Bitcoin (BTC) has surged to unprecedented levels, hitting new all-time highs and propelling the total crypto market cap beyond $2.7 trillion—the year’s peak. This rally has been fueled by a combination of factors, including Donald Trump’s U.S. election win and the Federal Reserve’s interest rate cuts.

Bitcoin Soars Past $82,000

Currently valued at $1.16 trillion, Bitcoin ranks as the ninth-largest financial asset. The cryptocurrency saw a 17% increase in the year’s second-best week, trailing only the 22% rise recorded in early March. To gauge Bitcoin’s further potential, it’s essential to understand who’s buying BTC and whether this is a spot-driven or leveraged rally.

Analyzing Spot Demand: Coinbase’s Role

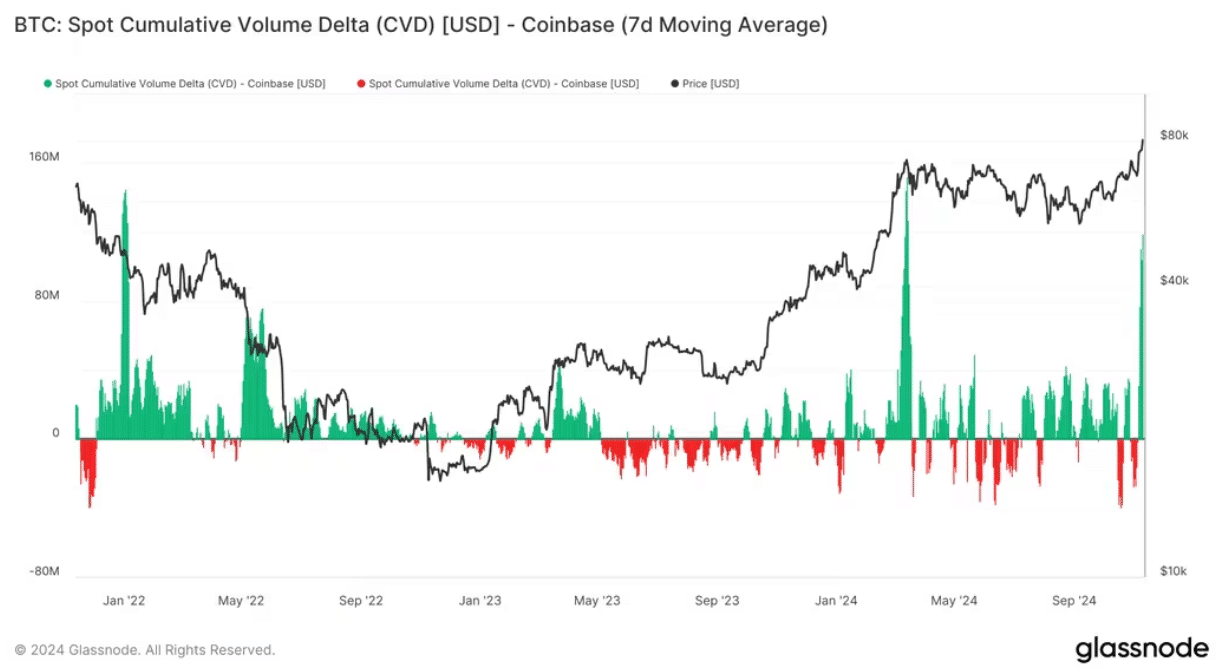

Glassnode’s “Cumulative Volume Delta” (CVD), which measures net buying and selling volume, highlights demand primarily coming from Coinbase, a platform favored by U.S. institutions and retail investors. An increase in the Coinbase Premium Index further supports this trend.

Historically, peaks in Coinbase’s CVD often align with Bitcoin’s local highs and lows. When Bitcoin reached over $73,000 in March, one of the highest CVD levels was recorded, similar to periods surrounding the Luna and FTX collapses in 2022. These trends suggest “smart money” buys near bottoms while others buy near peaks.

ETF Demand and Market Strategies

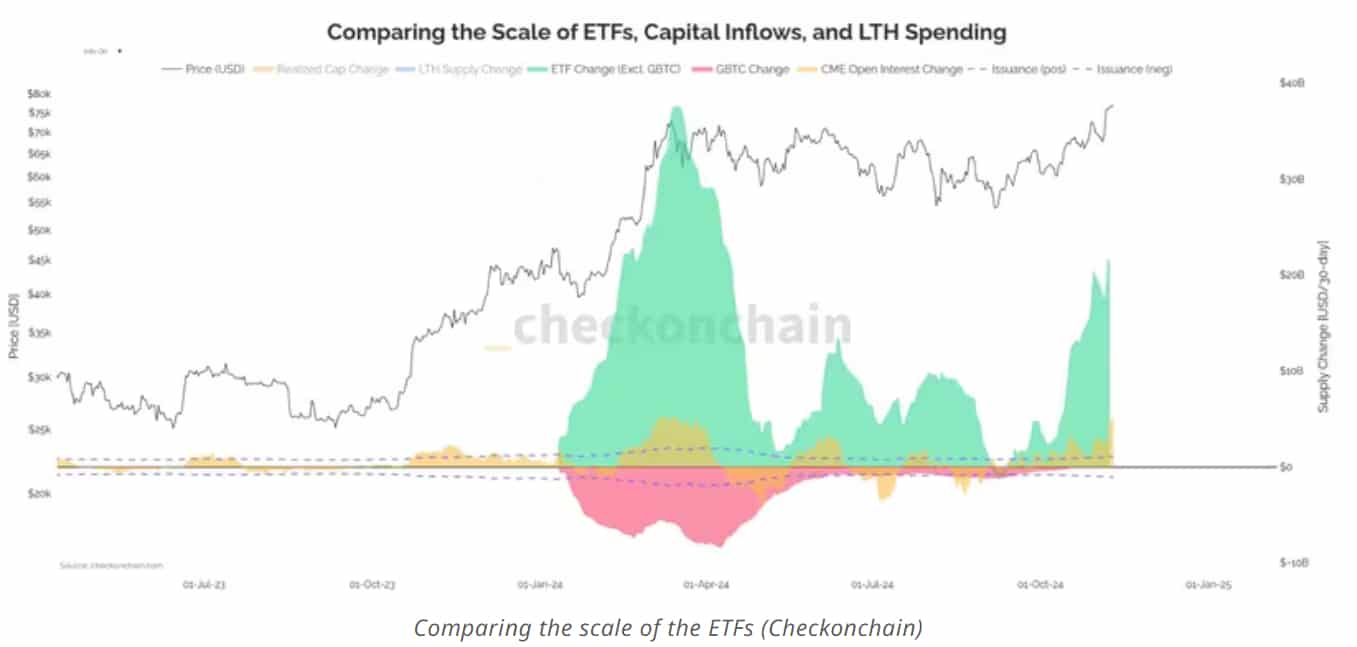

With Bitcoin spot ETFs gaining traction, questions arise about whether these inflows signify direct spot buying or are part of basis trading—where investors exploit the difference between spot and futures prices. In this strategy, investors take a long position on an ETF while shorting in the futures market, capturing price discrepancies.

CF Benchmarks’ CEO recently stated that 40% of ETF inflows were linked to basis trading. However, despite record ETF inflows, CME’s open interest has not seen equivalent growth, suggesting a more delta-neutral strategy rather than a purely directional one.

What the Experts Say

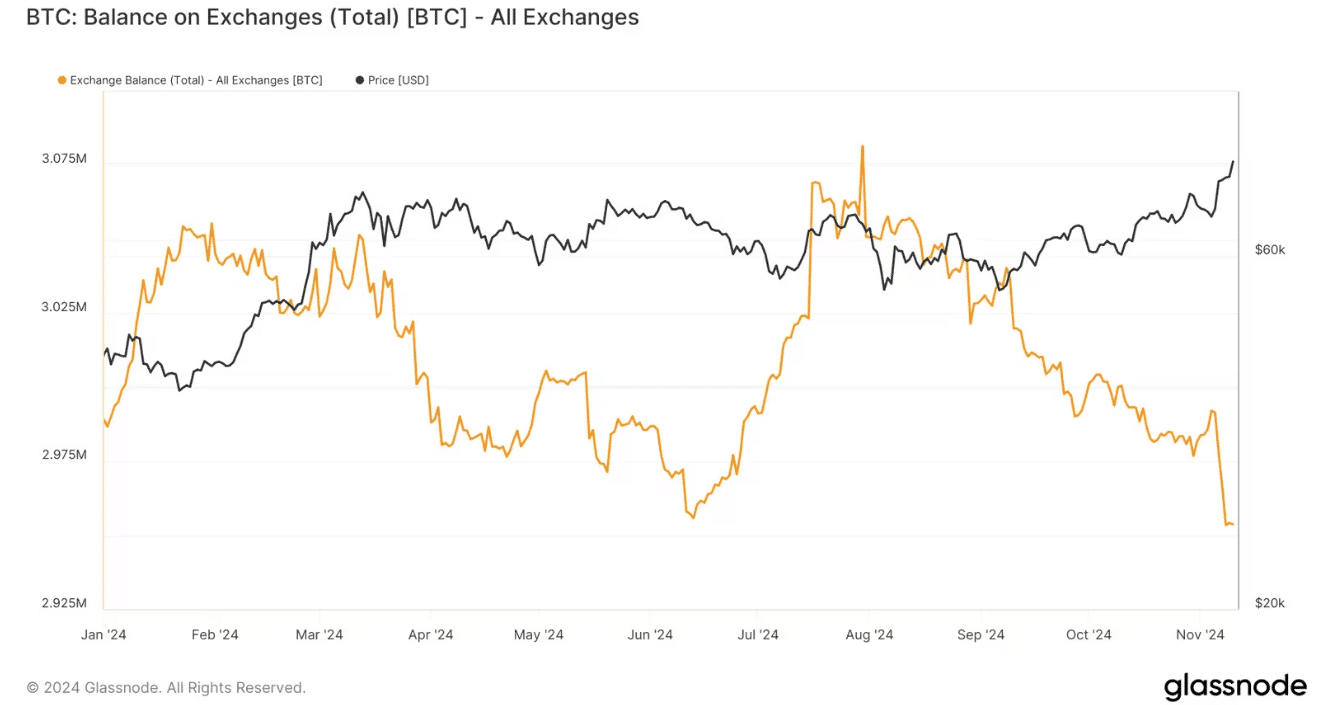

Bitcoin analyst Checkmate observed that spot Bitcoin ETF inflows are significantly outpacing CME open interest growth, signaling a return to directional spot buying. According to Glassnode data, Bitcoin reserves on exchanges dropped to a year-low of 2.95 million BTC post-election, with demand from platforms like Coinbase, Binance, and Bitfinex driving this trend. Lower exchange balances hint at investor appetite for acquiring more BTC as prices rise.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!