The Bitcoin Runes protocol has seen its influence wane significantly. This article will explore the meteoric rise and subsequent decline of the Bitcoin Runes protocol, its impact on the Bitcoin network, and what this means for the future of Bitcoin and decentralized finance (DeFi).

A Meteoric Rise: The Early Days of Bitcoin Runes Protocol

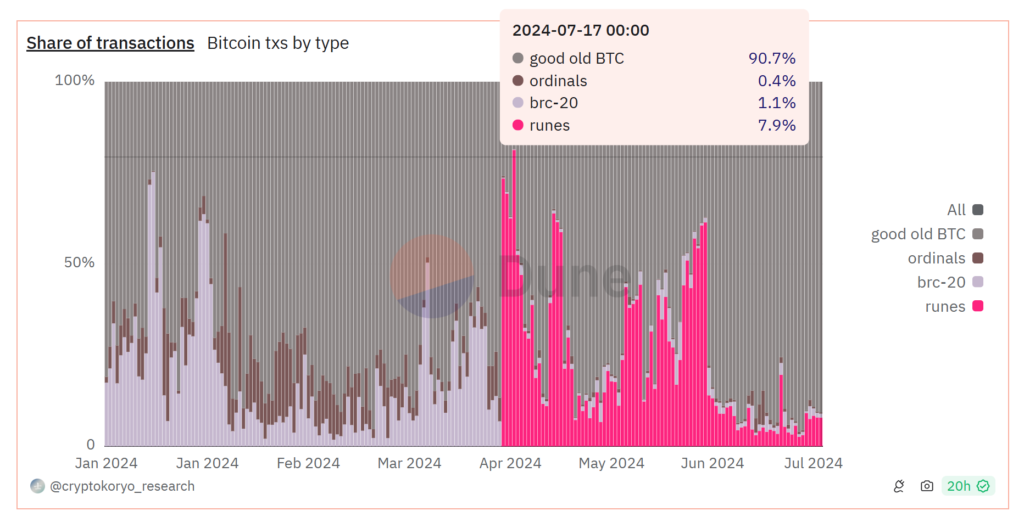

When the Bitcoin Runes protocol launched on April 20, it quickly made waves within the cryptocurrency community. For several days, Runes consumed the highest bandwidth on the Bitcoin network, accounting for more than 50% of transactions on 13 separate days. This level of activity was unprecedented and highlighted the protocol’s potential to revolutionize Bitcoin-based non-fungible tokens (NFTs).

In the initial weeks, the Bitcoin Runes protocol not only captured the attention of investors but also significantly benefited Bitcoin miners. Within just two months of its launch, Runes helped miners earn over 2,500 BTC in fees. This period marked the peak of investor interest and activity within the protocol, showcasing its potential to drive substantial economic activity on the Bitcoin network.

The Decline: What Happened to the Bitcoin Runes Protocol?

Despite its promising start, the Bitcoin Runes protocol could not maintain its momentum. Over the past month, Runes’ share of transactions on the Bitcoin network fell to under 9% on average. This decline signals a waning interest among investors and a shift in the dynamics of Bitcoin-based NFTs.

Several factors contributed to the decline of the Bitcoin Runes protocol. The initial hype surrounding the protocol began to fade, and with it, the frequency of transactions dropped significantly. While Runes earned 2,500 BTC in fees within the first two months, it managed to earn just 41 BTC in the following month. This drastic change in investor sentiment indicates a cooling-off period, much like what happens with other hyped-up assets once the initial excitement wears off.

Bitcoin Reclaims Dominance

As the Bitcoin Runes protocol’s influence waned, Bitcoin itself reclaimed its dominance in terms of bandwidth allocation on its network. Currently, Bitcoin represents 90% of all transactions over the blockchain. Despite this, Runes still maintains a significant presence among other Bitcoin protocols. On July 17, Runes represented 7.9% of all transactions, while BRC-20 and Ordinals claimed 1.1% and 0.4%, respectively.

The return to dominance by Bitcoin highlights the enduring strength and stability of the original cryptocurrency. Amidst the rise and fall of various protocols, Bitcoin continues to serve as the backbone of the cryptocurrency ecosystem, offering a reliable and robust platform for transactions and value storage.

Future Prospects: What Lies Ahead for the Bitcoin Runes Protocol?

Despite its decline, the Bitcoin Runes protocol still holds promise for the future of Bitcoin-native DeFi. Rich Rines, a Core DAO contributor building Bitcoin DeFi solutions, believes that Bitcoin Runes and BRC-20 tokens may only be a stepping stone in the evolution of Bitcoin-native DeFi. He stated, “Bitcoin started as a peer-to-peer electronic cash system, then morphed more into a store value and now protects $1.5 trillion of wealth. Over the last year, we’ve seen this desire to add more utility to the underlying Bitcoin through the rise of Ordinals, token protocols like BRC 20s and now Runes.”

Pseudonymous DeFi researcher Ignas also sees potential beyond the initial hype. “Runestone, RSIC, and PUPS are already pumping, promising holders shiny new Rune token airdrops. And FOMO threads keep coming. But, like the NFT frenzy post-JPEG reveal, the market could soon cool off.”

These insights suggest that while the Bitcoin Runes protocol may have experienced a significant drop in activity, its role in the broader evolution of Bitcoin DeFi is far from over. The initial excitement may have faded, but the real opportunity for Runes might emerge as the market stabilizes and matures.

In conclusion, the rise and fall of the Bitcoin Runes protocol illustrate the dynamic nature of the cryptocurrency market. While Runes’ initial success was remarkable, its subsequent decline serves as a reminder of digital assets’ volatile and rapidly changing landscape. As Bitcoin continues to evolve, the Bitcoin Runes protocol and similar innovations will play a crucial role in shaping the future of decentralized finance.