According to reports, Bitcoin’s trajectory toward mainstream financial integration has never been stronger, with analysts and industry leaders forecasting unprecedented adoption and investment inflows in 2025. Institutional interest, regulatory advancements, and new financial products have positioned BTC as a legitimate asset class, setting the stage for historic growth.

Leading industry experts, including Bitwise Asset Management CEO Hunter Horsley, have expressed unparalleled optimism regarding BTC’s future. In a recent statement on X (formerly Twitter), Horsley emphasized that Bitcoin is poised to take “massive leaps into the mainstream this year” and that he has “never been more optimistic.”

With institutional adoption skyrocketing, the success of spot BTC ETFs, and increasing government engagement, 2025 could be the year BTC finally cements itself as a core financial asset alongside traditional investments such as stocks and gold.

Why Experts Believe BTC’s Mainstream Growth Is Inevitable

The case for BTC’s expansion into mainstream finance is backed by several key factors that reinforce its long-term potential. These include institutional investment, improved regulatory clarity, and macroeconomic trends favoring digital assets.

1. Institutional Adoption and Market Confidence

Institutional investors are increasingly allocating capital into BTC, with major financial firms recognizing it as a viable long-term store of value.

- Spot Bitcoin ETFs Surging – The approval and subsequent success of spot BTC ETFs in the U.S. have opened doors for institutional investors to gain exposure to BTC through regulated products.

- Corporate Holdings on the Rise – Companies like MicroStrategy, Tesla, and Block continue to expand their Bitcoin reserves, viewing it as a hedge against economic instability.

- Wall Street Embracing BTC – Leading asset managers, including BlackRock, Fidelity, and Vanguard, have started offering BTC-related investment products.

2. Regulatory Clarity Encouraging Adoption

Governments worldwide are developing clear frameworks for cryptocurrency regulation, making it easier for institutional and retail investors to participate in the market.

- U.S. Regulatory Developments – The SEC’s approval of BTC ETFs signals growing acceptance of BTC as an institutional-grade investment.

- Global Policy Advancements – Countries such as the UK, UAE, and Hong Kong are working on progressive crypto regulations, fostering adoption.

- Corporate-Friendly Tax Policies – Nations like El Salvador and Switzerland continue offering favourable tax conditions for BTC investors and businesses.

3. Bitcoin’s Role in a Changing Macroeconomic Landscape

With global markets facing inflationary pressures and rising geopolitical tensions, Bitcoin’s fixed supply and decentralized nature make it an increasingly attractive asset.

- Hedge Against Inflation – BTC’s finite 21-million supply cap sets it apart from fiat currencies subject to inflationary risks.

- Decentralization as a Strength – Unlike traditional financial assets, BTC operates outside central banking influence, offering an alternative safe haven.

- Growing Adoption as a Settlement Layer – BTC’s use for cross-border payments and institutional settlements continues to expand, solidifying its role in global finance.

Bitcoin Price Predictions for 2025 and Beyond

As BTC continues to gain traction among institutional investors and global regulators, price predictions for the digital asset have become a key focus for analysts. Experts argue that increasing adoption, macroeconomic shifts, and the rise of BTC ETFs will fuel significant price movements in the coming years.

Technical Analysis of BTC’s Price Predictions

Technical analysis plays a crucial role in evaluating Bitcoin’s potential price movements and assessing the likelihood of reaching forecasted targets. Analysts leverage historical price patterns, key support and resistance levels, and trading volume to determine possible breakout points. Moving averages, Fibonacci retracements, and Relative Strength Index (RSI) readings indicate whether Bitcoin is overbought or oversold, helping investors make informed decisions.

Recent technical indicators suggest that Bitcoin is forming a strong uptrend, with momentum building as institutional adoption increases. Below, we provide an in-depth chart-based analysis of Bitcoin’s projected price trends and the key factors influencing its movements.

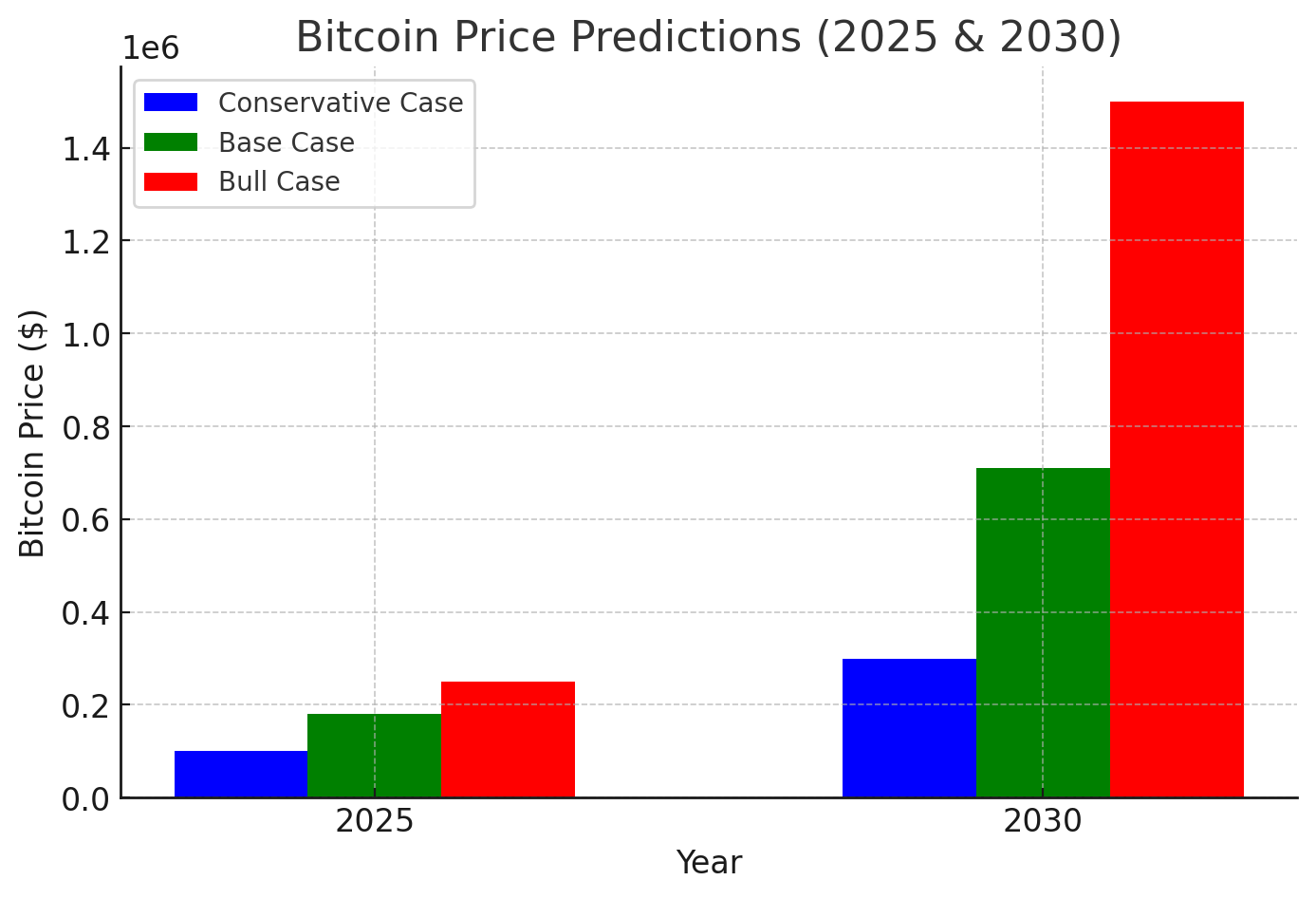

Historically, Bitcoin’s price has experienced exponential growth following key adoption milestones and halving events. As BTC enters 2025, projections suggest that it could break previous all-time highs, with some estimates reaching well into six figures. Below, we outline different price scenarios based on conservative, base, and bullish outlooks. As institutional adoption grows, analysts are issuing bold price forecasts for Bitcoin’s future, with some models predicting a surge beyond previous all-time highs.

| Year | Conservative Case | Base Case | Bull Case |

| 2025 | $100,000 | $180,000 | $250,000 |

| 2030 | $300,000 | $710,000 | $1,500,000 |

Source: ARK Invest, Bloomberg, Bitwise Research

Institutional Sentiment at an All-Time High

Industry leaders continue to reaffirm Bitcoin’s mainstream growth potential, highlighting factors that could propel BTC to unprecedented heights.

Hunter Horsley, CEO of Bitwise Asset Management:

“People are wildly underestimating the massive leaps Bitcoin is going to take into the mainstream this year. I’ve never been more optimistic.”

Matt Hougan, CIO of Bitwise:

“Institutional sentiment toward crypto is the most bullish I’ve ever seen. From a risk-adjusted perspective, this is arguably the best time in history to invest in Bitcoin.”

Cathie Wood, CEO of ARK Invest:

“Bitcoin’s fundamental value proposition remains stronger than ever. We see BTC reaching $1.5 million per coin by 2030 under a high-conviction bull case.”

Conclusion: BTC’s Unstoppable March Toward Mainstream Finance

Bitcoin’s rapid adoption by institutional investors, regulatory bodies, and mainstream financial firms signals a new era for digital assets. As spot BTC ETFs gain traction and global governments establish clearer regulatory frameworks, BTC’s role in the global financial system is set to expand further.

With bullish predictions from leading industry experts and rising institutional interest, BTC’s mainstream explosion in 2025 appears inevitable. Whether it reaches $100,000 or $250,000, its long-term trajectory remains firmly on an upward path toward financial legitimacy and mass adoption.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQ

1. What is driving BTC’s mainstream adoption in 2025?

Institutional investment, regulatory advancements, and BTC ETFs have made BTC more accessible, driving mainstream adoption.

2. Could BTC replace traditional financial assets?

While Bitcoin may not replace traditional assets, it is increasingly viewed as a hedge against inflation and economic uncertainty, much like gold.

3. Is BTC’s price expected to hit new highs in 2025?

Many analysts predict BTC could exceed its previous all-time highs, with projections ranging from $100,000 to $250,000.

4. How can retail investors benefit from BTC’s growth?

Retail investors can gain exposure through spot ETFs, crypto exchanges, and self-custody wallets, depending on their risk tolerance and investment strategy.

Glossary

Spot Bitcoin ETF: A regulated investment product that allows investors to gain exposure to Bitcoin without directly holding the asset.

Institutional Adoption: Large-scale investments from hedge funds, pension funds, and corporations into Bitcoin.

Hedge Against Inflation: The concept that Bitcoin’s fixed supply protects purchasing power against fiat currency devaluation.

Macroeconomic Trends: Large-scale economic factors such as inflation, interest rates, and global financial policies impact Bitcoin’s price movements.

References

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Readers should conduct independent research before making investment decisions.