The cryptocurrency market experienced extreme turbulence over the past 24 hours as Bitcoin (BTC) briefly plunged to $80,000 before making a sharp recovery. This sudden drop triggered widespread panic among investors, but BTC quickly rebounded to $84,000, reaffirming the market’s notorious volatility.

Bitcoin’s Wild Ride: What’s Next?

After consolidating around $86,000 over the weekend, BTC kicked off the new week with a sharp decline. The plunge to $80,000 led to millions of dollars in liquidations. However, bullish momentum quickly returned, pushing BTC back up to $84,000.

Despite the recovery, uncertainty lingers. The upcoming U.S. inflation report and potential Federal Reserve (FED) interest rate decisions could add further pressure to the market. Currently, Bitcoin’s market capitalization stands at $1.66 trillion, with a dominance of 58.1% over the altcoin market.

Altcoins Continue to Bleed

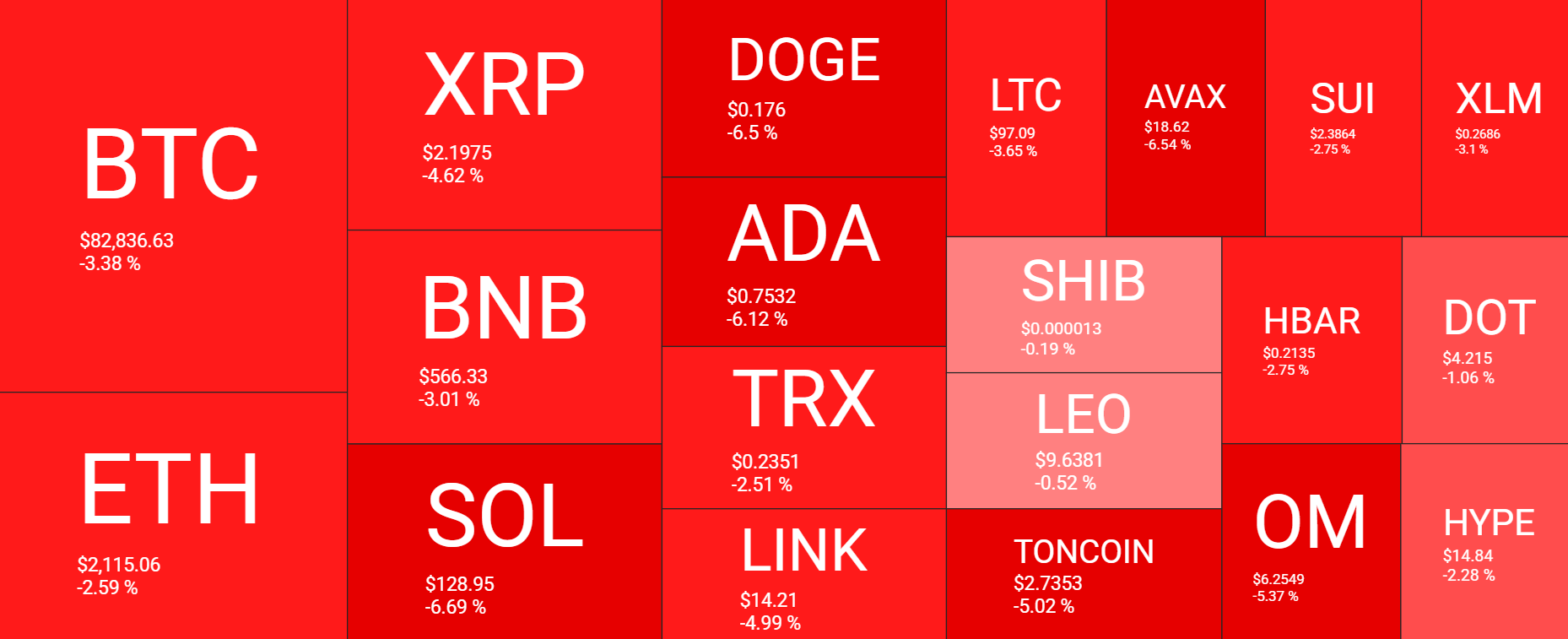

While Bitcoin has shown resilience, the altcoin market remains deep in the red. Ethereum (ETH) briefly dipped below $2,000 before recovering to $2,120. Other major altcoins, including Solana (SOL), Ripple (XRP), Dogecoin (DOGE), and Litecoin (LTC), have suffered significant losses.

Pi Network (PI) saw one of the largest declines, dropping 14% over the past week to $1.43. Meanwhile, a few assets, such as Ethena (ENA), Aave (AAVE), and Story (IP), have managed to defy the trend and post gains. Overall, the total cryptocurrency market cap has fallen 5% in the past 24 hours to $2.82 trillion.

More Volatility on the Horizon?

According to The Bit Journal’s analysis, market volatility is expected to persist in the coming days. The FED’s interest rate decisions and U.S. inflation data will play a crucial role in shaping investor sentiment. Bitcoin’s ability to hold above $84,000 could determine the market’s next direction. Traders and investors should closely monitor key support and resistance levels as the market braces for more potential swings.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!