According to a recent analysis released during the early Asian hours on Monday, Bitcoin price has hit the $64,000 level as the week is packed with key U.S. economic data, including the release of the Federal Reserve’s FOMC minutes and August reports that track economic growth.

BTC saw a 3% increase, sparking a market-wide surge. Major cryptocurrencies like ether (ETH) and dogecoin (DOGE) also rose by up to 4%. The CoinDesk 20 (CD20), an index tracking the biggest liquid tokens, gained 3.26%, while the frog-themed token Pepe (PEPE) soared by 14%.

Statistics Statement to Affect Bitcoin Price and Some Memecoins

The public has been informed of key economic data that will be launched by the Bureau of Labor Statistics (BLS), including the unadjusted annual rate for the Consumer Price Index (CPI), the annual rate for the Producer Price Index (PPI), and the number of initial jobless claims for the week ending October 5.

Asian stocks climbed on Monday, with the tech-heavy Hang Seng index rising 3% and Korea’s KOSPI gaining 1%. This positive movement comes after the People’s Bank of China rolled out several stimulus measures over the past two weeks, lifting market sentiment across the region. China is also expected to announce more economic support measures during a press conference on Tuesday morning, local time.

In the crypto market, Bittensor’s TAO led the gains among mid-cap tokens (those with a market cap below $5 billion), surging 14% due to increased social interest and the recent growth in artificial intelligence tokens. Overall, this category on CoinGecko saw a 7.5% rise, with tokens like NEAR and Internet Computer (ICP) also posting gains.

Memecoins saw a boost over the weekend as social chatter picked up and traders showed a greater appetite for risk. Discussions around a potential “memecoin supercycle”—the idea that meme-based tokens could lead the next crypto bull market—were trending on the social app X.

Analyst Sees Bitcoin Price to Pump 84% to $116,600

The crypto analyst Javon Marks is still bullish on Bitcoin price despite the recent decline and is forecasting an 84% surge to six figures. He thinks the cryptocurrency is quietly preparing to break from its current trading range.

Marks also mentioned the same in his latest Bitcoin price update where he said that if bitcoin is traded at current level of $63,500, then a 84% uptick towards upside can be visible soon. He argued the cryptocurrency must smash past a crucial resistance at $67,556 for an upward momentum to drive it toward the $116,600-level.

Marks has been predicting this possible rise to $116,600 well in advance. He spoke, after all, on September 22, expressing that Bitcoin seemed ready to make this upward manoeuvre. After a boost from nearly $64,000, Bitcoin failed to clear the all-important $67,556 hurdle.

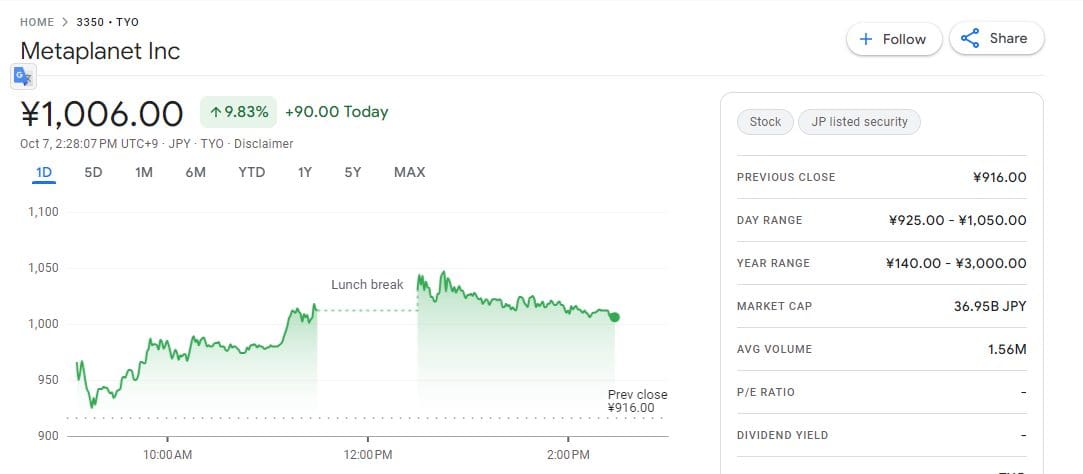

Metaplanet Makes $7M Bitcoin Buy

Japanese investment firm Metaplanet has made another big move in the Bitcoin market, pushing its total holdings close to 640 Bitcoin and boosting its stock by over 10%. On October 7, the Tokyo-listed company announced its latest purchase, adding 108.78 Bitcoin to its reserves. The buy was worth around $6.92 million, with Bitcoin priced at roughly $63,600 at the time.

Often called “Asia’s MicroStrategy” due to its aggressive Bitcoin strategy, Metaplanet has been on a buying spree. The company added more than 215 Bitcoin this past week alone, following a 107.91 Bitcoin purchase on October 1. As of October 7, Metaplanet’s total Bitcoin holdings stand at 639.5 BTC, valued at approximately $40.5 million.

The 3% rise in Bitcoin price fueled gains across the market, with other major cryptocurrencies like ether (ETH) and dogecoin (DOGE) rising by up to 4%. The growing interest in memecoins comes amid low volatility in more established crypto sectors and negative sentiment toward venture capital-backed tokens, which many retail traders now see as overpriced.

Stay in touch with TheBITJournal follow on Twitter and LinkedIn, and join the Telegram channel to be instantly informed about breaking news!