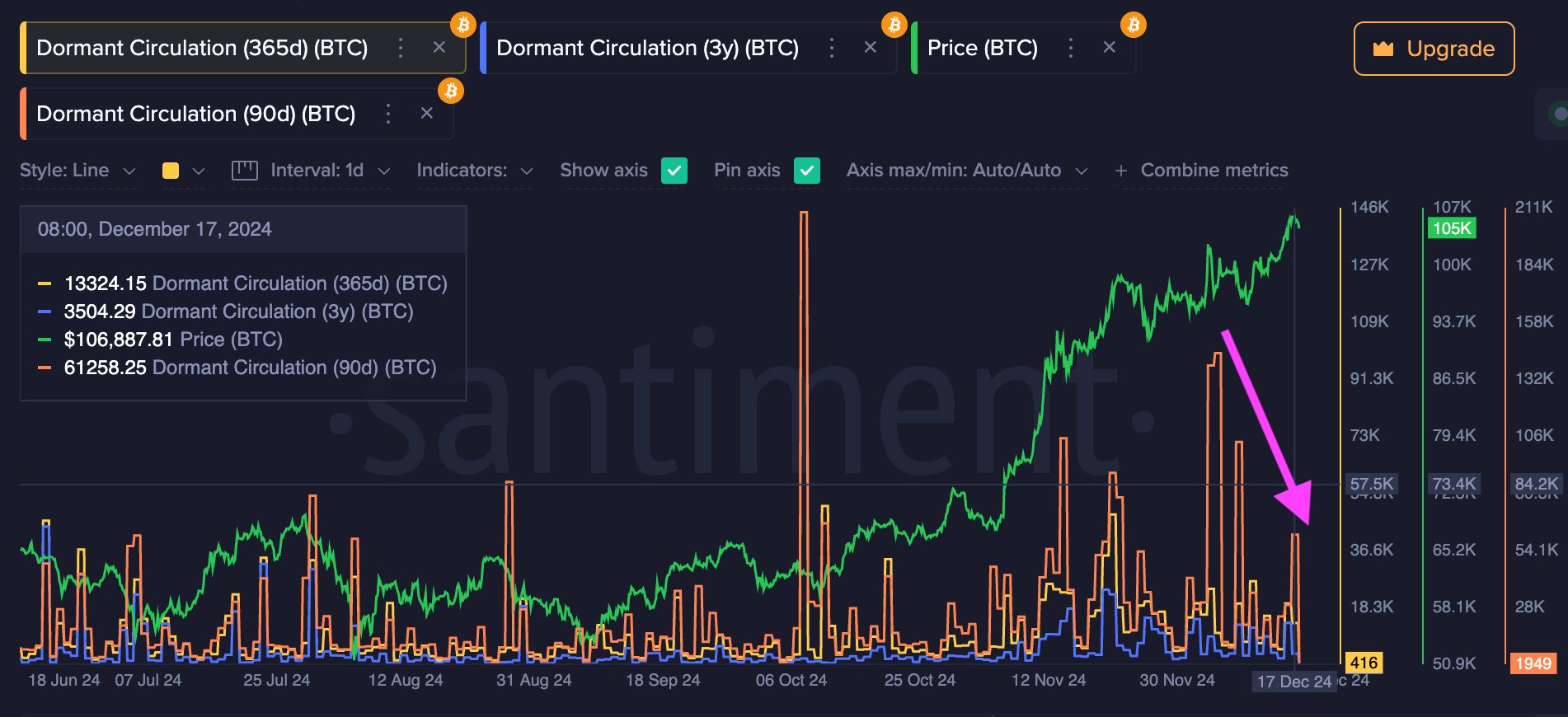

Data Signals Selling Pressure

On-chain data indicates that short-term BTC holders opted to take profits during the last meeting, with traders who held Bitcoin for 90 to 365 days benefiting from prices above $100,000. Meanwhile, long-term holders, active in the $90,000 to $100,000 range, showed reduced activity once prices surpassed $100,000.

Historical trends suggest a potential pullback this week. Popular crypto analyst Rekt Capital highlights that similar price discovery cycles have often led to corrections. For example:

- In 2013, Bitcoin faced a pullback in the 7th week of price discovery.

- In 2017, BTC dropped 34% in its 8th week.

- In 2021, Bitcoin corrected by 16% in its 6th week.

If history repeats itself, Bitcoin could retrace below the $100,000 level. Rekt Capital emphasizes that such corrections are a natural part of Bitcoin’s price cycles, often erasing weeks of gains within days.

Arthur Hayes Predicts Market Turbulence

Adding to the uncertainty, BitMEX co-founder Arthur Hayes predicts significant market volatility around January 20, coinciding with Donald Trump’s inauguration day. Hayes expects a major market correction, driven by broader geopolitical and financial disruptions. He noted that the Maelstrom investment fund plans to adjust its positions ahead of the anticipated turbulence.

What’s Next for Bitcoin?

The market’s focus remains on the Fed’s decision and Powell’s forward guidance. Investors should prepare for potential short-term volatility, keeping an eye on key levels around $100,000. Whether Bitcoin rebounds or faces further downside depends on how the Fed’s monetary policy aligns with broader market expectations.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!