U.S.-China trade negotiations produced progress which sent Bitcoin price soaring beyond $97K while generating a surge in risk assets during Wednesday’s closing market hours. The digital currency experienced a 3% rise in value shortly after indications emerged that the world’s top two economies were making progress in their dialogue.

U.S. Treasury Secretary Scott Bessent plans to discuss tariff easing with Chinese trade officials during this weekend’s meetings in Switzerland per U.S. Treasury statements.

Bessent told reporters that “the ongoing trade barriers alongside tariffs present an unsustainable situation although we reject total disconnection.”

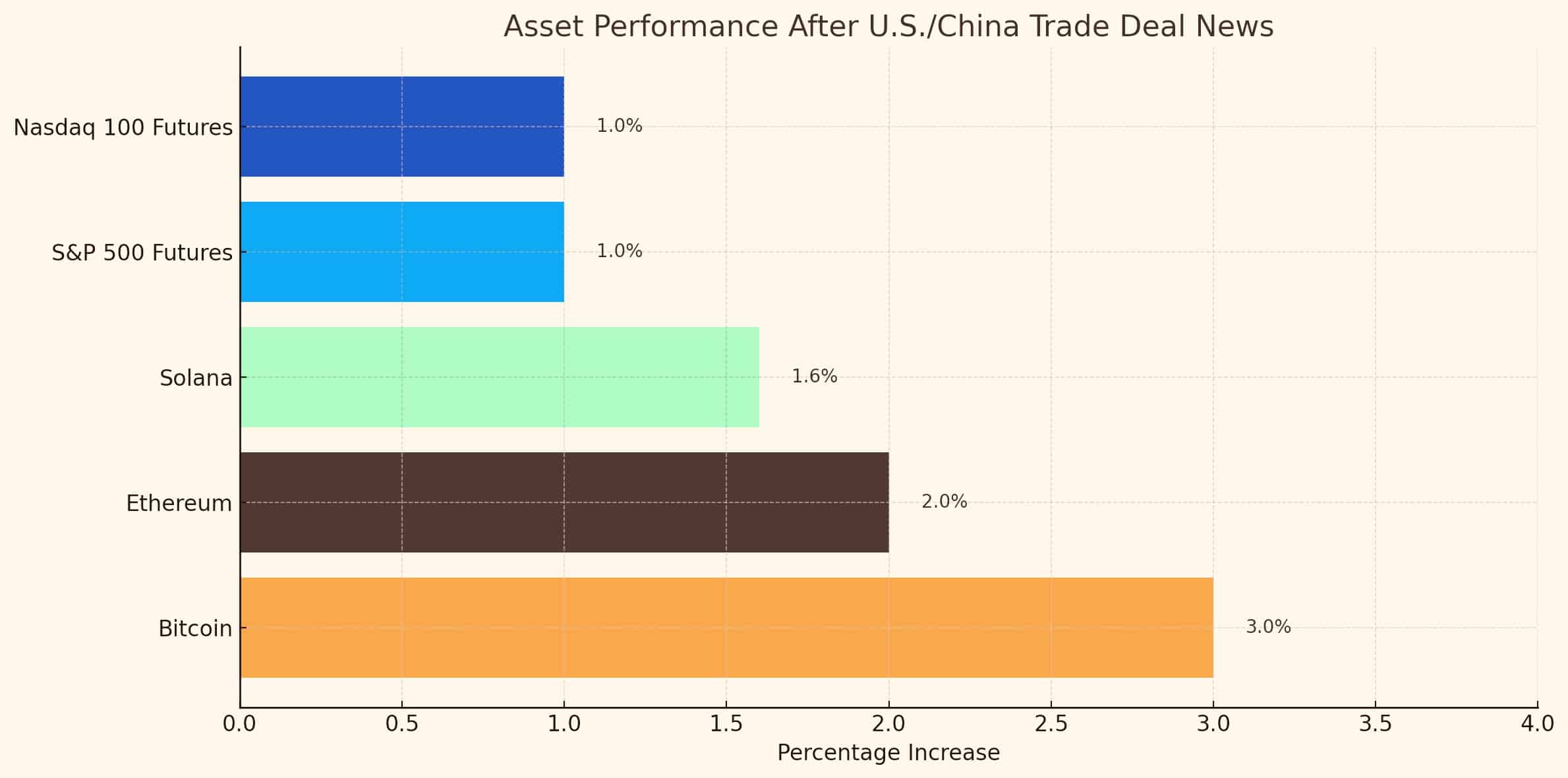

A single announcement generated market rallies within crypto platforms coupled with stock market gains. After regular trading hours both the Nasdaq 100 and the S&P 500 futures rose approximately 1%.

Bessent’s Switzerland Trip Triggers Market Optimism

Bessent’s visit to Switzerland created market enthusiasm in response. In response to U.S./China trade negotiations investors pushed Bitcoin price higher than $97K while seeking trade clarity between these two countries.

Bessent made the remarks during the Biden administration’s efforts to maintain Chinese diplomatic relations while preventing trade protections from crumbling. Bessent will meet with representatives from both countries to address trade issues during his Zurich visit that the Treasury Department has confirmed.

Markets responded instantly. According to CoinDesk “data Bitcoin reached its highest value since early April when it rose above $97K.”

The positive outlook for reduced trade tensions between nations drives up market sentiment according to CryptoQuant senior analyst Lisa Walters.

| Data Point | Details |

| Event | Bitcoin races above $97K on U.S./China trade deal progress |

| Bitcoin Price Surge | 3% increase within two hours |

| New Bitcoin Price | $97,200 (as of May 7, 2025, 5:57 a.m. EST) |

| Key Trigger | Announcement of U.S.-China trade talks |

| U.S. Official Involved | Treasury Secretary Scott Bessent |

| Bessent’s Statement | “The current tariffs and trade barriers are unsustainable, but we don’t want to decouple.” |

| Location of Upcoming Talks | Switzerland (likely Zurich) |

| China’s Official Response | China agrees to engage in talks, citing global and domestic concerns |

| Equity Market Impact | Nasdaq 100 and S&P 500 futures rose ~1% |

| Other Crypto Movements | Ethereum +2%, Solana +1.6% |

| Regulatory Watch | SEC expected to announce stablecoin rules in May 2025 |

| Source of Bitcoin Data | CoinDesk Price Index |

| Market Analyst Quoted | Lisa Walters, CryptoQuant |

| China Ministry Quoted | Ministry of Commerce spokesperson |

China Responds with Cautious Optimism

China Responds with Cautious Optimism

Chinese officials expressed their readiness to start conversations with American interests. According to the Ministry of Commerce spokesperson China looked at U.S. messages carefully before agreeing to bilateral talks based on international standards and national interests and American business and consumer demands.

The informal announcement maintained unspecific details yet represented a departure from the intense language seen during recent months.

China’s export business continues to face difficulties due to American trade restrictions put in place by Donald Trump which Joe Biden has maintained. Experts predict that establishing negotiating terms will minimize long-term economic uncertainty.

Bitcoin Price Performance Mirrors Broader Market Sentiment

The Bitcoin price market demonstrates direct correlation with changes in broader market factors. The recent 3% Bitcoin price increase reaching $97,200 demonstrates investors believe Bitcoin represents more than digital currency. Solana and Ethereum each gained 1.6% and 2% during this period. The equity market rallied afterward while tech-focused indexes outperformed all other sectors.

Historically Bitcoin has demonstrated sensitivity to both monetary policies and trade actions in the market. The U.S.-China trade ceasefire along with projections for upcoming Fed interest rate reductions has established favorable conditions for optimistic market direction.

Traders view $97K as a psychological threshold and Bitcoin has now surpassed it six times this year.

Crypto Still Faces Headwinds Despite Short-Term Gains

Even though positive market trends have emerged some underlying threats continue to exist. A complete settlement between American and Chinese parties shows no certain signs of happening. Previous gatherings between the two nations produced minimal progress while forthcoming elections could redirect both governments’ priorities.

Numerous regulatory shifts affect the delicate stability of the crypto market ecosystem. New SEC guidelines regarding stablecoins will launch in late May showing potential to alter market volatility.

Crypto assets always come with steep price volatility and continually evolving regulatory challenges that investors need to accept and monitor.

Conclusion: Bitcoin Price Rises on Trade Hopes, but Caution Remains

Market analysts link Bitcoin price recent upward trend to trade optimism although they maintain an alert stance.

Bitcoin exceeded $97K because investors viewed progress in U.S.-China trade negotiations as positive for the market’s performance. The rising market shows sentiment rather than solving ongoing geopolitical challenges.

Media observers will closely monitor Treasury Secretary Scott Bessent’s upcoming weekend trip to Switzerland. Financial markets currently exhibit positive responses to details which suggest the reduction of worldwide trading tensions.

FAQs

Q1: Why did Bitcoin price rise to $97K?

A: Bitcoin price value increased because U.S./China trade talk optimism grew stronger and Treasury Secretary Scott Bessent planned to meet Chinese officials in Switzerland.

Q2: Will the recent price increases continue?

A: Market sentiment behind this price surge depends on both pending trade agreement outcomes and upcoming regulatory procedures.

Glossary

Bitcoin: The digital payment system powered by blockchain technology operates as a decentralized currency between connected peer users.

Tariffs: Governments use import tariffs as a common instrument in international trade policy.

Risk assets: Investors take risks with stocks along with cryptocurrencies because they deliver both volatile market performance and significant potential returns.

S&P 500: A stock market index continuously measures 500 large corporations which operate on United States stock exchanges.

Nasdaq 100: The Nasdaq 100 consists of one hundred major non-financial companies which trade on the Nasdaq stock exchange.

References

- U.S. Treasury Department

- Ministry of Commerce of the People’s Republic of China

- CoinDesk Bitcoin Price Index

- CryptoQuant Market Analysis

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!